Opening a Fifth Third Bank account online has become more accessible and convenient than ever before. Whether you're looking to manage your finances better or need a reliable banking service, Fifth Third Bank offers a seamless digital experience. This guide will walk you through everything you need to know about opening an account online, from the requirements to the step-by-step process.

Fifth Third Bank is one of the leading financial institutions in the United States, providing a wide range of banking services to individuals and businesses. With its user-friendly online platform, you can easily open a Fifth Third Bank account from the comfort of your home. In this article, we'll explore the benefits, requirements, and procedures involved in opening your account online.

By the end of this guide, you'll have a clear understanding of how to open a Fifth Third Bank account online, ensuring that you make an informed decision about your financial future. Let's dive in!

Read also:Tmobile On The Las Vegas Strip Your Ultimate Connectivity Guide

Table of Contents

- Benefits of Opening a Fifth Third Bank Account Online

- Requirements for Opening an Account

- Step-by-Step Guide to Open Fifth Third Bank Account Online

- Types of Accounts Available

- Fees and Charges

- Security Features of Online Banking

- Customer Support for Online Account Opening

- Comparison with Other Banks

- Tips for a Successful Account Opening

- Conclusion

Benefits of Opening a Fifth Third Bank Account Online

Opening a Fifth Third Bank account online comes with several advantages that make it an attractive option for many individuals. Here are some of the key benefits:

- Convenience: You can open an account from anywhere at any time, as long as you have internet access.

- Time-Saving: The online process is faster compared to visiting a physical branch, saving you valuable time.

- Security: Fifth Third Bank employs robust security measures to protect your personal and financial information.

- Accessibility: Once your account is set up, you can manage it easily through their mobile app or website.

These benefits make Fifth Third Bank a top choice for those looking to streamline their banking experience.

Requirements for Opening an Account

Before you begin the process of opening a Fifth Third Bank account online, it's important to ensure you have all the necessary documents and information ready. Here's what you'll need:

Personal Identification

You must provide valid identification to verify your identity. Acceptable forms of ID include:

- Driver's license

- State ID card

- Passport

Personal Information

Be prepared to provide the following personal details:

- Social Security Number (SSN) or Taxpayer Identification Number (TIN)

- Your full legal name

- Date of birth

- Residential address

Step-by-Step Guide to Open Fifth Third Bank Account Online

Here's a detailed guide on how to open a Fifth Third Bank account online:

Read also:Comprehensive Guide To Chase Com Banking Help Your Ultimate Resource

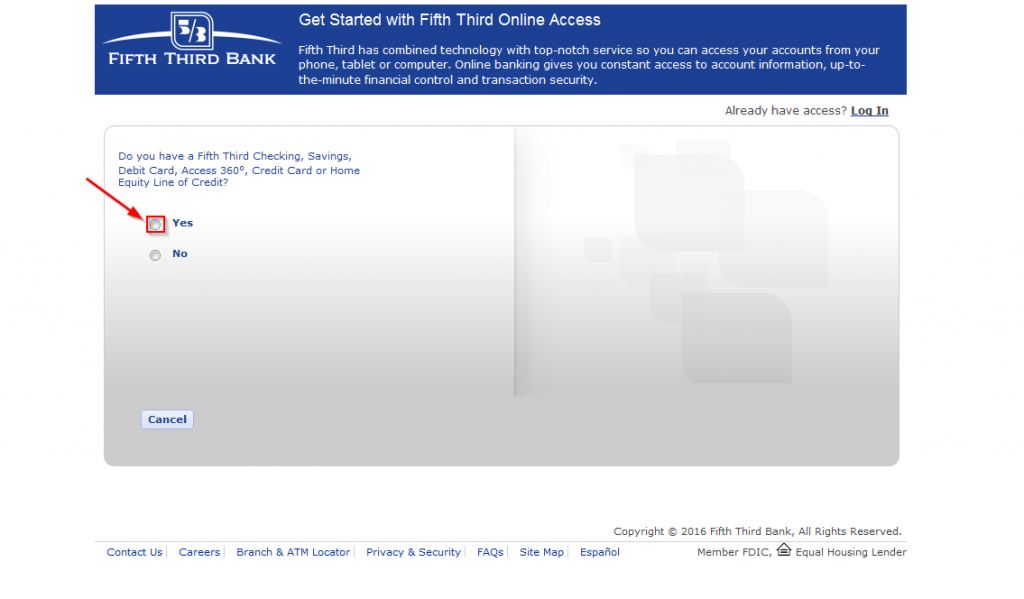

Step 1: Visit the Official Website

Go to the Fifth Third Bank website and navigate to the account opening section. Ensure you're on the official site to avoid security risks.

Step 2: Choose the Right Account

Select the type of account that best suits your needs. Fifth Third Bank offers various options, including checking, savings, and money market accounts.

Step 3: Provide Personal Information

Fill out the required personal information fields. Make sure all the details are accurate and up-to-date.

Step 4: Upload Documents

Upload the necessary identification documents as requested. This step is crucial for verifying your identity.

Step 5: Review and Submit

Double-check all the information you've entered, and then submit your application. You'll receive a confirmation once the process is complete.

Types of Accounts Available

Fifth Third Bank offers a variety of account types to cater to different financial needs:

- Checking Accounts: Ideal for everyday transactions and bill payments.

- Savings Accounts: Designed for saving money with competitive interest rates.

- Money Market Accounts: Offers higher interest rates with limited check-writing capabilities.

Each account type comes with its own set of features and benefits, so it's important to choose the one that aligns with your financial goals.

Fees and Charges

Understanding the fees associated with your account is essential for effective financial planning. Fifth Third Bank charges various fees depending on the type of account and services used. Some common fees include:

- Monthly maintenance fees

- Overdraft fees

- ATM withdrawal fees

However, many of these fees can be waived by maintaining a minimum balance or setting up direct deposits. Be sure to review the fee schedule provided by Fifth Third Bank for more details.

Security Features of Online Banking

Fifth Third Bank prioritizes the security of its customers' information. Here are some of the security features implemented:

- Encryption Technology: Protects your data during transmission.

- Two-Factor Authentication: Adds an extra layer of security to your account.

- Regular Monitoring: Detects and prevents suspicious activities.

These features ensure that your online banking experience is safe and secure.

Customer Support for Online Account Opening

If you encounter any issues while opening your account online, Fifth Third Bank's customer support team is available to assist you. You can reach them through:

- Phone: Call their customer service hotline for immediate assistance.

- Email: Send an email for inquiries that don't require urgent attention.

- Live Chat: Use the live chat feature on their website for real-time support.

Their support team is knowledgeable and dedicated to helping you resolve any problems you may face.

Comparison with Other Banks

When considering opening a Fifth Third Bank account online, it's helpful to compare it with other banks. Some factors to consider include:

- Interest rates

- Fees and charges

- Customer service quality

- Available features and tools

While Fifth Third Bank offers competitive rates and excellent customer service, it's always a good idea to weigh your options before making a decision.

Tips for a Successful Account Opening

To ensure a smooth account opening process, here are some tips to keep in mind:

- Gather all required documents beforehand to avoid delays.

- Read the terms and conditions carefully to understand the account's features and limitations.

- Set up automatic alerts to stay informed about your account activity.

Following these tips will help you avoid common pitfalls and make the most of your Fifth Third Bank account.

Conclusion

Opening a Fifth Third Bank account online is a straightforward process that offers numerous benefits, including convenience, security, and accessibility. By following the steps outlined in this guide, you can successfully open an account and start managing your finances with ease.

We encourage you to take action by visiting the Fifth Third Bank website and starting your application today. Don't forget to share this article with others who might find it helpful and leave a comment below if you have any questions or feedback.

For more information on banking and finance, explore our other articles on the site. Thank you for reading!