In today's fast-paced world, financial flexibility is essential for managing day-to-day expenses. Visa debit vanilla gift cards have become a popular solution for both personal and business transactions. These prepaid cards offer convenience, security, and control over spending. Whether you're looking to streamline your budget or provide a valuable gift, understanding how to manage your vanilla gift card balance is crucial.

Visa debit gift cards provide users with a versatile payment option that combines the security of a prepaid card with the global acceptance of Visa. Unlike traditional credit or debit cards, these cards are preloaded with funds, making them ideal for specific purchases or as gifts. By mastering how to monitor and maintain your vanilla gift card balance, you can maximize the benefits of this financial tool.

Throughout this article, we will explore everything you need to know about vanilla gift cards, including how to check your balance, common uses, security features, and tips for optimizing your card usage. Whether you're a first-time user or a seasoned cardholder, this comprehensive guide will equip you with the knowledge to make the most of your Visa debit vanilla gift card.

Read also:Tmobile On The Las Vegas Strip Your Ultimate Connectivity Guide

Table of Contents

- Introduction to Vanilla Gift Cards

- Types of Vanilla Gift Cards

- How to Check Your Vanilla Gift Card Balance

- Security Features of Visa Debit Gift Cards

- Common Uses of Vanilla Gift Cards

- Benefits of Using Vanilla Gift Cards

- Limitations and Restrictions

- Activating Your Vanilla Gift Card

- Troubleshooting Common Issues

- The Future of Prepaid Gift Cards

- Conclusion and Final Thoughts

Introduction to Vanilla Gift Cards

Vanilla gift cards have gained popularity due to their simplicity and versatility. These cards, often branded with Visa or Mastercard logos, function similarly to traditional debit cards but are preloaded with a specific amount of money. Unlike credit cards, which require a line of credit, and standard debit cards, which are linked to a bank account, vanilla gift cards operate independently. This makes them an excellent choice for individuals who prefer not to use credit or for those who want to control their spending.

One of the key advantages of vanilla gift cards is their wide acceptance. Since they carry the Visa logo, they can be used wherever Visa is accepted, both online and in-store. Additionally, these cards are reloadable, meaning users can add more funds as needed. This feature enhances their usability, making them suitable for various purposes, from personal budgeting to corporate expense management.

Understanding the Basics

Before diving into the specifics of managing your vanilla gift card balance, it's important to understand the fundamental aspects of these cards. They are typically purchased in predetermined denominations, ranging from $10 to $500 or more. Once activated, the cardholder can use the funds for purchases, ATM withdrawals, or even bill payments, depending on the card's features.

Types of Vanilla Gift Cards

Not all vanilla gift cards are created equal. There are several types available, each catering to different needs and preferences. The most common categories include:

- Single-Use Cards: These cards are designed for one-time use and cannot be reloaded. They are ideal for gifting or specific purchases.

- Reloadable Cards: As the name suggests, these cards allow users to add more funds after the initial balance is depleted. They are perfect for recurring expenses or long-term use.

- Branded Cards: Some vanilla gift cards are co-branded with specific retailers or service providers, offering additional perks or discounts when used at participating locations.

Choosing the right type of card depends on your intended use and financial goals. For example, if you plan to use the card for monthly expenses, a reloadable option might be more suitable. On the other hand, a single-use card could be ideal for a one-time gift.

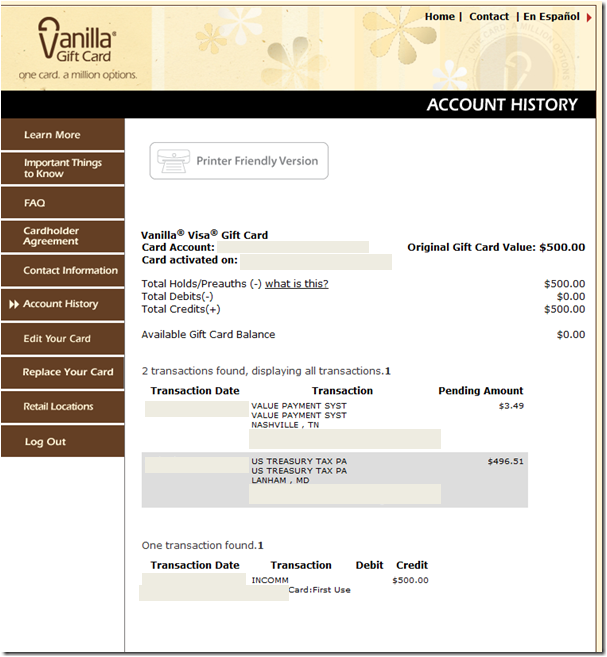

How to Check Your Vanilla Gift Card Balance

Monitoring your vanilla gift card balance is crucial to ensure you have sufficient funds for your transactions. Fortunately, there are several methods to check your balance:

Read also:Exploring The Allure Of 6502 S New Braunfels A Comprehensive Guide

Online Balance Check

Most vanilla gift card issuers provide an online portal where cardholders can log in to view their balance. This method is convenient and allows for real-time updates. To access this feature, you will need the card's 16-digit number and the security code (CVV) located on the back of the card.

Phone Support

Another option is to call the customer service number provided on the back of the card. Representatives can assist you in checking your balance and answering any questions you may have. This method is particularly useful if you encounter any issues with your card.

ATM Withdrawals

Using an ATM is a straightforward way to verify your balance. Simply insert your card, select the "Balance Inquiry" option, and follow the prompts. Keep in mind that some ATMs may charge fees for this service, so it's best to use a network-affiliated machine whenever possible.

Security Features of Visa Debit Gift Cards

Security is a top priority for vanilla gift card issuers. Visa debit gift cards come equipped with several features to protect your funds and personal information:

- Chip Technology: Modern gift cards often include EMV chips, which enhance security by encrypting transaction data.

- CVV Code: The three-digit security code on the back of the card adds an extra layer of protection for online purchases.

- Zero Liability Policy: Visa offers a zero liability policy for unauthorized transactions, ensuring cardholders are not held responsible for fraudulent activity.

It's essential to keep your card secure by safeguarding your PIN and not sharing your card information with others. Additionally, regularly monitoring your transactions can help detect any suspicious activity early.

Common Uses of Vanilla Gift Cards

Vanilla gift cards are incredibly versatile, with applications ranging from personal to professional use. Here are some of the most common scenarios where these cards shine:

Gifting

As the name suggests, vanilla gift cards make excellent presents. They allow recipients the freedom to choose what they want while ensuring the gift is practical and useful.

Expense Management

Businesses often utilize vanilla gift cards for employee reimbursements, travel expenses, or vendor payments. Their reloadable nature makes them a cost-effective solution for managing corporate finances.

Budgeting

For individuals, vanilla gift cards can serve as a tool for budgeting. By loading specific amounts onto the card, users can allocate funds for different categories, such as groceries, entertainment, or utilities.

Benefits of Using Vanilla Gift Cards

The advantages of vanilla gift cards extend beyond convenience. Here are some of the key benefits:

- No Credit Checks: Unlike credit cards, vanilla gift cards do not require a credit check, making them accessible to everyone.

- Global Acceptance: The Visa logo ensures your card is accepted worldwide, providing flexibility for international transactions.

- Expense Control: Preloaded funds help users stay within their budget, avoiding overspending.

These benefits make vanilla gift cards an attractive option for a wide range of users, from students to small business owners.

Limitations and Restrictions

While vanilla gift cards offer numerous advantages, they also come with certain limitations. Understanding these restrictions can help you make informed decisions:

Expiration Dates

Some vanilla gift cards have expiration dates, after which the remaining balance may become invalid. Always check the terms and conditions before purchasing or using the card.

Fees

Certain fees may apply, such as activation fees, reload fees, or ATM withdrawal fees. It's important to review the fee schedule to avoid unexpected charges.

Reload Limits

Reloadable cards often have daily, monthly, or annual limits on the amount of funds that can be added. Be aware of these restrictions to ensure your card meets your needs.

Activating Your Vanilla Gift Card

Before using your vanilla gift card, you must activate it. Activation is typically a straightforward process that can be completed online or via phone:

Online Activation

Visit the issuer's website and follow the prompts to enter your card number and personal information. Once activated, your card will be ready for use.

Phone Activation

Alternatively, you can call the toll-free number on the back of the card to activate it. A customer service representative will guide you through the process.

Troubleshooting Common Issues

Occasionally, cardholders may encounter problems with their vanilla gift cards. Here are some common issues and solutions:

- Transaction Declined: Ensure your card has sufficient funds and is activated. Verify the merchant accepts Visa.

- Lost or Stolen Card: Contact customer service immediately to report the issue and request a replacement card.

- Balance Discrepancy: Double-check your transaction history and contact the issuer if discrepancies persist.

By addressing these issues promptly, you can minimize disruptions to your card usage.

The Future of Prepaid Gift Cards

As technology continues to evolve, the future of prepaid gift cards looks promising. Innovations such as mobile wallets and digital cards are expanding the possibilities for cardholders. These advancements promise enhanced security, convenience, and functionality, further solidifying the role of vanilla gift cards in modern finance.

Conclusion and Final Thoughts

Vanilla gift cards, especially those integrated with Visa debit functionality, offer a powerful tool for managing finances and simplifying transactions. By understanding how to check your balance, utilizing security features, and exploring common uses, you can maximize the benefits of these cards. Remember to review the terms and conditions, monitor your transactions, and take advantage of available resources to ensure a seamless experience.

We invite you to share your experiences with vanilla gift cards in the comments below. Your feedback can help others make informed decisions. Additionally, explore our other articles for more insights into personal finance and payment solutions. Together, let's navigate the ever-changing financial landscape with confidence and expertise.