The US Department of Treasury Bureau of Fiscal Service check plays a crucial role in the financial operations of the United States government. Issued by the Bureau of Fiscal Service, these checks represent a formal method of payment for various government obligations. Whether you're a citizen receiving federal benefits or a business dealing with government contracts, understanding this system is essential for financial management and compliance.

For many individuals and businesses, navigating the intricacies of government checks and fiscal services can seem daunting. This guide aims to demystify the process by providing an in-depth look into the Bureau of Fiscal Service's operations, the types of checks issued, and how to manage them effectively. By the end of this article, you'll have a clear understanding of the importance and functionality of these checks.

Whether you're looking to learn more about government payments or need practical advice on handling these financial instruments, this article covers all the essential aspects of the US Department of Treasury Bureau of Fiscal Service check. Let's dive into the details and empower you with the knowledge needed to manage your finances confidently.

Read also:Two And A Half Men A Comprehensive Guide To The Iconic Tv Series

Table of Contents

- Overview of the Bureau of Fiscal Service

- Types of Checks Issued by the Bureau

- The Process of Issuing US Department of Treasury Checks

- How to Verify and Validate Treasury Checks

- Common Issues with Treasury Checks

- Security Features of Treasury Checks

- Digital Alternatives to Paper Checks

- Understanding Fiscal Service Regulations

- Key Statistics and Trends in Treasury Payments

- Conclusion and Next Steps

Overview of the Bureau of Fiscal Service

The Bureau of Fiscal Service is a vital component of the US Department of Treasury, responsible for managing the financial operations of the federal government. Established to streamline and enhance the efficiency of government payments, the Bureau ensures that funds are distributed accurately and securely. Its primary mission is to provide fiscal services that support the nation's financial health.

The Bureau handles a wide range of financial transactions, including issuing checks for federal programs, managing public debt, and overseeing government accounts. By focusing on transparency and accountability, the Bureau ensures that taxpayers' money is managed responsibly. This section provides a detailed look into the structure and responsibilities of the Bureau of Fiscal Service.

Key Functions of the Bureau

- Issuing payments for federal programs

- Managing government accounts and debt

- Providing fiscal services to federal agencies

- Ensuring compliance with financial regulations

Types of Checks Issued by the Bureau

The US Department of Treasury Bureau of Fiscal Service check comes in various forms, each serving a specific purpose. These checks are used to fulfill government obligations, such as Social Security payments, veterans' benefits, and federal grants. Understanding the different types of checks can help recipients manage their finances more effectively.

Some of the most common types of checks include:

Examples of Treasury Checks

- Social Security checks

- Veterans Affairs payments

- Federal employee retirement benefits

- Grant disbursements for government programs

Each type of check has unique features and requirements, ensuring that payments are made accurately and securely.

The Process of Issuing US Department of Treasury Checks

The process of issuing US Department of Treasury Bureau of Fiscal Service checks involves several steps to ensure accuracy and security. From verifying recipient information to printing and distributing checks, the Bureau follows strict protocols to prevent fraud and errors. This section outlines the key stages in the check issuance process.

Read also:What Is Vertical Labret A Comprehensive Guide To This Unique Piercing

Steps in the Issuance Process

- Verification of recipient data

- Approval by relevant government agencies

- Printing and security enhancements

- Distribution through secure channels

By adhering to these steps, the Bureau ensures that checks are delivered promptly and securely to their intended recipients.

How to Verify and Validate Treasury Checks

Verifying the authenticity of a US Department of Treasury Bureau of Fiscal Service check is crucial to avoid fraud and ensure financial security. Recipients should be aware of the security features embedded in these checks and understand the validation process. This section provides practical advice on how to verify and validate treasury checks.

Key verification steps include:

Verification Tips

- Check for security features such as watermarks and microprinting

- Verify the check amount and recipient information

- Contact the Bureau of Fiscal Service for confirmation if needed

By following these steps, recipients can ensure the legitimacy of their checks and protect themselves from potential fraud.

Common Issues with Treasury Checks

Despite the Bureau's efforts to ensure accuracy and security, issues with US Department of Treasury Bureau of Fiscal Service checks can arise. Common problems include lost or stolen checks, discrepancies in payment amounts, and delays in delivery. This section addresses these issues and provides solutions to help recipients resolve them effectively.

Solutions to Common Problems

- Report lost or stolen checks immediately to the Bureau

- Request reissues for delayed or missing checks

- Contact the issuing agency for discrepancies in payment amounts

By taking proactive measures, recipients can minimize the impact of these issues and ensure timely receipt of their payments.

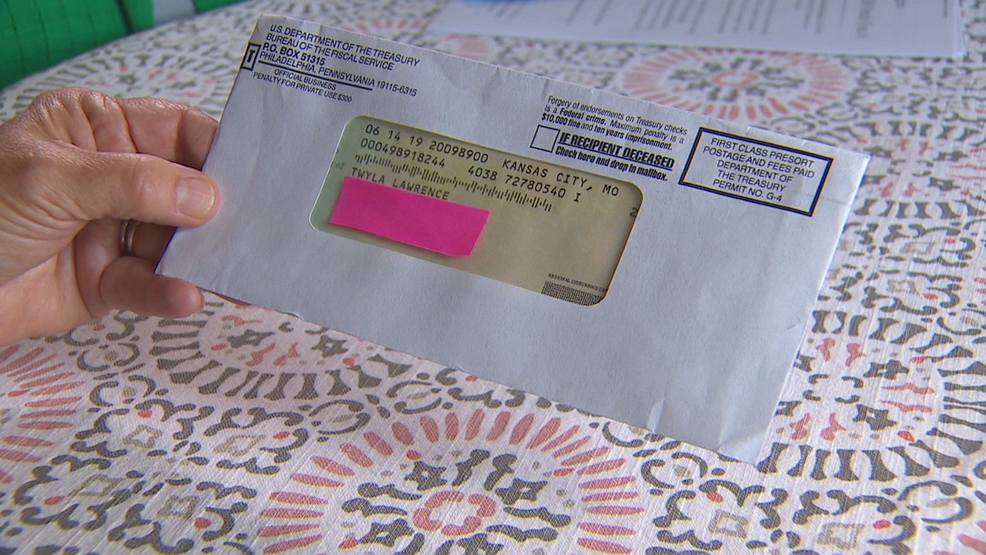

Security Features of Treasury Checks

The US Department of Treasury Bureau of Fiscal Service incorporates advanced security features into its checks to prevent fraud and ensure authenticity. These features include watermarks, microprinting, and special inks that make counterfeiting extremely difficult. Understanding these security measures can help recipients identify genuine checks and avoid fraudulent ones.

Some of the key security features include:

Security Features

- Watermarks visible when held up to light

- Microprinting that is difficult to replicate

- Special security fibers embedded in the paper

By incorporating these features, the Bureau ensures that its checks remain secure and trustworthy.

Digital Alternatives to Paper Checks

As technology advances, the US Department of Treasury Bureau of Fiscal Service is increasingly moving toward digital payment methods as alternatives to paper checks. Direct deposit and electronic funds transfer (EFT) are becoming popular options for government payments. This section explores the benefits and challenges of transitioning to digital payments.

Advantages of Digital Payments

- Faster processing times

- Reduced risk of fraud and theft

- Convenience for recipients

While digital payments offer numerous advantages, some recipients may still prefer traditional paper checks. The Bureau continues to support both options to accommodate diverse needs.

Understanding Fiscal Service Regulations

The US Department of Treasury Bureau of Fiscal Service operates under strict regulations to ensure compliance with federal laws and standards. These regulations govern the issuance, verification, and management of government checks. Understanding these regulations is essential for recipients and businesses dealing with government payments.

Key regulations include:

Regulatory Framework

- Compliance with the Federal Financial Management Improvement Act

- Adherence to the Government Accountability Office standards

- Implementation of anti-fraud measures

By following these regulations, the Bureau ensures that its operations remain transparent, efficient, and secure.

Key Statistics and Trends in Treasury Payments

Data and statistics provide valuable insights into the trends and developments in US Department of Treasury Bureau of Fiscal Service payments. According to recent reports, the Bureau processes millions of checks annually, with an increasing shift toward digital payment methods. These trends reflect the evolving needs of recipients and the government's commitment to modernizing its financial systems.

Some key statistics include:

- Over 100 million checks issued annually

- Approximately 70% of payments now processed digitally

- A steady decline in paper check usage over the past decade

These figures highlight the importance of adapting to changing payment preferences and technologies.

Conclusion and Next Steps

In conclusion, the US Department of Treasury Bureau of Fiscal Service check represents a critical component of the federal government's financial operations. By understanding the processes, security features, and regulations governing these checks, recipients can manage their finances more effectively and securely. Whether you prefer traditional paper checks or digital payment methods, the Bureau offers reliable solutions to meet your needs.

We encourage you to take the following steps:

- Verify the authenticity of your checks using the tips provided

- Consider transitioning to digital payment methods for convenience

- Stay informed about the latest trends and developments in treasury payments

Feel free to leave your thoughts and questions in the comments section below. For more information on financial topics, explore our other articles and resources. Together, let's build a more secure and informed financial future.