ABA numbers play a crucial role in the financial system, ensuring seamless transactions between banks. If you've ever wondered what these numbers are and how they function, this article will provide you with an in-depth understanding. From their origins to their practical applications, we will explore everything you need to know about ABA numbers.

ABA numbers, also known as routing transit numbers (RTNs), serve as a critical component of the banking infrastructure in the United States. These numbers ensure that funds are transferred accurately and efficiently between financial institutions. In this article, we will delve into the history, importance, and functionality of ABA numbers, providing you with a clear picture of their significance in modern banking.

Whether you're a business owner, an individual managing personal finances, or simply curious about banking operations, understanding ABA numbers is essential. Let's dive into the details to uncover their role and relevance in today's financial landscape.

Read also:Who Is Cch Pounder A Comprehensive Look Into The Life And Career Of A Renowned Actress

Table of Contents:

- Introduction to ABA Numbers

- History of ABA Numbers

- Structure of ABA Numbers

- Uses of ABA Numbers

- Finding Your ABA Number

- Differences Between ABA and ACH Numbers

- Security of ABA Numbers

- Common Questions About ABA Numbers

- Importance of ABA Numbers in Banking

- Conclusion

Introduction to ABA Numbers

ABA numbers, or routing transit numbers, are nine-digit codes assigned to financial institutions in the United States. These numbers facilitate the identification of banks and ensure that transactions are routed correctly. Without ABA numbers, the banking system would face significant challenges in processing payments and transfers efficiently.

Why Are ABA Numbers Important?

ABA numbers are vital for several reasons:

- They ensure accurate routing of transactions between banks.

- They help prevent errors in payment processing.

- They enhance the security of financial transactions.

History of ABA Numbers

The concept of ABA numbers dates back to 1910 when the American Bankers Association (ABA) developed the routing transit number system. This system was created to streamline the process of clearing checks and other financial instruments. Over the years, the use of ABA numbers has expanded to include electronic transactions, making them an indispensable part of modern banking.

Evolution of ABA Numbers

With advancements in technology, ABA numbers have evolved to accommodate various transaction types, including:

- Direct deposits

- Bill payments

- Wire transfers

Structure of ABA Numbers

An ABA number consists of nine digits, each with a specific purpose:

Read also:Why Did Lois Marry Peter A Comprehensive Analysis

- The first four digits represent the Federal Reserve routing symbol.

- The next four digits identify the bank or financial institution.

- The final digit serves as a checksum to validate the number.

How to Validate an ABA Number

To validate an ABA number, you can use the checksum formula, which involves multiplying specific digits by predetermined weights and ensuring the result is divisible by 10.

Uses of ABA Numbers

ABA numbers are used in various financial transactions, including:

- Direct deposits

- Automated Clearing House (ACH) transfers

- Check processing

- Wire transfers

ABA Numbers in International Transactions

While ABA numbers are primarily used within the United States, they can also play a role in international transactions when dealing with U.S.-based banks.

Finding Your ABA Number

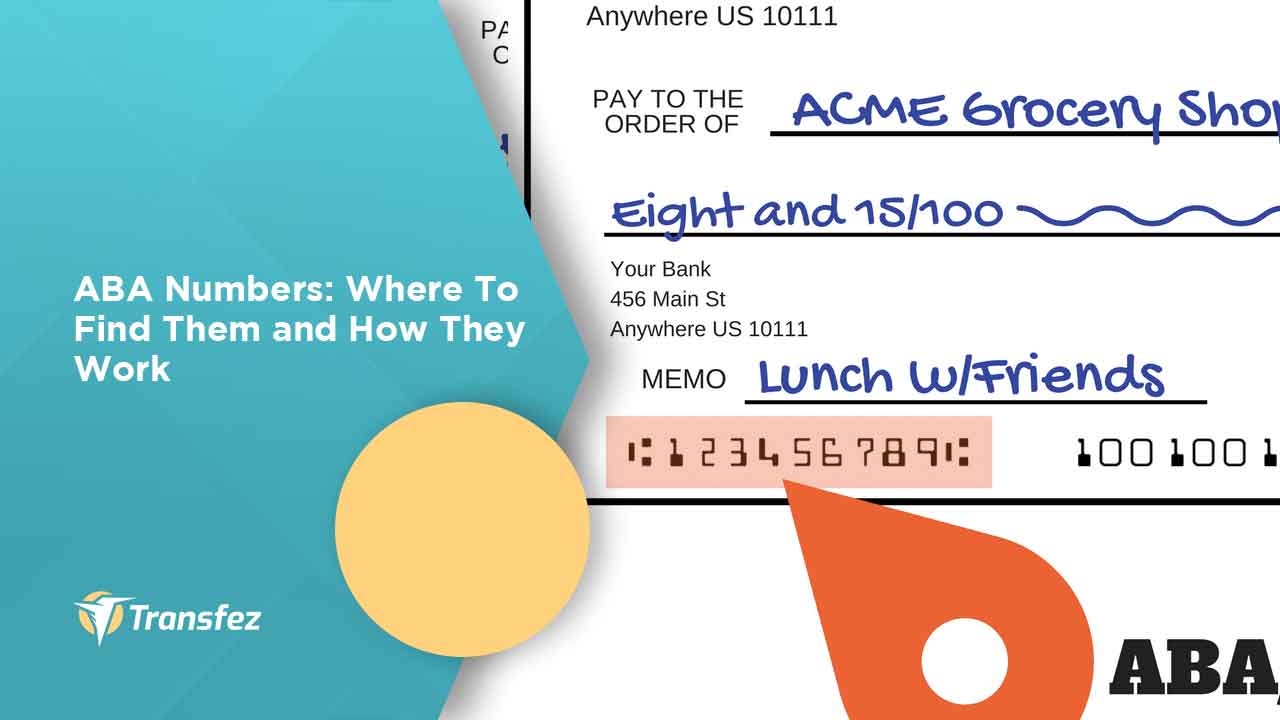

Locating your ABA number is straightforward. You can find it on your checks, online banking platform, or by contacting your bank directly. Here's how:

- On checks: The ABA number is typically located at the bottom left corner of your checks.

- Online banking: Log in to your account and navigate to the account details section.

- Contact your bank: Reach out to your bank's customer service for assistance.

Differences Between ABA and ACH Numbers

While ABA numbers and ACH numbers are often used interchangeably, they serve different purposes. ABA numbers identify banks, while ACH numbers are used specifically for electronic transactions. Understanding the distinction between the two is essential for accurate transaction processing.

Key Differences

- ABA numbers are nine digits, while ACH numbers may vary in length.

- ABA numbers are primarily used for routing, while ACH numbers focus on electronic transfers.

Security of ABA Numbers

Protecting your ABA number is crucial to prevent unauthorized access to your accounts. Here are some tips to ensure the security of your ABA number:

- Keep your checks in a secure location.

- Monitor your account activity regularly.

- Be cautious when sharing your ABA number online.

Common Questions About ABA Numbers

Can ABA Numbers Be Changed?

Yes, ABA numbers can change if a bank undergoes a merger or acquisition. In such cases, the bank will notify its customers of the new routing number.

Are ABA Numbers Unique?

Yes, each bank or financial institution is assigned a unique ABA number to ensure accurate transaction routing.

Importance of ABA Numbers in Banking

ABA numbers are a cornerstone of the U.S. banking system, enabling seamless transactions and enhancing the overall efficiency of financial operations. Their role in modern banking cannot be overstated, as they ensure that funds are transferred accurately and securely.

Impact on Financial Efficiency

By providing a standardized system for routing transactions, ABA numbers contribute significantly to the efficiency and reliability of the banking industry. This standardization helps reduce errors and ensures timely processing of payments.

Conclusion

In conclusion, ABA numbers are an essential component of the U.S. banking system, facilitating accurate and secure transactions. Understanding their structure, uses, and importance can empower individuals and businesses to manage their finances more effectively. We encourage you to share this article with others and explore additional resources to deepen your knowledge of banking practices.

For further reading, consider exploring related topics such as electronic payments, banking security, and financial regulations. Together, we can build a more informed and secure financial future.

Data Sources: