Taxes play a crucial role in funding public services, infrastructure, and essential programs. If you're a resident of Virginia or planning to relocate to the state, understanding what is VA state tax is essential for financial planning and compliance. This article will delve into the details of Virginia state tax, including its structure, rates, exemptions, and key considerations.

Whether you're an individual taxpayer, a business owner, or simply curious about the tax landscape in Virginia, this guide aims to provide clarity and actionable insights. By the end of this article, you'll have a thorough understanding of VA state tax and how it impacts your finances.

As part of the "Your Money or Your Life" (YMYL) category, this article is designed to offer authoritative and trustworthy information to help you make informed decisions. Let's dive in!

Read also:What Is An Aba Number In Banking A Comprehensive Guide

Table of Contents

- Introduction to VA State Tax

- History of Virginia State Tax

- Virginia Income Tax

- Sales Tax in Virginia

- Property Tax in Virginia

- Business Taxes in Virginia

- Tax Exemptions and Deductions

- Filing VA State Tax

- Penalties for Late Filings

- Useful Resources for Taxpayers

Introduction to VA State Tax

Virginia state tax is a critical component of the state's revenue system, contributing to the funding of public education, healthcare, transportation, and other essential services. The tax structure in Virginia includes income tax, sales tax, property tax, and various other levies that apply to individuals and businesses.

The VA state tax system is designed to be fair and efficient, ensuring that all residents contribute to the state's growth and development. Understanding the nuances of this system can help taxpayers plan their finances effectively and avoid potential penalties.

History of Virginia State Tax

The history of Virginia state tax dates back to the early 20th century when the state implemented its first income tax in 1928. Over the years, the tax system has evolved to adapt to changing economic conditions and societal needs.

Key Milestones in VA Tax History

- 1928: Introduction of the state income tax.

- 1934: Implementation of the state sales tax.

- 1980s: Expansion of property tax reforms to address equity concerns.

These milestones reflect Virginia's commitment to maintaining a balanced and equitable tax system that supports the needs of its residents.

Virginia Income Tax

Virginia income tax is a progressive tax system that applies to individuals, corporations, and other entities earning income within the state. The tax rates vary based on income levels, ensuring that higher earners contribute a larger share of their income.

2023 Income Tax Rates

In 2023, Virginia's income tax rates are as follows:

Read also:Tampa Bay Rays Baseball Schedule Your Ultimate Guide To The 2023 Season

- $3,000 or less: 2% of taxable income

- $3,001 to $5,000: $60 + 3% of the amount over $3,000

- $5,001 or more: $120 + 5.75% of the amount over $5,000

These rates are subject to change, so it's important to stay updated with the latest tax laws and regulations.

Sales Tax in Virginia

Sales tax in Virginia is a consumption tax levied on the sale of goods and services. The standard state sales tax rate is 4.3%, but local jurisdictions may impose additional taxes, bringing the total rate to as high as 6% in some areas.

Exemptions and Special Rates

Some items are exempt from sales tax, including:

- Prescription medications

- Most groceries

- Clothing priced under $100 during the annual back-to-school sales tax holiday

Understanding these exemptions can help taxpayers save money on essential purchases.

Property Tax in Virginia

Property tax in Virginia is assessed on real estate and personal property owned by individuals and businesses. The tax rate varies by locality, with cities and counties setting their own millage rates.

How Property Tax is Calculated

The property tax is calculated by multiplying the assessed value of the property by the local tax rate. For example, if a property is assessed at $200,000 and the local tax rate is 0.01%, the annual property tax would be $2,000.

Homeowners can apply for various exemptions, such as senior citizen discounts or veteran benefits, to reduce their tax liability.

Business Taxes in Virginia

Businesses operating in Virginia are subject to various taxes, including corporate income tax, franchise tax, and unemployment tax. These taxes ensure that businesses contribute to the state's economy while providing essential services.

Corporate Income Tax

The corporate income tax rate in Virginia is 6% of net income. Businesses must file annual tax returns and pay estimated taxes quarterly to avoid penalties.

In addition to state taxes, businesses may also be subject to local taxes, such as business license fees and occupational taxes.

Tax Exemptions and Deductions

Virginia offers several tax exemptions and deductions to help taxpayers reduce their tax liability. These include:

- Standard deductions for individuals and families

- Itemized deductions for medical expenses, mortgage interest, and charitable contributions

- Exemptions for low-income seniors and disabled individuals

Taxpayers should consult with a tax professional or use tax preparation software to ensure they take advantage of all available deductions and credits.

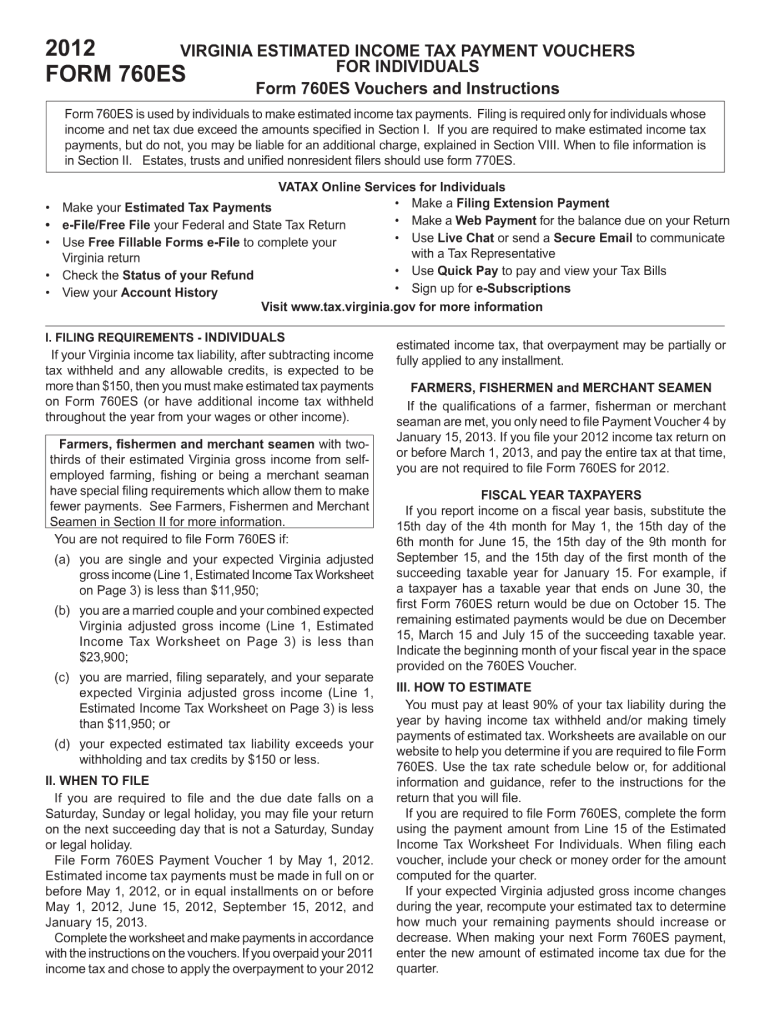

Filing VA State Tax

Filing VA state tax is a straightforward process, especially with the availability of online resources and tax preparation software. Taxpayers can file their returns electronically or by mail, depending on their preference.

Important Deadlines

The deadline for filing VA state tax is typically April 15th, aligning with the federal tax deadline. However, taxpayers can request an extension if they need more time to prepare their returns.

It's important to keep accurate records of income, expenses, and deductions to ensure a smooth filing process.

Penalties for Late Filings

Failing to file VA state tax on time can result in penalties and interest charges. The state imposes a late filing penalty of 5% of the unpaid tax per month, up to a maximum of 25%. Additionally, interest accrues on unpaid taxes at a rate determined by the Virginia Department of Taxation.

To avoid penalties, taxpayers should file their returns on time and pay any outstanding taxes promptly.

Useful Resources for Taxpayers

Several resources are available to assist taxpayers in understanding and complying with VA state tax laws:

- Virginia Department of Taxation: The official website for state tax information and resources.

- Internal Revenue Service: Provides guidance on federal tax laws and their interaction with state taxes.

- Tax Professionals: Certified public accountants (CPAs) and enrolled agents can offer personalized advice and assistance.

Utilizing these resources can help taxpayers navigate the complexities of VA state tax with confidence.

Kesimpulan

In conclusion, understanding what is VA state tax is essential for anyone living or doing business in Virginia. By familiarizing yourself with the various types of taxes, exemptions, and filing requirements, you can ensure compliance and optimize your financial planning.

We encourage you to share this article with others who may benefit from the information and to leave a comment if you have any questions or insights to add. For more detailed guidance, consider consulting a tax professional or exploring the resources provided by the Virginia Department of Taxation.