ABA routing numbers play a critical role in the financial system, enabling seamless transactions across banks and financial institutions. These numbers, often referred to as ABA routing transit numbers or simply routing numbers, are essential for transferring funds, processing checks, and initiating direct deposits. If you've ever wondered whether the ABA is the same as a routing number, you're in the right place.

This article dives deep into the world of ABA routing numbers, explaining their purpose, structure, and importance in modern banking. Whether you're a business owner, an individual managing personal finances, or simply curious about banking operations, understanding ABA routing numbers is crucial for ensuring smooth financial transactions.

As we explore the topic, we'll cover everything from the historical origins of ABA routing numbers to their current applications in banking systems. By the end of this guide, you'll have a clear understanding of how these numbers work and why they are indispensable in today's financial landscape.

Read also:Who Is Cch Pounder A Comprehensive Look Into The Life And Career Of A Renowned Actress

Table of Contents

- What is an ABA Routing Number?

- ABA Same as Routing Number: Understanding the Terminology

- Structure of an ABA Routing Number

- Functions of ABA Routing Numbers

- History and Evolution of ABA Routing Numbers

- How to Find Your ABA Routing Number

- Security Measures for ABA Routing Numbers

- Common Uses of ABA Routing Numbers

- Common Issues and Troubleshooting

- Conclusion: Why Understanding ABA Routing Numbers Matters

What is an ABA Routing Number?

An ABA routing number, also known as an ABA routing transit number (RTN), is a nine-digit code assigned to financial institutions in the United States. It serves as a unique identifier for banks and credit unions, ensuring that financial transactions are directed to the correct institution. This number is critical for domestic transactions, such as direct deposits, wire transfers, and check processing.

History of ABA Routing Numbers

The American Bankers Association (ABA) introduced routing numbers in 1910 to streamline the processing of checks. Over the decades, the system has evolved to accommodate modern banking needs, including electronic transactions and automated clearing house (ACH) processes.

Importance in Banking

ABA routing numbers are vital for maintaining the integrity of the financial system. They ensure that funds are transferred accurately and efficiently, reducing the risk of errors and fraud. Without these numbers, the banking system would face significant challenges in processing millions of transactions daily.

ABA Same as Routing Number: Understanding the Terminology

The terms "ABA routing number" and "routing number" are often used interchangeably. However, it's essential to understand that they refer to the same concept. The "ABA" prefix indicates the origin of the system, as it was developed by the American Bankers Association. Today, routing numbers are a standard feature of U.S. banking, regardless of whether they are labeled as ABA routing numbers.

For clarity:

- ABA routing number = Routing number

- Both terms describe the nine-digit code used to identify financial institutions.

Structure of an ABA Routing Number

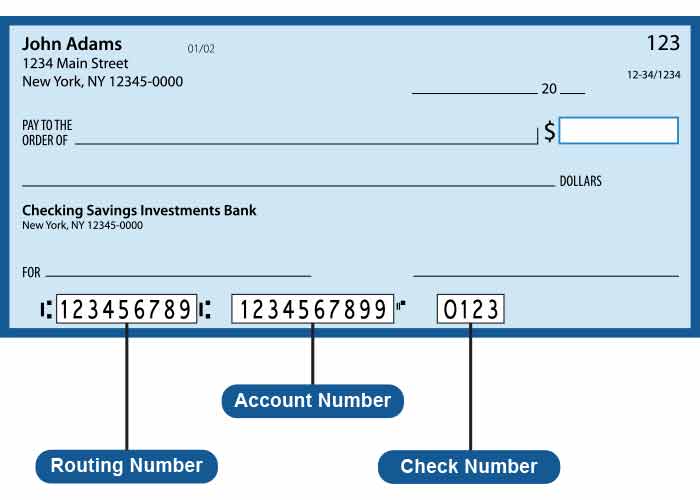

ABA routing numbers follow a specific format to ensure consistency and accuracy. Each number consists of nine digits, divided into three key components:

Read also:The Randy Watson Experience A Comprehensive Exploration Of His Journey Legacy And Impact

1. Federal Reserve Identifier

The first two digits of an ABA routing number identify the Federal Reserve Bank responsible for processing transactions for the financial institution. For example:

- 01-12: Federal Reserve Bank of Boston

- 61-72: Federal Reserve Bank of San Francisco

2. Institution Identifier

The next four digits represent the financial institution's unique identifier. This code ensures that transactions are directed to the correct bank or credit union.

3. Check Digit

The final digit serves as a checksum, verifying the validity of the routing number. This digit is calculated using a specific algorithm to prevent errors during data entry.

Functions of ABA Routing Numbers

ABA routing numbers perform several critical functions in the financial system:

1. Check Processing

When you write a check, the ABA routing number ensures that the funds are drawn from the correct account and credited to the intended recipient. This process is automated, reducing the need for manual intervention.

2. Direct Deposits

Employers use ABA routing numbers to deposit employee salaries directly into their bank accounts. This method is convenient, secure, and widely adopted across industries.

3. Wire Transfers

For domestic wire transfers, ABA routing numbers ensure that funds are transferred accurately and promptly. This is particularly important for large transactions, such as real estate purchases or business payments.

History and Evolution of ABA Routing Numbers

The development of ABA routing numbers dates back to 1910, when the American Bankers Association introduced the system to standardize check processing. Initially, routing numbers were used exclusively for paper checks. However, as technology advanced, the system expanded to accommodate electronic transactions.

Today, ABA routing numbers are integral to various financial processes, including:

- Automated Clearing House (ACH) transactions

- Electronic funds transfers (EFT)

- Online banking services

How to Find Your ABA Routing Number

Finding your ABA routing number is straightforward. Here are several methods you can use:

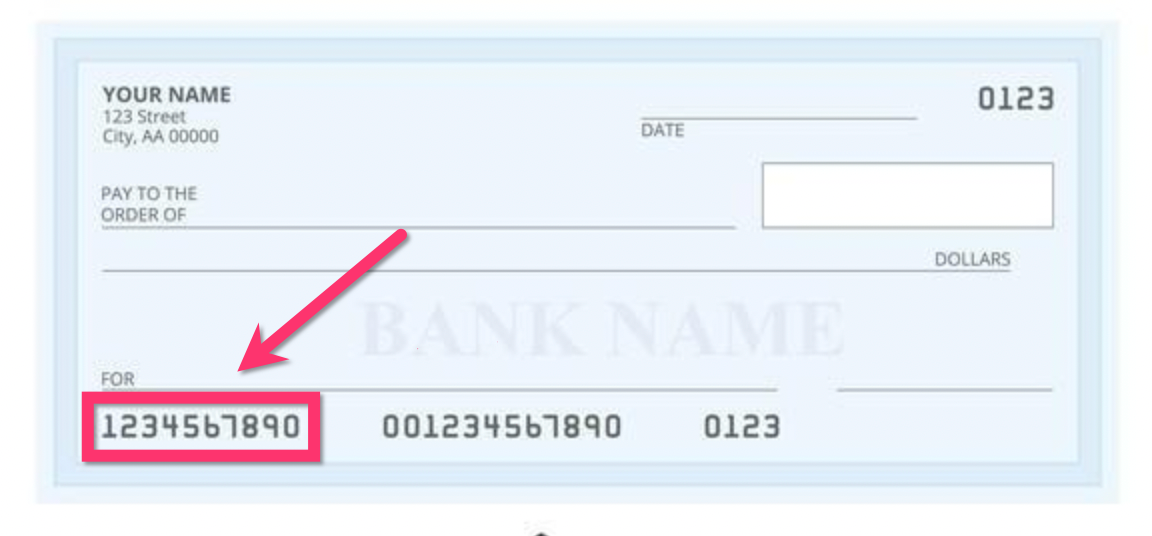

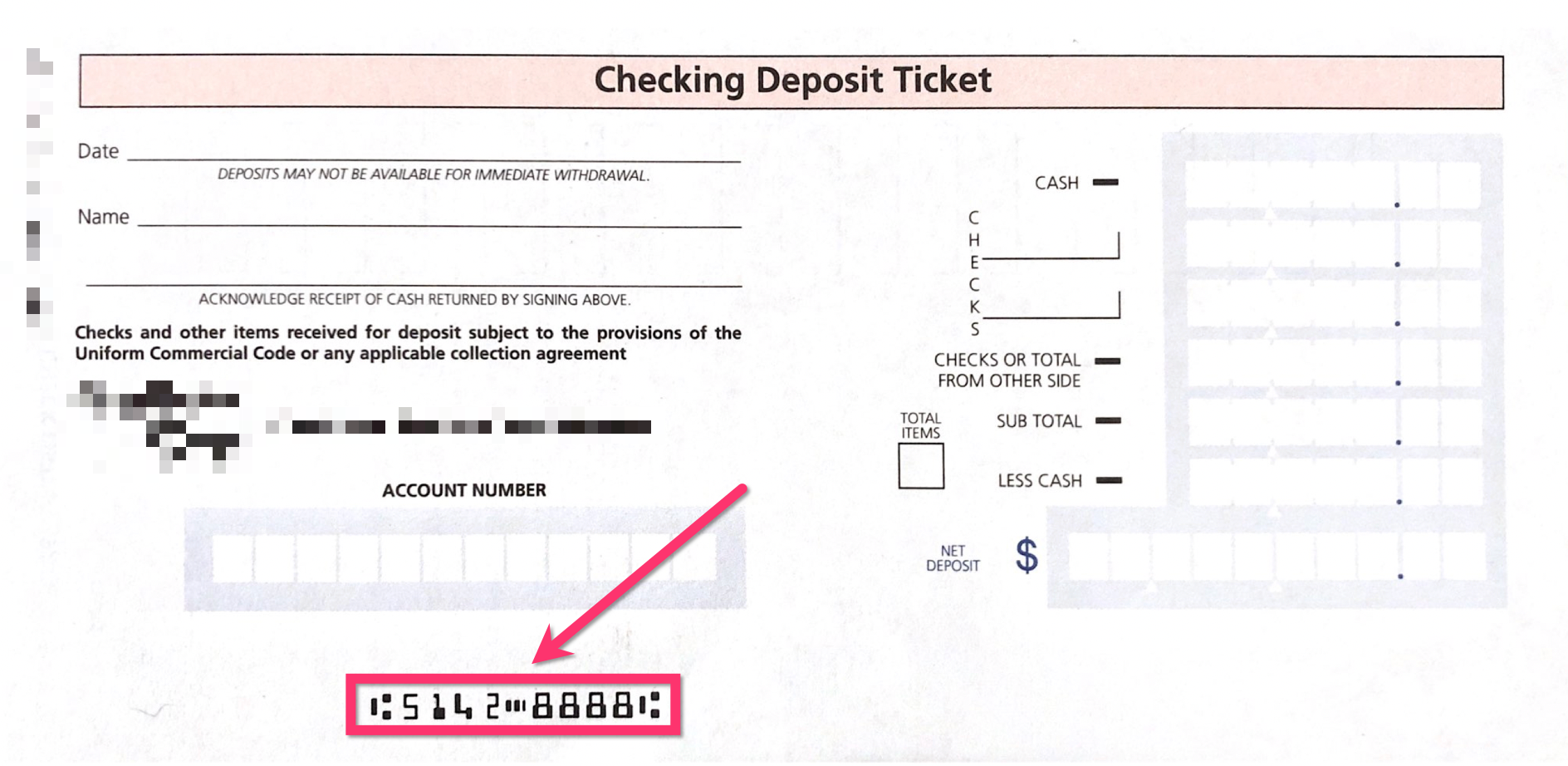

1. Check the Bottom of Your Checks

The ABA routing number is printed on the bottom left corner of your checks. It appears as a nine-digit code and is usually the first number in the sequence.

2. Online Banking Portal

Most banks provide ABA routing numbers through their online banking platforms. Log in to your account and look for account details or settings to locate the number.

3. Contact Your Bank

If you're unable to find your routing number, contact your bank's customer service department. They can provide the correct number based on your account type and location.

Security Measures for ABA Routing Numbers

While ABA routing numbers are essential for financial transactions, they must be handled with care to prevent misuse. Here are some security tips:

- Keep your routing number confidential, especially when sharing it online or over the phone.

- Verify the legitimacy of any request for your routing number before sharing it.

- Monitor your account activity regularly to detect unauthorized transactions.

Common Uses of ABA Routing Numbers

ABA routing numbers are used in various financial scenarios. Some of the most common applications include:

1. Paying Bills

Many bill payment services require ABA routing numbers to process payments from your bank account. This method is convenient and often free of charge.

2. Setting Up Recurring Payments

For recurring expenses, such as subscriptions or utility bills, providing your ABA routing number allows for automated payments.

3. Transferring Money Between Accounts

If you need to transfer funds between accounts at different banks, your ABA routing number ensures that the transaction is processed correctly.

Common Issues and Troubleshooting

Despite their importance, ABA routing numbers can sometimes cause issues. Here are some common problems and solutions:

1. Incorrect Routing Number

Using the wrong routing number can lead to failed transactions. Double-check the number before initiating any financial process.

2. Delays in Processing

Occasionally, delays may occur due to technical issues or bank processing times. If you experience delays, contact your bank for clarification.

3. Security Concerns

If you suspect unauthorized use of your ABA routing number, report it to your bank immediately. They can help you secure your account and prevent further issues.

Conclusion: Why Understanding ABA Routing Numbers Matters

In conclusion, understanding ABA routing numbers is essential for managing personal and business finances effectively. These nine-digit codes play a vital role in ensuring accurate and secure financial transactions. By familiarizing yourself with their structure, functions, and security measures, you can avoid common issues and make the most of modern banking services.

We encourage you to take action by:

- Verifying your ABA routing number for accuracy.

- Staying informed about the latest developments in banking technology.

- Sharing this article with others to promote financial literacy.

For more insights into banking and finance, explore our other articles. Together, let's build a stronger financial future!