Chase Zelle Phone Number has become an essential tool for individuals who rely on digital banking services. In today's fast-paced world, having access to reliable customer support is crucial for resolving issues quickly and efficiently. Whether you're looking to transfer funds, verify transactions, or address security concerns, understanding how to contact Chase Zelle support is vital. This guide will provide you with everything you need to know about Chase Zelle's phone number, its features, and how it can enhance your banking experience.

Chase Zelle is one of the most popular digital payment platforms in the United States. It allows users to send and receive money instantly between bank accounts, making it an ideal solution for peer-to-peer transactions. However, like any financial service, there may be times when you need assistance. That's where the Chase Zelle phone number comes into play, offering a direct line to customer support for all your banking needs.

This article will delve into the importance of Chase Zelle's phone number, how to use it effectively, and what you can expect when contacting customer service. We'll also explore related topics such as Zelle's security features, troubleshooting tips, and alternative contact methods. By the end of this guide, you'll have a comprehensive understanding of how to leverage Chase Zelle's support services to enhance your banking experience.

Read also:The Randy Watson Experience A Comprehensive Exploration Of His Journey Legacy And Impact

Table of Contents

- Introduction to Chase Zelle Phone Number

- Biography of Chase Zelle

- Contact Methods for Chase Zelle

- Security Features of Chase Zelle

- Troubleshooting Tips

- Customer Support Services

- Alternative Contact Options

- Important Statistics About Chase Zelle

- Comparison with Other Payment Services

- Conclusion

Introduction to Chase Zelle Phone Number

Chase Zelle phone number serves as a lifeline for customers who require immediate assistance with their banking transactions. Whether you're experiencing issues with fund transfers, account verification, or security concerns, calling the dedicated support line can resolve your problems swiftly. The phone number is available 24/7, ensuring that help is just a call away whenever you need it.

Why Use Chase Zelle Phone Number?

There are several reasons why using the Chase Zelle phone number is beneficial:

- Immediate Assistance: Get real-time support from trained professionals.

- Convenience: Access support anytime, anywhere, without needing an internet connection.

- Security: Discuss sensitive information securely over a direct phone line.

How to Prepare Before Calling

Before dialing the Chase Zelle phone number, ensure you have the following information ready:

- Your full name and account details.

- Details of the transaction or issue you're experiencing.

- A secure environment to discuss sensitive financial information.

Biography of Chase Zelle

Zelle is a digital payment network that allows users to send and receive money directly from their bank accounts. Launched in 2017, Zelle quickly gained popularity due to its simplicity, speed, and security. Chase Bank, one of the largest financial institutions in the U.S., integrated Zelle into its mobile app, providing customers with seamless access to the service.

Biodata of Chase Zelle

| Attribute | Details |

|---|---|

| Launch Date | 2017 |

| Parent Company | Early Warning Services |

| Participating Banks | Chase, Bank of America, Wells Fargo, and more |

| Users | Over 35 million active users |

Contact Methods for Chase Zelle

While the Chase Zelle phone number is a primary contact method, there are other ways to reach customer support:

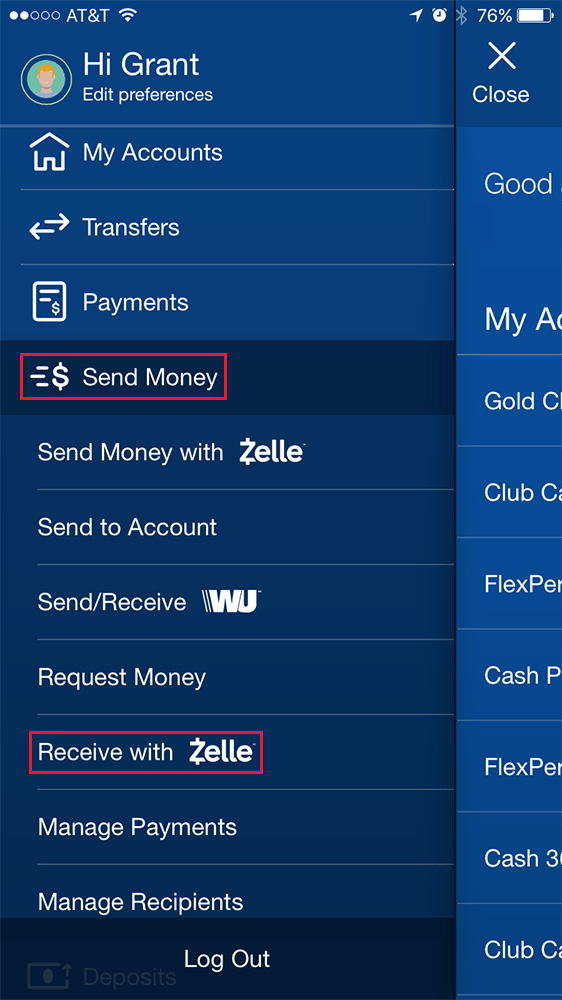

Mobile App Support

The Chase Mobile app includes a built-in chat feature for resolving issues quickly. Users can initiate conversations with support agents directly from the app, making it a convenient option for resolving non-critical issues.

Read also:Lake Mary Fl Movies Your Ultimate Guide To Movie Theaters And Entertainment

Online Chat

Chase offers an online chat service through its official website. This method is ideal for customers who prefer text-based communication and need assistance during business hours.

Security Features of Chase Zelle

Security is a top priority for Chase Zelle. The platform employs several advanced features to protect user data and ensure safe transactions:

- Encryption: All transactions are encrypted to prevent unauthorized access.

- Two-Factor Authentication: Users can enable two-factor authentication for added security.

- Real-Time Alerts: Receive instant notifications for every transaction, helping you monitor your account activity.

Troubleshooting Tips

If you encounter issues while using Chase Zelle, here are some troubleshooting tips:

Common Issues and Solutions

- Transaction Delays: Ensure both parties are enrolled in Zelle and have linked their bank accounts.

- Account Verification: Provide the required documents or information to complete the verification process.

- Security Alerts: Review your transaction history and contact support if you notice any suspicious activity.

Customer Support Services

Chase Zelle's customer support team is dedicated to assisting users with a wide range of issues. From technical problems to security concerns, their experienced agents are equipped to handle all inquiries:

What to Expect When Calling

When you call the Chase Zelle phone number, you can expect:

- A friendly and professional agent to assist you.

- A thorough review of your issue to provide an accurate solution.

- Follow-up communication if additional information is required.

Alternative Contact Options

In addition to the Chase Zelle phone number, there are other ways to contact support:

Email Support

Chase offers an email support service for non-urgent inquiries. While response times may vary, this method is ideal for detailed questions or documentation requests.

FAQ Section

The official Chase website features an extensive FAQ section covering common questions and issues. Browsing this resource can save time and provide quick answers to your concerns.

Important Statistics About Chase Zelle

Understanding the scale and impact of Chase Zelle can help users appreciate its significance in the financial industry:

- Over $186 billion was transferred through Zelle in 2022.

- The platform processes an average of 1.3 billion transactions annually.

- More than 75% of U.S. banks participate in the Zelle network.

Comparison with Other Payment Services

While Chase Zelle offers numerous advantages, it's essential to compare it with other popular payment services:

Zelle vs. PayPal

Both Zelle and PayPal facilitate peer-to-peer transactions, but Zelle offers faster transfers directly between bank accounts. PayPal, on the other hand, provides more international options and merchant services.

Zelle vs. Venmo

Venmo is another popular payment app, known for its social features and ease of use. However, Zelle's integration with banks and lack of transaction fees make it a preferred choice for many users.

Conclusion

Chase Zelle phone number plays a crucial role in ensuring a smooth and secure banking experience for its users. By providing immediate access to customer support, it addresses concerns promptly and effectively. Whether you're dealing with transaction issues, security alerts, or account verification, the phone number is a reliable resource for resolving problems.

We encourage you to bookmark this guide for future reference and share it with others who may benefit from the information. If you have any questions or feedback, please leave a comment below. Additionally, explore other articles on our website for more insights into digital banking and financial services.