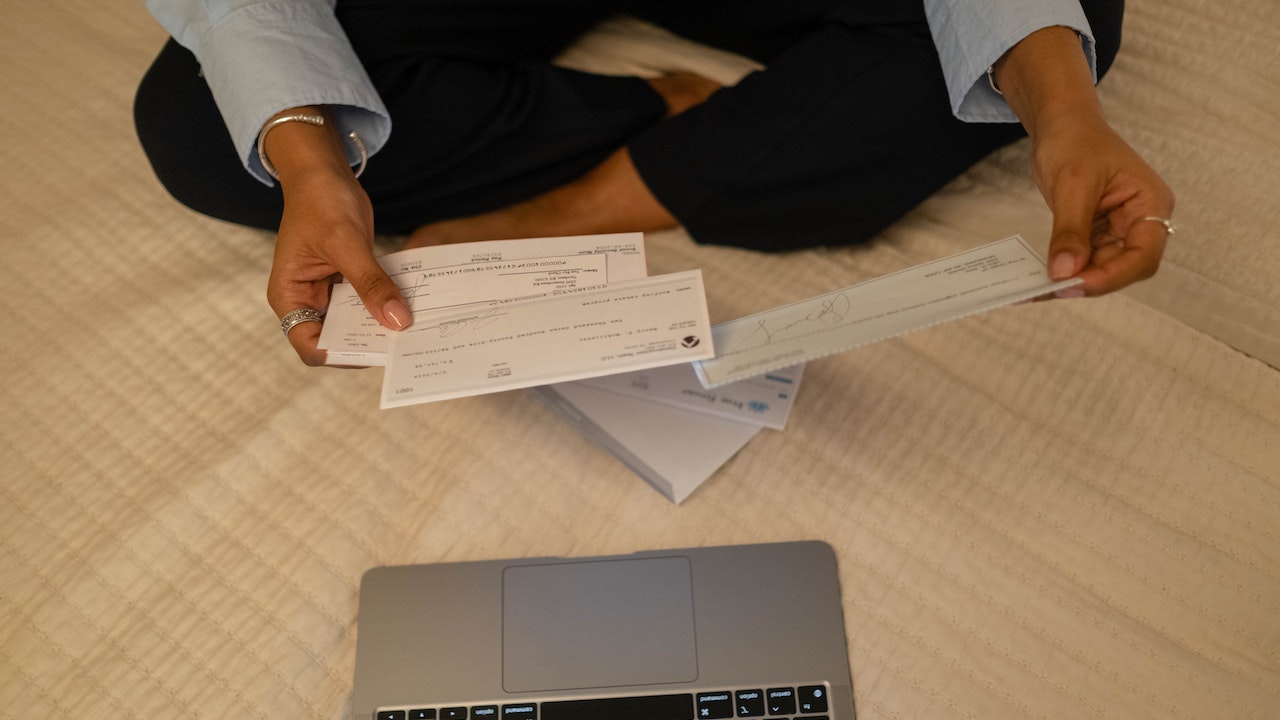

Cashing a check without an ID might seem challenging, but it is possible with the right strategies and resources. Whether you've misplaced your identification or simply don't have one, there are alternative methods to access your funds securely. This article will guide you through the process step by step, ensuring you have all the information you need to proceed confidently.

In today's fast-paced world, financial transactions often require identification to verify your identity. However, there are scenarios where obtaining or presenting an ID might not be feasible. This is where knowing alternative methods becomes crucial. By understanding the options available, you can still access your money without unnecessary delays or complications.

Whether you're looking for ways to cash a paycheck, personal check, or government check without an ID, this article will provide you with actionable insights and practical solutions. Let's dive into the details to help you navigate this process effectively.

Read also:The Randy Watson Experience A Comprehensive Exploration Of His Journey Legacy And Impact

Table of Contents

- Biography (if applicable)

- Methods to Cash Your Check Without ID

- Why ID Is Important in Cashing Checks

- Acceptable Alternative Identification

- Banks That Cash Checks Without ID

- Retail Stores Accepting Checks Without ID

- Online Options for Cashing Checks

- Tips to Avoid Scams

- Legal Considerations When Cashing Checks Without ID

- Conclusion

Methods to Cash Your Check Without ID

Learning how to cash my check without ID can be a lifesaver in certain situations. Below are some practical methods you can consider:

1. Direct Deposit

Direct deposit is one of the easiest ways to access your funds without needing an ID. Many employers offer this service, allowing you to receive your paycheck directly into your bank account. This eliminates the need to physically cash a check.

2. Check Cashing Stores

Some check cashing stores may accept alternative forms of identification or rely on their own verification processes. Research local stores in your area to find ones that accommodate your situation.

- Look for stores with flexible policies.

- Be prepared to pay a small fee for their services.

Why ID Is Important in Cashing Checks

ID verification is a standard practice to prevent fraud and ensure the legitimacy of financial transactions. While it may seem inconvenient, IDs play a critical role in safeguarding both the financial institution and the individual. Understanding this importance can help you appreciate why alternatives are necessary.

Acceptable Alternative Identification

Not all institutions strictly require government-issued IDs. Here are some alternative forms of identification you can use:

- Employee badge or work ID

- Student ID

- Utility bill with your name and address

- Bank account statement

Always check with the institution beforehand to confirm which forms of identification they accept.

Read also:Discover The Charm Of Santa Cruz Why Hotel Santa Cruz Scotts Valley Is Your Perfect Getaway

Banks That Cash Checks Without ID

Some banks are more lenient when it comes to cashing checks without an ID. Below are a few examples:

1. Bank of America

Bank of America allows deposit account holders to cash checks without presenting an ID, provided the account is in good standing.

2. Chase Bank

Chase Bank may allow you to cash a check if you have an existing account and the check is under a certain amount.

Always verify the specific policies of your local branch, as they may vary.

Retail Stores Accepting Checks Without ID

Several retail stores offer check cashing services, and some may not require an ID. Below are a few options:

1. Walmart

Walmart is known for its convenient check cashing services. While they typically require an ID, some locations may accept alternative forms of verification.

2. Grocery Stores

Certain grocery chains, such as Safeway or Kroger, may allow you to cash checks if you have an existing account or loyalty card.

Research the policies of stores in your area to find the best option for your needs.

Online Options for Cashing Checks

Technology has made it easier to cash checks without visiting a physical location. Here are some online options to consider:

1. Mobile Banking Apps

Many banks now offer mobile check deposit services. By using your bank's app, you can deposit checks directly from your phone, eliminating the need for an ID.

2. Third-Party Apps

Apps like Cash App or Venmo allow you to deposit checks electronically. These platforms often have their own verification processes, so ensure you meet their requirements.

Always prioritize security when using online services to protect your personal and financial information.

Tips to Avoid Scams

When cashing checks without an ID, it's essential to remain vigilant against potential scams. Follow these tips to stay safe:

- Only use reputable institutions or services.

- Verify the authenticity of the check before attempting to cash it.

- Be cautious of offers that seem too good to be true.

By exercising caution and doing your research, you can avoid falling victim to fraudulent activities.

Legal Considerations When Cashing Checks Without ID

It's important to understand the legal implications of cashing checks without proper identification. While it is possible, ensure that you comply with all relevant laws and regulations. Misrepresenting your identity or engaging in fraudulent activities can lead to serious consequences.

Consult with a legal professional if you have concerns about the legality of your situation. Staying informed will help you make the right decisions and protect your interests.

Conclusion

Cashing a check without an ID is achievable with the right approach and resources. By exploring alternative methods, such as direct deposit, check cashing stores, and online platforms, you can access your funds securely and efficiently. Remember to prioritize safety, verify the legitimacy of the services you use, and comply with all legal requirements.

We encourage you to share this article with others who may find it helpful. If you have any questions or additional tips, please leave a comment below. Together, we can empower individuals to manage their finances effectively, even in challenging situations.

Data Sources:

- FDIC Consumer News

- Federal Reserve Bank Publications

- Consumer Financial Protection Bureau (CFPB)