Fifth Third Bank create an account is a straightforward process that allows you to access a wide range of banking services online. Whether you're looking to open a savings account, checking account, or even invest in financial products, Fifth Third Bank offers a seamless experience for customers. In this guide, we will walk you through the steps to set up your account, ensuring you have all the information you need to get started.

Fifth Third Bank has been a trusted financial institution for decades, providing individuals and businesses with reliable banking solutions. With its digital transformation, the bank now offers a user-friendly platform where you can create an account online without visiting a branch. This guide aims to simplify the process for you, ensuring you understand each step involved.

By the end of this article, you'll have a clear understanding of the requirements, steps, and benefits of opening an account with Fifth Third Bank. Let's dive in and explore how you can take control of your finances with ease.

Read also:Why Did Lois Marry Peter A Comprehensive Analysis

Table of Contents

- Introduction to Fifth Third Bank

- Why Choose Fifth Third Bank?

- Steps to Create an Account

- Account Types Available

- Requirements for Opening an Account

- Benefits of Online Account Creation

- Common Questions About Creating an Account

- Security Features of Fifth Third Bank

- Customer Support Options

- Conclusion and Next Steps

Introduction to Fifth Third Bank

Fifth Third Bank is a leading financial institution in the United States, serving millions of customers across the country. Established in 1858, the bank has grown to become one of the largest banking organizations, offering a wide range of services to meet the needs of individuals and businesses alike.

With a focus on innovation and customer satisfaction, Fifth Third Bank continues to enhance its digital offerings, making it easier than ever to manage your finances. Whether you're looking to open a checking account, savings account, or explore investment opportunities, Fifth Third Bank provides the tools and resources you need to succeed financially.

History and Growth

Fifth Third Bank's journey began in Cincinnati, Ohio, where it established itself as a trusted financial partner for the community. Over the years, the bank has expanded its reach, acquiring other financial institutions and growing its network of branches and ATMs. Today, Fifth Third Bank serves customers in 10 states, with a robust online presence that makes banking accessible to all.

Why Choose Fifth Third Bank?

Choosing Fifth Third Bank as your financial partner offers numerous advantages. From competitive interest rates to a wide array of financial products, the bank ensures that you have access to everything you need to achieve your financial goals.

Key reasons to choose Fifth Third Bank:

- Reliable customer service

- Innovative digital banking solutions

- A wide range of account options

- Competitive interest rates

- Strong community involvement

Customer-Centric Approach

Fifth Third Bank prides itself on its customer-centric approach, ensuring that each customer receives personalized attention and support. Whether you're a first-time account holder or an experienced investor, the bank's team of experts is ready to assist you every step of the way.

Read also:Unveiling The Legacy Of Notre Dames Old Football Coach A Journey Through History

Steps to Create an Account

Creating an account at Fifth Third Bank is a simple and straightforward process. Follow these steps to get started:

- Visit the official Fifth Third Bank website.

- Click on the "Open an Account" option.

- Select the type of account you wish to open.

- Provide the required personal information.

- Upload necessary documents for verification.

- Review and confirm your account details.

- Set up your login credentials for online banking.

Online vs. In-Person Account Creation

While you can create an account online, Fifth Third Bank also offers the option to open an account in person at one of their branches. Both methods are secure and efficient, allowing you to choose the option that best suits your preferences.

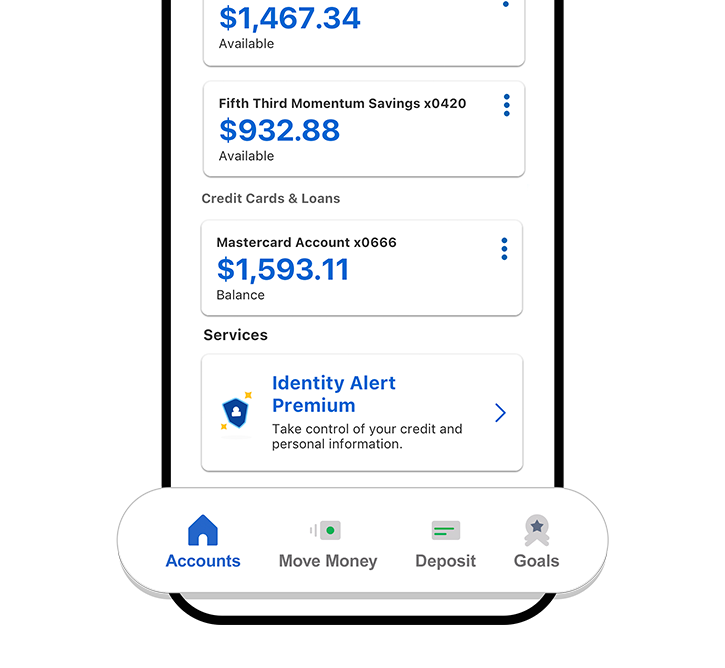

Account Types Available

Fifth Third Bank offers a variety of account types to cater to different financial needs. Whether you're looking to save for the future, manage daily expenses, or invest in your future, there's an account option for you.

Popular account types:

- Checking accounts

- Savings accounts

- Money market accounts

- Certificates of deposit (CDs)

- Business accounts

Features of Checking Accounts

Checking accounts at Fifth Third Bank come with features such as mobile banking, bill pay, and ATM access, making it easy to manage your finances on the go.

Requirements for Opening an Account

To open an account at Fifth Third Bank, you'll need to provide certain documents and information. Ensure you have the following ready:

- Valid government-issued ID (driver's license, passport, etc.)

- Social Security number or Taxpayer Identification Number

- Proof of address (utility bill, lease agreement, etc.)

- Initial deposit amount (varies by account type)

Having these documents on hand will make the account creation process smoother and faster.

Identity Verification Process

Fifth Third Bank employs a robust identity verification process to ensure the security of your account. This process involves matching the information you provide with official records to confirm your identity.

Benefits of Online Account Creation

Creating an account online with Fifth Third Bank offers several advantages, including:

- Convenience: You can open an account from the comfort of your home.

- Speed: The process is faster compared to in-person account creation.

- Accessibility: Access your account details and manage your finances anytime, anywhere.

- Security: Fifth Third Bank employs advanced security measures to protect your information.

These benefits make online account creation an attractive option for many customers.

Enhanced Digital Experience

Fifth Third Bank continues to enhance its digital platforms, ensuring that customers have a seamless experience when managing their accounts online. From mobile apps to online banking portals, the bank provides tools that make banking easier than ever.

Common Questions About Creating an Account

Here are some frequently asked questions about creating an account at Fifth Third Bank:

- Can I open an account online? Yes, Fifth Third Bank offers online account creation for convenience.

- What documents do I need? You'll need a valid ID, proof of address, and your Social Security number.

- Is there a minimum deposit requirement? Yes, the minimum deposit varies depending on the account type.

- How long does it take to open an account? The process typically takes about 15-20 minutes.

These questions and answers should help clarify any doubts you may have about the account creation process.

Addressing Concerns

For any additional concerns, Fifth Third Bank's customer support team is available to assist you. Don't hesitate to reach out if you need further clarification or assistance.

Security Features of Fifth Third Bank

At Fifth Third Bank, security is a top priority. The bank employs various measures to protect your account and personal information, including:

- Two-factor authentication

- Encryption technology

- Fraud monitoring

- Secure login credentials

These features ensure that your financial information remains safe and secure at all times.

Staying Safe Online

As a customer, it's important to practice safe online habits, such as using strong passwords and avoiding phishing scams. Fifth Third Bank provides resources to help you stay informed about online security best practices.

Customer Support Options

Fifth Third Bank offers multiple channels for customer support, ensuring you can get help whenever you need it. These include:

- Phone support

- Live chat

- Email assistance

- In-person support at branches

Regardless of your preferred method of communication, Fifth Third Bank is committed to providing exceptional customer service.

24/7 Support

For urgent matters, Fifth Third Bank offers 24/7 support, ensuring that you can reach a representative at any time of the day or night.

Conclusion and Next Steps

Creating an account at Fifth Third Bank is a simple and secure process that opens up a world of financial possibilities. With a wide range of account options, competitive interest rates, and robust security features, Fifth Third Bank is an excellent choice for your banking needs.

We encourage you to take the next step and open your account today. If you have any questions or need further assistance, don't hesitate to reach out to Fifth Third Bank's customer support team. Share this article with others who may benefit from it, and explore more resources on our website to enhance your financial knowledge.

Call to Action: Start your journey with Fifth Third Bank by clicking the link below to begin the account creation process. Your financial future starts here!