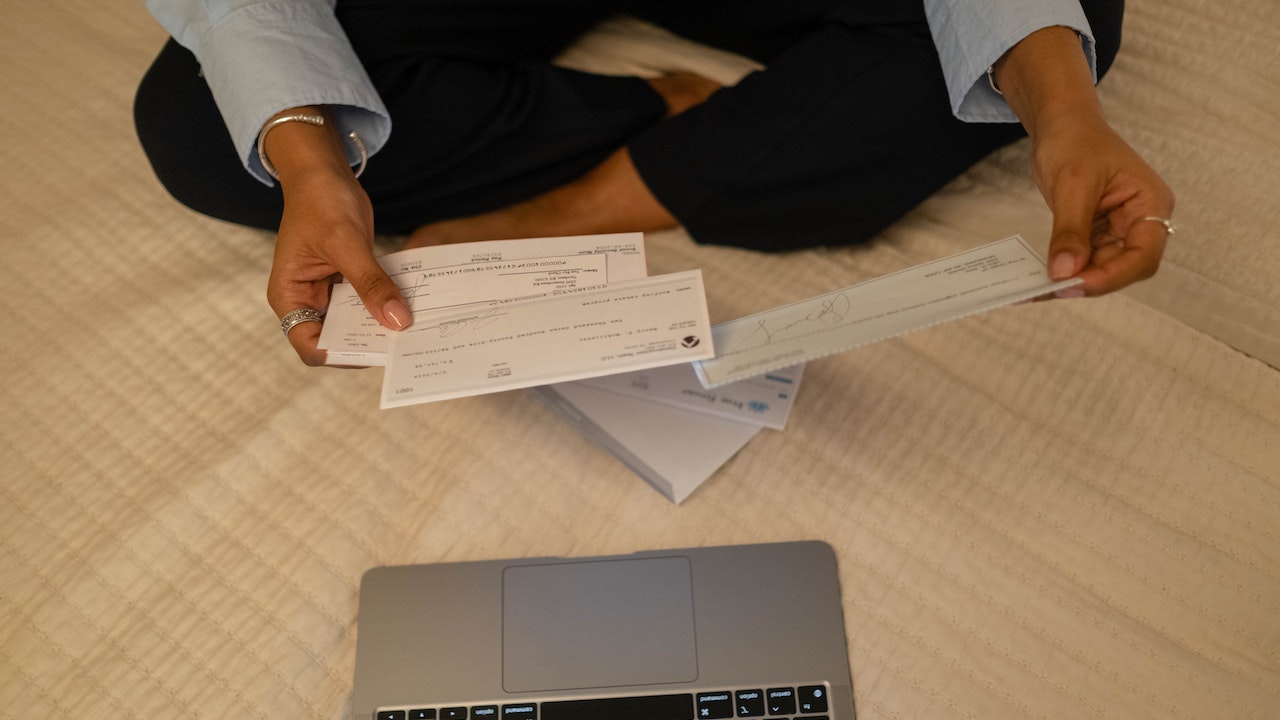

Can you cash a check without ID? This is a question that many people ask when they find themselves in a situation where they need to cash a check but don't have their identification documents with them. Cashing checks without an ID can be challenging, but it's not entirely impossible. In this article, we will explore the possibilities and provide you with detailed information to help you navigate this situation effectively.

Checks remain one of the most common methods of payment, especially for significant transactions like salary payments, refunds, or settlements. However, banks and check-cashing stores often require identification to verify the identity of the person cashing the check. Understanding the rules and alternatives can help you make informed decisions.

This guide will provide practical tips, expert advice, and actionable steps to help you cash a check without ID. Whether you're in an emergency or simply don't have access to your ID at the moment, this article will equip you with the knowledge you need to handle such situations.

Read also:What Is An Aba Number In Banking A Comprehensive Guide

Understanding the Basics of Cashing Checks Without ID

Cashing a check without ID is possible in certain circumstances, but it depends on the policies of the financial institution or check-cashing store you're dealing with. Most banks and stores have strict rules in place to prevent fraud and ensure security. However, there are alternative methods and strategies you can use to cash your check without an ID.

Let's delve into the basics:

- Bank policies vary depending on the institution.

- Some stores may accept other forms of identification or proof of identity.

- Prepaid debit cards and mobile banking apps can offer alternative solutions.

Why Banks Require ID for Cashing Checks

Banks require identification to comply with federal regulations and to protect both the customer and the institution from fraud. The Bank Secrecy Act and the USA PATRIOT Act mandate that financial institutions verify the identity of individuals conducting transactions above a certain amount.

Here are the main reasons:

- Fraud Prevention: Verifying identity helps prevent unauthorized individuals from cashing someone else's check.

- Regulatory Compliance: Banks must adhere to anti-money laundering laws.

- Customer Protection: ID verification ensures that the rightful owner of the check receives the funds.

Can You Cash a Check Without ID at Your Bank?

If the check is made out to you and you have an account at the bank where the check is drawn, you may still be able to cash it without an ID. Many banks allow account holders to cash checks using their account information instead of requiring an ID.

Steps to Cash a Check Without ID at Your Bank

Here’s how you can do it:

Read also:What Is Vertical Labret A Comprehensive Guide To This Unique Piercing

- Endorse the check by signing the back of it.

- Go to the bank where the check is drawn.

- Provide your account number or use your debit card to verify your identity.

- Follow the bank's instructions to complete the transaction.

It’s important to note that this process may vary depending on the bank's policies and the amount of the check.

Alternative Forms of Identification

While traditional ID cards are the most common form of identification, some institutions accept alternative forms of ID. These alternatives can help you cash a check even if you don’t have a government-issued ID.

Common Alternatives to Traditional ID

- Passport

- Employee ID card

- Student ID card

- Utility bill in your name

- Social Security card

Check with the specific institution to confirm which forms of identification they accept.

Using Mobile Banking to Cash a Check Without ID

Mobile banking apps have revolutionized the way people handle their finances. Many banks now offer mobile check deposit services, allowing you to cash a check using your smartphone without visiting a physical branch or presenting an ID.

How Mobile Check Deposit Works

- Download your bank's mobile app.

- Log in to your account.

- Select the "Deposit Check" option.

- Take a clear photo of the front and back of the endorsed check.

- Submit the deposit request and wait for confirmation.

This method is convenient, secure, and eliminates the need for physical ID verification.

Prepaid Debit Cards as an Alternative

Prepaid debit cards are another viable option for cashing checks without ID. These cards allow you to load funds directly onto the card without the need for a traditional bank account or ID verification.

Steps to Use a Prepaid Debit Card

- Acquire a prepaid debit card from a retailer or online.

- Activate the card and set up any required security features.

- Take the check to a participating retailer or ATM.

- Endorse the check and follow the retailer's instructions to load the funds onto the card.

Prepaid cards are especially useful for individuals who do not have access to traditional banking services.

Check-Cashing Stores: Policies and Procedures

Check-cashing stores often have more flexible policies than banks when it comes to ID requirements. However, these policies can vary significantly from one store to another.

What to Expect at a Check-Cashing Store

- Some stores may accept alternative forms of ID.

- Others may require a deposit into a prepaid card or account.

- Fees for cashing checks at these stores can be higher than at banks.

It’s essential to research the store's policies beforehand to avoid surprises.

Legal Considerations and Risks

Cashing a check without ID can come with legal risks. Attempting to cash a check without proper identification can raise suspicions and may lead to legal consequences if the institution believes fraud is involved.

Key Legal Points to Consider

- Always ensure that the check is legitimate and made out to you.

- Be honest about your situation with the institution.

- Keep records of all transactions for future reference.

Understanding the legal landscape can help you avoid potential pitfalls.

Can You Cash a Check Without ID? Expert Advice

According to financial experts, while it is possible to cash a check without ID, it’s crucial to explore all available options and choose the safest and most convenient method for your situation.

Here are some expert tips:

- Establish a relationship with a local bank or credit union.

- Consider using mobile banking services for convenience and security.

- Explore prepaid debit card options for flexibility.

These strategies can help you navigate the process effectively.

Conclusion: Taking Action

Cashing a check without ID is possible, but it requires careful consideration of the available options and a thorough understanding of the associated risks. By following the steps outlined in this guide, you can make informed decisions and handle such situations with confidence.

We encourage you to:

- Share this article with others who may find it helpful.

- Leave a comment below with your thoughts or questions.

- Explore other articles on our site for more financial tips and advice.

Remember, staying informed and proactive is the key to managing your finances effectively. Thank you for reading, and we hope this guide has been valuable to you.

Table of Contents

- Understanding the Basics of Cashing Checks Without ID

- Why Banks Require ID for Cashing Checks

- Can You Cash a Check Without ID at Your Bank?

- Alternative Forms of Identification

- Using Mobile Banking to Cash a Check Without ID

- Prepaid Debit Cards as an Alternative

- Check-Cashing Stores: Policies and Procedures

- Legal Considerations and Risks

- Can You Cash a Check Without ID? Expert Advice

- Conclusion: Taking Action