Understanding the concept of an ABA routing number is crucial for anyone involved in banking or financial transactions in the United States. Whether you're setting up direct deposits, transferring funds, or paying bills online, this unique code plays a significant role in ensuring that your money reaches the correct destination. In this article, we will delve into what an ABA routing number is, its importance, and how it functions in the financial ecosystem.

ABA routing numbers, officially known as American Bankers Association routing transit numbers, are essential components of the U.S. banking system. They were first introduced in 1910 to help streamline check processing. Today, they have evolved to serve multiple purposes in electronic banking and payment systems. By the end of this guide, you will have a clear understanding of how these numbers work and why they are indispensable for modern banking.

For businesses and individuals alike, knowing how to locate and verify your ABA routing number can save time and prevent errors in financial transactions. Let’s explore this topic in detail, starting with the basics and moving on to advanced applications.

Read also:Comprehensive Guide To Ohio Bmv Registration Fee Everything You Need To Know

Table of Contents

- Overview of ABA Routing Numbers

- Structure of an ABA Routing Number

- Key Functions of ABA Routing Numbers

- How to Find Your ABA Routing Number

- Types of ABA Routing Numbers

- History and Evolution of ABA Routing Numbers

- Security Considerations

- Common Questions About ABA Routing Numbers

- Why ABA Routing Numbers Are Important

- Conclusion

Overview of ABA Routing Numbers

An ABA routing number is a nine-digit code assigned to financial institutions in the United States. It serves as a digital address, enabling banks and credit unions to identify each other when processing checks, wire transfers, and other financial transactions. Each bank or credit union has its own unique routing number, ensuring that funds are routed correctly.

How ABA Routing Numbers Were Introduced

The ABA routing number system was developed by the American Bankers Association in 1910 to simplify the process of clearing checks. At the time, the banking industry faced challenges in efficiently processing large volumes of checks. The introduction of routing numbers revolutionized this process by providing a standardized method for identifying financial institutions.

Modern-Day Uses

Today, ABA routing numbers are used not only for check processing but also for various electronic transactions. They are essential for direct deposits, automatic bill payments, wire transfers, and other financial activities. Understanding the role of routing numbers in these processes is vital for anyone managing their finances.

Structure of an ABA Routing Number

Each ABA routing number consists of nine digits, and its structure is carefully designed to encode specific information about the financial institution. Breaking down the number reveals details such as the Federal Reserve Bank, the bank’s location, and its unique identifier.

Decoding the Nine Digits

- Digits 1-4: Represent the Federal Reserve Routing Symbol, identifying the Federal Reserve Bank servicing the institution.

- Digits 5-8: Represent the ABA Institution Identifier, which is unique to each financial institution.

- Digit 9: Acts as a check digit, used to verify the accuracy of the routing number.

This structure ensures that routing numbers are both unique and verifiable, reducing the risk of errors in financial transactions.

Key Functions of ABA Routing Numbers

ABA routing numbers perform several critical functions in the financial ecosystem. They are indispensable for ensuring the accuracy and security of transactions across different platforms.

Read also:What Is An Aba Number In Banking A Comprehensive Guide

Check Processing

One of the primary functions of ABA routing numbers is facilitating the processing of checks. When you write a check, the routing number ensures that the funds are drawn from the correct bank account and credited to the intended recipient.

Electronic Transactions

In addition to checks, ABA routing numbers are used for electronic transactions such as direct deposits, automatic bill payments, and wire transfers. These transactions rely on routing numbers to ensure that funds are transferred securely and efficiently.

How to Find Your ABA Routing Number

Locating your ABA routing number is straightforward and can be done in several ways. Whether you prefer using physical checks or digital tools, there are multiple options available.

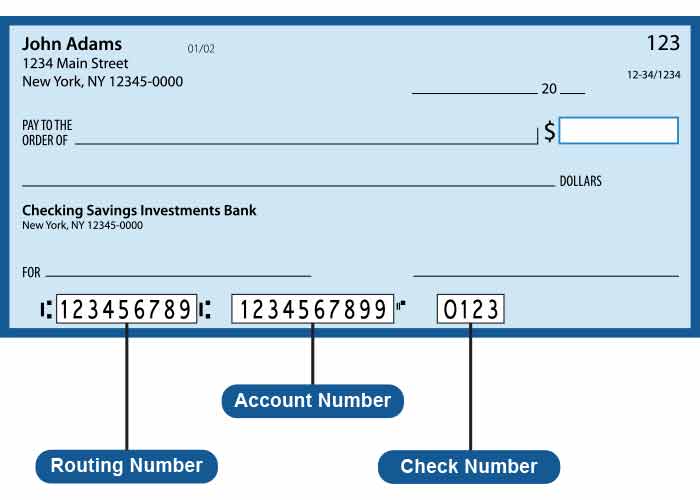

On Your Checks

The easiest way to find your ABA routing number is by looking at the bottom of your personal checks. It is the first set of numbers in the magnetic ink character recognition (MICR) line. This number is printed in a standardized format to ensure easy readability by machines.

Online Banking

Many banks provide customers with access to their routing numbers through online banking platforms. By logging into your account, you can usually find this information under the account details or settings section.

Bank’s Website or Customer Support

If you don’t have checks or access to online banking, you can visit your bank’s website or contact their customer support team. Most banks publish their routing numbers on their official websites for easy reference.

Types of ABA Routing Numbers

Not all ABA routing numbers are created equal. Depending on the type of transaction, different routing numbers may be used. Understanding the distinction between these types is important for ensuring smooth financial operations.

Checking Account Routing Numbers

Checking account routing numbers are used for transactions involving checking accounts, such as check processing and direct deposits. These numbers are typically the most commonly used by individuals and businesses.

Savings Account Routing Numbers

Savings account routing numbers are used for transactions involving savings accounts. While similar to checking account routing numbers, they may differ depending on the bank’s internal systems.

Wire Transfer Routing Numbers

For international or domestic wire transfers, a separate routing number may be required. Wire transfer routing numbers are designed to handle larger transactions and often involve additional security measures.

History and Evolution of ABA Routing Numbers

The history of ABA routing numbers dates back over a century, and their evolution reflects the changing landscape of the financial industry. From manual check processing to advanced digital systems, routing numbers have adapted to meet the needs of modern banking.

Early Days of Check Processing

In the early 20th century, the banking industry faced significant challenges in processing checks efficiently. The introduction of ABA routing numbers provided a solution by standardizing the identification of financial institutions.

Transition to Electronic Banking

With the advent of electronic banking, routing numbers became even more critical. They enabled the development of systems like the Automated Clearing House (ACH), which processes millions of transactions daily. This transition marked a significant milestone in the evolution of financial technology.

Security Considerations

While ABA routing numbers are essential for financial transactions, they also pose potential security risks if misused. Protecting your routing number is crucial to safeguarding your financial information.

Best Practices for Security

- Never share your routing number unless it is necessary for a legitimate transaction.

- Be cautious when providing your routing number online and ensure the website is secure.

- Regularly monitor your bank statements for any unauthorized transactions.

By following these best practices, you can minimize the risk of fraud and protect your financial data.

Common Questions About ABA Routing Numbers

Many people have questions about ABA routing numbers, and addressing these queries can provide clarity and reassurance. Below are some frequently asked questions and their answers.

Can Routing Numbers Change?

Yes, routing numbers can change due to mergers, acquisitions, or updates to the banking system. If your bank undergoes such changes, they will notify you of any updates to your routing number.

Are Routing Numbers the Same for All Accounts?

Routing numbers are typically the same for all accounts within the same bank. However, some banks may use different routing numbers for different types of transactions or accounts.

What Happens if I Use the Wrong Routing Number?

Using the wrong routing number can result in delayed or failed transactions. Always double-check the routing number before initiating any financial transaction to avoid errors.

Why ABA Routing Numbers Are Important

ABA routing numbers are indispensable for maintaining the integrity and efficiency of the financial system. They ensure that funds are transferred accurately and securely, preventing errors and fraud. Understanding their importance is key to managing your finances effectively.

Impact on Financial Transactions

Routing numbers play a critical role in various financial transactions, from everyday activities like paying bills to more complex processes like international wire transfers. Their accuracy and reliability are essential for the smooth functioning of the banking system.

Contribution to Financial Security

By providing a standardized method for identifying financial institutions, routing numbers enhance security and reduce the risk of errors. This contributes to a more stable and trustworthy financial ecosystem.

Conclusion

In conclusion, ABA routing numbers are vital components of the U.S. banking system, ensuring the accuracy and security of financial transactions. From their introduction in 1910 to their current role in electronic banking, routing numbers have evolved to meet the needs of a rapidly changing financial landscape. By understanding their structure, functions, and importance, you can better manage your finances and protect your information.

We encourage you to take action by verifying your routing number and implementing best practices for security. Share this article with others to help them understand the significance of ABA routing numbers. For more insights into personal finance and banking, explore our other articles and resources.

Data Source: Federal Reserve Bank, American Bankers Association.