Financial Accounting Standards Board (FASB) plays a critical role in shaping the accounting landscape in the United States. Established to create and maintain standards for financial reporting, FASB ensures transparency, consistency, and reliability in financial statements. As businesses continue to grow and evolve, understanding FASB's role and standards is essential for anyone involved in the world of finance and accounting.

Accounting standards are the backbone of financial reporting, providing a framework that helps organizations communicate their financial health clearly and accurately. FASB is at the forefront of this effort, ensuring that businesses adhere to universally accepted principles. In this article, we will delve deep into the history, responsibilities, and impact of FASB, offering insights into how it affects financial statements and decision-making processes.

Whether you are an accountant, a business owner, or simply someone interested in understanding financial regulations, this article will equip you with the knowledge you need to navigate the complex world of financial accounting. Let’s explore the intricacies of FASB and its significance in today’s global economy.

Read also:Michael Keatons Movie Career A Comprehensive Look At What Movies Did Michael Keaton Play In

Table of Contents:

- History of Financial Accounting Standards Board

- Mission and Objectives of FASB

- Overview of FASB Accounting Standards

- FASB Standard-Setting Process

- Impact of FASB on Businesses

- FASB vs. IASB: Key Differences

- Challenges Faced by FASB

- Future Trends in FASB Standards

- Useful Resources for Understanding FASB

- Conclusion

History of Financial Accounting Standards Board

The Financial Accounting Standards Board (FASB) was established in 1973, marking a pivotal moment in the evolution of accounting standards in the United States. Before FASB, the Committee on Accounting Procedure (CAP) and the Accounting Principles Board (APB) were responsible for setting accounting standards. However, these organizations faced criticism for their lack of independence and effectiveness.

FASB was created to address these shortcomings and establish a more robust and independent framework for developing accounting standards. Composed of a diverse group of experts, FASB operates as a private, not-for-profit organization dedicated to improving financial reporting. Over the years, FASB has played a crucial role in shaping the Generally Accepted Accounting Principles (GAAP) that govern financial reporting in the U.S.

Key Milestones in FASB's History

- 1973: Formation of FASB to replace the APB.

- 1984: Introduction of Statement of Financial Accounting Standards (SFAS) No. 95, mandating cash flow statements.

- 2008: Release of FASB Accounting Standards Codification (ASC), consolidating all U.S. GAAP into a single source.

Mission and Objectives of FASB

FASB's mission is to establish and improve financial accounting standards that provide useful information for decision-making. The board aims to enhance transparency, comparability, and reliability in financial reporting, ensuring that stakeholders can make informed decisions based on accurate financial data.

The primary objectives of FASB include:

- Improving the usefulness of financial information.

- Ensuring consistency and comparability across financial statements.

- Addressing emerging issues in financial reporting.

FASB's Role in the Accounting Ecosystem

FASB serves as the primary authority for developing and maintaining accounting standards in the U.S. It collaborates closely with other organizations, such as the International Accounting Standards Board (IASB), to promote global convergence in accounting practices.

Read also:What Is Vertical Labret A Comprehensive Guide To This Unique Piercing

Overview of FASB Accounting Standards

FASB Accounting Standards Codification (ASC) is the authoritative source of U.S. GAAP for public and private companies, not-for-profit organizations, and employee benefit plans. The codification organizes standards into a consistent, accessible framework, making it easier for accountants and auditors to navigate complex regulations.

Key Areas Covered by FASB Standards

- Revenue recognition

- Lease accounting

- Financial instruments

- Consolidations

These standards ensure that financial statements accurately reflect an organization's financial position, results of operations, and cash flows.

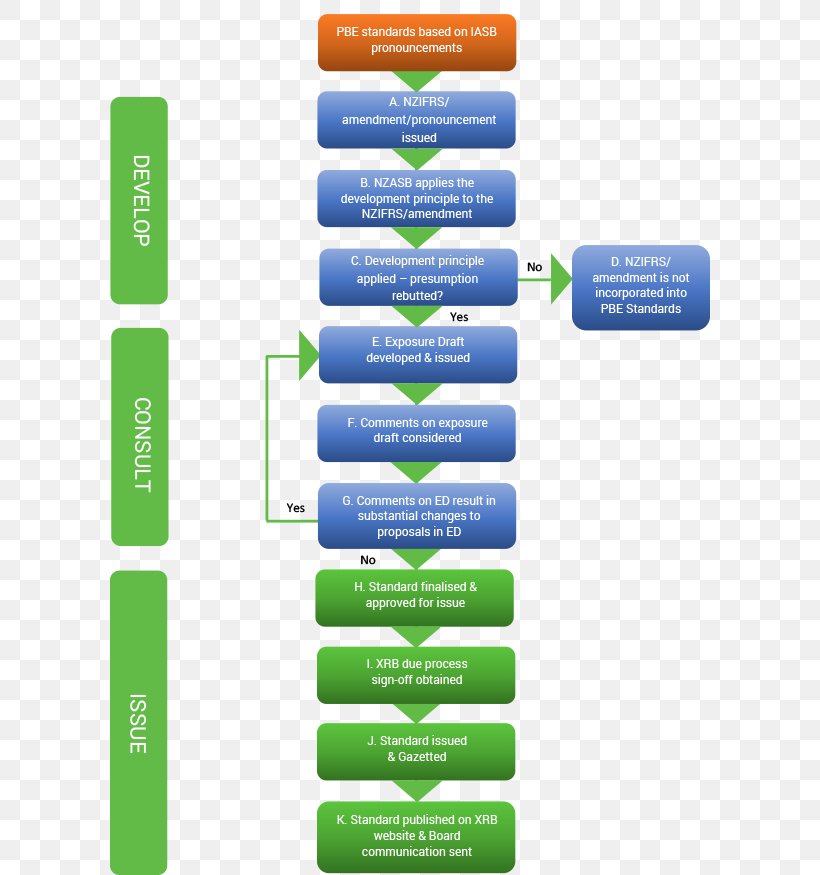

FASB Standard-Setting Process

FASB follows a rigorous and transparent process to develop and issue accounting standards. The process involves extensive research, public consultations, and deliberations to ensure that standards meet the needs of all stakeholders.

Steps in the FASB Standard-Setting Process

- Identify and prioritize potential projects.

- Conduct research and gather input from experts and stakeholders.

- Issue exposure drafts for public comment.

- Review feedback and finalize standards.

This process ensures that FASB standards are well-informed and broadly accepted by the accounting community.

Impact of FASB on Businesses

FASB standards have a profound impact on businesses, influencing how financial information is reported and interpreted. Compliance with FASB standards is essential for maintaining investor confidence and ensuring regulatory compliance.

Businesses must stay updated with changes in FASB standards to avoid financial misstatements and potential legal consequences. For example, the adoption of new revenue recognition standards has required companies to reassess how they report revenue, leading to significant changes in financial statements.

Benefits of FASB Standards for Businesses

- Improved transparency and accountability.

- Enhanced investor confidence.

- Streamlined financial reporting processes.

FASB vs. IASB: Key Differences

While FASB governs accounting standards in the U.S., the International Accounting Standards Board (IASB) develops International Financial Reporting Standards (IFRS) used globally. Understanding the differences between FASB and IASB is crucial for multinational companies operating in multiple jurisdictions.

Key Differences Between FASB and IASB

- FASB focuses on U.S. GAAP, while IASB focuses on IFRS.

- FASB standards are more rule-based, whereas IFRS is principle-based.

- FASB and IASB collaborate on convergence projects to reduce differences between the two frameworks.

Challenges Faced by FASB

Despite its successes, FASB faces several challenges in its mission to improve financial reporting. Rapid technological advancements, globalization, and evolving business models require FASB to continuously adapt and innovate.

Key challenges include:

- Addressing the impact of digital transformation on financial reporting.

- Ensuring global convergence with IASB while maintaining U.S. GAAP integrity.

- Responding to emerging risks and uncertainties in the financial markets.

Future Trends in FASB Standards

Looking ahead, FASB is likely to focus on integrating sustainability and environmental, social, and governance (ESG) factors into financial reporting. As investors increasingly prioritize non-financial metrics, FASB may explore ways to incorporate these elements into its standards.

Additionally, advancements in artificial intelligence and data analytics are expected to influence how financial information is processed and reported. FASB will need to stay ahead of these trends to maintain its relevance in the ever-evolving accounting landscape.

Useful Resources for Understanding FASB

For those seeking to deepen their understanding of FASB and its standards, several resources are available:

- FASB website: Offers access to current standards, exposure drafts, and educational materials.

- Accounting journals and publications: Provide insights into emerging trends and developments in accounting standards.

- Professional organizations: Offer training and certification programs for accountants and financial professionals.

Conclusion

In conclusion, the Financial Accounting Standards Board plays a vital role in shaping the accounting landscape in the United States. By establishing and maintaining high-quality accounting standards, FASB ensures transparency, consistency, and reliability in financial reporting. Understanding FASB's mission, standards, and processes is essential for anyone involved in the world of finance and accounting.

We encourage you to explore the resources mentioned in this article and stay updated with the latest developments in FASB standards. Your feedback and questions are valuable to us, so feel free to leave a comment or share this article with others who may benefit from it. Together, let’s continue to advance the field of financial accounting and reporting.