State Farm Insurance Liability Coverage is a critical component of your auto insurance policy that provides financial protection when you're at fault in an accident. Whether you're a new driver or a seasoned one, understanding liability coverage is essential to ensure you're adequately protected on the road. This article will delve into everything you need to know about State Farm's liability coverage, helping you make informed decisions about your insurance needs.

Driving is a privilege, but it also comes with significant responsibilities. One of those responsibilities is ensuring you have the right insurance coverage to protect yourself, your passengers, and others on the road. State Farm, as one of the leading insurance providers in the United States, offers robust liability coverage options designed to meet the needs of drivers across the country.

This guide will cover everything from the basics of liability coverage to advanced strategies for optimizing your policy. By the end of this article, you'll have a clear understanding of how State Farm's liability coverage works, why it's important, and how to choose the right limits for your situation. Let's dive in!

Read also:Tampa Bay Rays Baseball Schedule Your Ultimate Guide To The 2023 Season

Table of Contents

- What is Liability Coverage?

- State Farm Liability Coverage Basics

- Why is Liability Coverage Important?

- Types of Liability Coverage

- State Farm Coverage Limits

- How Much Coverage Do You Need?

- Factors Affecting Premiums

- State Farm Claims Process

- Common Misconceptions About Liability Coverage

- Tips for Saving Money on State Farm Liability Coverage

What is Liability Coverage?

Liability coverage is a fundamental part of your auto insurance policy that protects you financially if you're found at fault in an accident. It covers the damages and injuries caused to others, including property damage and medical expenses. Without adequate liability coverage, you could face significant financial burdens if an accident occurs.

Key Features of Liability Coverage

- Protects against lawsuits and legal fees

- Covers medical expenses for injured parties

- Compensates for property damage

- Required by law in most states

State Farm's liability coverage is designed to provide comprehensive protection, ensuring you're prepared for any unexpected incidents on the road.

State Farm Liability Coverage Basics

State Farm is one of the largest and most reputable insurance providers in the United States, offering a wide range of insurance products, including auto insurance. Their liability coverage is a cornerstone of their auto insurance offerings, providing drivers with peace of mind and financial security.

Why Choose State Farm?

- Over 85 years of experience in the insurance industry

- Wide network of agents and customer service representatives

- 24/7 claims support

- Customizable coverage options

With State Farm, you can trust that you're getting a policy that meets your unique needs and budget.

Why is Liability Coverage Important?

Liability coverage is more than just a legal requirement; it's a crucial safeguard against potential financial disasters. Accidents happen, and when they do, the costs can be astronomical. Without liability coverage, you could be held personally liable for damages and injuries, leading to lawsuits, judgments, and even bankruptcy.

According to the National Highway Traffic Safety Administration (NHTSA), the average cost of a car accident in the United States is over $40,000. This figure includes medical expenses, property damage, and lost wages. Liability coverage ensures that you're not left footing the bill for these expenses.

Read also:Unveiling The Legacy Of Notre Dames Old Football Coach A Journey Through History

Types of Liability Coverage

State Farm offers two primary types of liability coverage:

1. Bodily Injury Liability

Bodily injury liability coverage pays for medical expenses, lost wages, and other damages if you're found at fault in an accident that causes injury to others. This coverage is essential for protecting yourself from lawsuits and legal fees.

2. Property Damage Liability

Property damage liability coverage pays for repairs or replacement of property damaged in an accident where you're at fault. This includes vehicles, buildings, fences, and other structures.

Both types of coverage are typically sold together as part of a standard auto insurance policy.

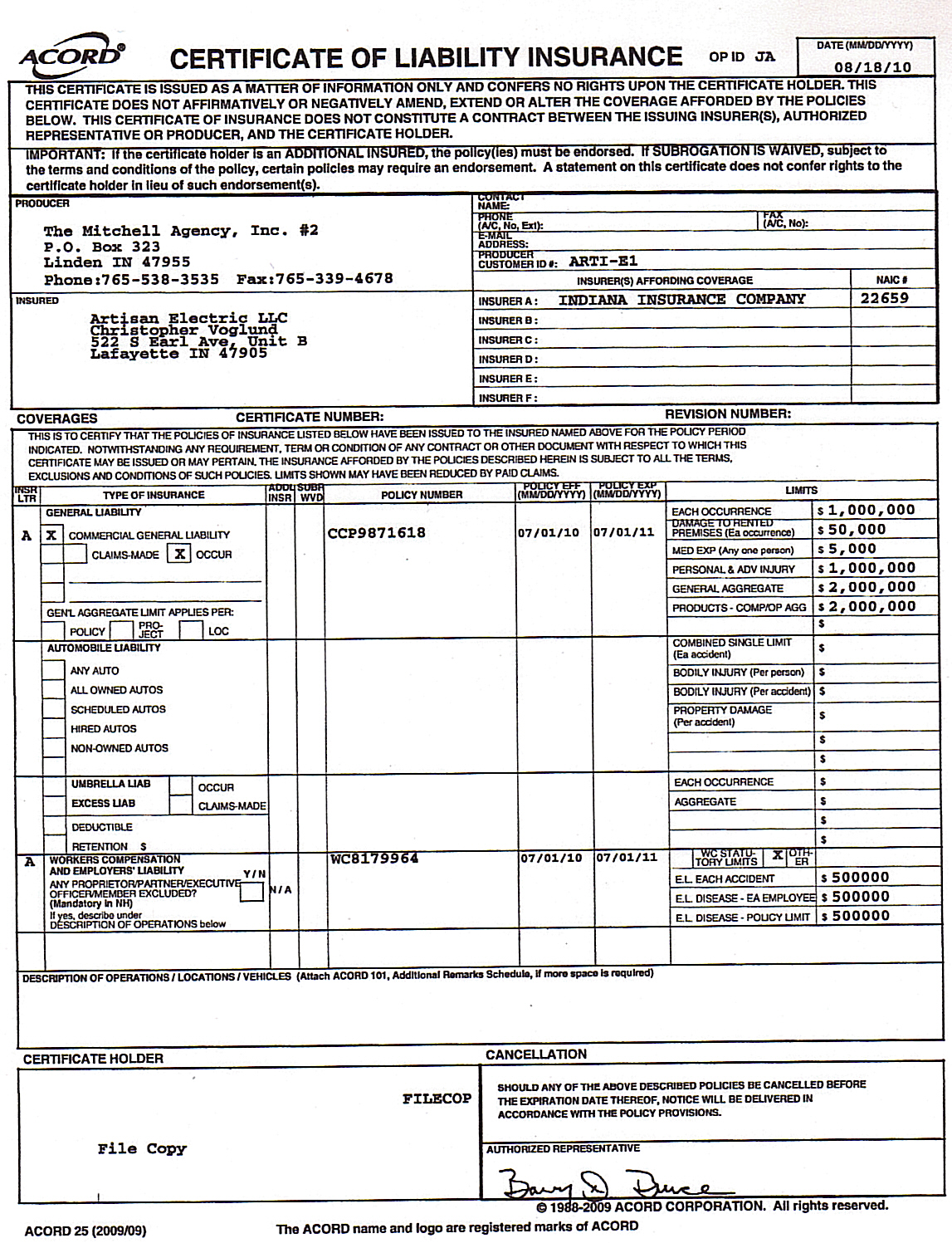

State Farm Coverage Limits

State Farm offers a variety of coverage limits to suit different drivers' needs. The most common limits are expressed in the format "25/50/10," which represents:

- $25,000 per person for bodily injury

- $50,000 per accident for bodily injury

- $10,000 for property damage

However, State Farm also offers higher limits, such as "100/300/50," which provides significantly more protection for drivers who want extra peace of mind.

How Much Coverage Do You Need?

The amount of liability coverage you need depends on several factors, including your financial situation, driving habits, and state requirements. While most states require a minimum level of coverage, experts recommend choosing higher limits to ensure adequate protection.

Consider the Following Factors

- Your net worth: If you have significant assets, you may want to consider higher coverage limits to protect them.

- Your driving record: Drivers with a history of accidents or traffic violations may face higher premiums and should consider more coverage.

- Local traffic conditions: If you live in an area with high traffic volumes or frequent accidents, you may need additional coverage.

Consulting with a State Farm agent can help you determine the right coverage limits for your situation.

Factors Affecting Premiums

Your liability coverage premiums are influenced by a variety of factors, including:

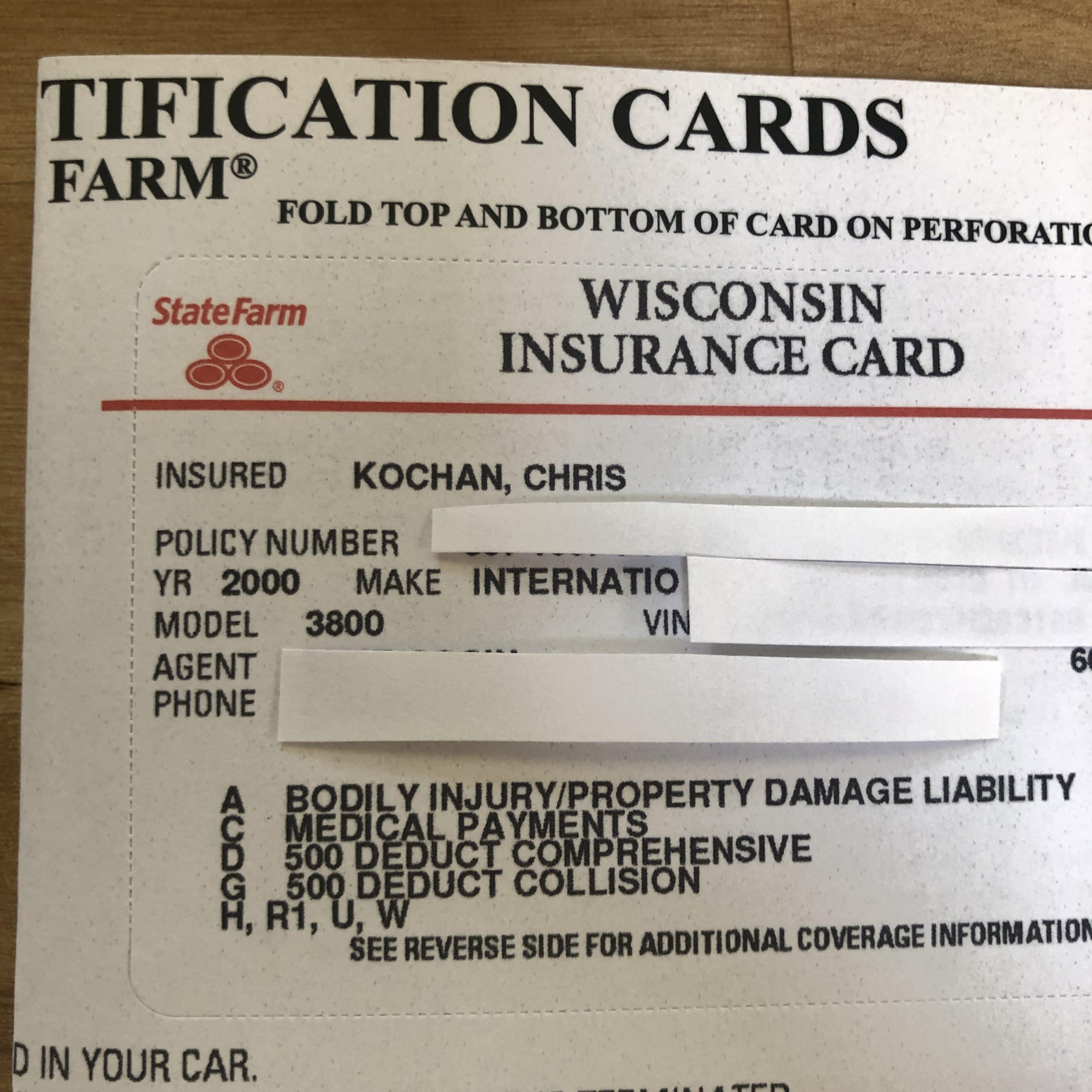

- Your age, gender, and marital status

- Your driving record and claims history

- The type of vehicle you drive

- Your credit score (in some states)

- The coverage limits and deductibles you choose

State Farm uses advanced algorithms to calculate premiums, ensuring you get a fair and competitive rate based on your unique profile.

State Farm Claims Process

When an accident occurs, knowing how to file a claim with State Farm is crucial. Their claims process is designed to be simple and efficient, ensuring you receive the compensation you're entitled to as quickly as possible.

Steps to File a Claim

- Contact State Farm immediately after the accident

- Provide details about the incident, including photos and witness statements if available

- Work with a claims adjuster to assess damages and determine fault

- Receive a settlement offer and finalize the claim

State Farm's 24/7 claims support ensures you're never left without assistance when you need it most.

Common Misconceptions About Liability Coverage

There are several common misconceptions about liability coverage that can lead to misunderstandings and inadequate protection. Let's debunk some of the most prevalent myths:

Myth 1: Liability Coverage is Only Necessary for High-Risk Drivers

Fact: Liability coverage is essential for all drivers, regardless of their driving record. Accidents can happen to anyone, and being adequately insured is the best way to protect yourself and others.

Myth 2: Higher Coverage Limits Mean Higher Premiums

Fact: While higher coverage limits may increase your premiums slightly, the added protection is often worth the cost, especially if you have significant assets to protect.

Myth 3: Liability Coverage is the Same as Comprehensive Coverage

Fact: Liability coverage only covers damages and injuries to others, while comprehensive coverage protects your own vehicle from non-collision incidents like theft or natural disasters.

Tips for Saving Money on State Farm Liability Coverage

While it's important to have adequate liability coverage, you can still save money on your premiums by following these tips:

- Bundle policies: Combine your auto insurance with other policies, such as homeowners or renters insurance, for discounts.

- Improve your driving record: Safe driving habits can lead to lower premiums over time.

- Choose higher deductibles: Opting for a higher deductible can reduce your monthly premiums, though you'll pay more out-of-pocket in the event of a claim.

- Take advantage of discounts: State Farm offers various discounts for safe drivers, good students, and military personnel.

By implementing these strategies, you can enjoy the peace of mind that comes with comprehensive liability coverage without breaking the bank.

Conclusion

State Farm Insurance Liability Coverage is an essential component of your auto insurance policy, providing financial protection and peace of mind in the event of an accident. Understanding the basics of liability coverage, choosing the right limits, and knowing how to file a claim are all critical steps in ensuring you're adequately protected on the road.

We encourage you to take action by reviewing your current policy, consulting with a State Farm agent, and making any necessary adjustments to ensure you have the coverage you need. Don't forget to share this article with friends and family who may benefit from the information, and explore other resources on our site for more valuable insights into insurance and personal finance.