Routing ABA numbers play a crucial role in the banking system, enabling seamless transactions between financial institutions. If you're new to banking terminology, understanding what a routing ABA number is and how it works can help you manage your finances more effectively. This guide will walk you through everything you need to know about routing ABA numbers, their importance, and how to use them safely.

Whether you're setting up direct deposits, transferring funds, or paying bills online, you'll encounter routing ABA numbers frequently. These numbers act as unique identifiers for banks and financial institutions, ensuring that your money goes to the right place. Understanding their function is essential for maintaining financial security and avoiding costly errors.

This article delves into the details of routing ABA numbers, covering everything from their history and purpose to practical applications and security tips. By the end of this guide, you'll have a thorough understanding of how routing ABA numbers work and why they're indispensable in modern banking.

Read also:Exploring The Allure Of 6502 S New Braunfels A Comprehensive Guide

Table of Contents

- What is Routing ABA Number?

- History of Routing ABA Numbers

- How Routing ABA Numbers Work

- Types of Routing ABA Numbers

- Finding Your Routing Number

- Importance of Routing ABA Numbers

- Security Considerations

- Common Questions About Routing ABA Numbers

- Routing ABA Numbers in Digital Banking

- Future of Routing ABA Numbers

What is Routing ABA Number?

A routing ABA number, also known as a routing transit number (RTN), is a nine-digit code used to identify financial institutions in the United States. This number ensures that funds are routed to the correct bank or credit union during transactions such as direct deposits, wire transfers, and automated payments.

Each bank or credit union has its own unique routing number, making it an essential component of the U.S. banking system. Without this number, financial transactions would be much more complicated and prone to errors.

Structure of a Routing ABA Number

The nine-digit routing number follows a specific format:

- First four digits: Represent the Federal Reserve routing symbol.

- Next four digits: Identify the financial institution.

- Ninth digit: A checksum digit used for validation purposes.

History of Routing ABA Numbers

The American Bankers Association (ABA) introduced routing numbers in 1910 to streamline check processing. Initially, these numbers were used primarily for paper checks, but their application has expanded significantly with the rise of digital banking.

Evolution Over Time

As banking technology has advanced, the use of routing ABA numbers has evolved to accommodate electronic transactions. Today, they are integral to various financial processes, including:

- Direct deposits

- Bill payments

- Wire transfers

How Routing ABA Numbers Work

When you initiate a transaction, the routing ABA number directs the funds to the appropriate bank. This process involves several steps:

Read also:San Diego Airport Amenities A Comprehensive Guide To Traveler Comfort

- Verification of the routing number

- Identification of the financial institution

- Completion of the transaction

This system ensures that your money reaches the intended recipient without errors.

Types of Routing ABA Numbers

There are two main types of routing ABA numbers:

- Checking account routing numbers: Used for transactions involving checking accounts.

- Savings account routing numbers: Used for transactions involving savings accounts.

Some banks may have different routing numbers for different types of transactions or branches.

Regional Variations

Large banks often have multiple routing numbers based on geographic location. It's important to use the correct number for your specific branch to avoid transaction delays.

Finding Your Routing Number

Locating your routing ABA number is straightforward. You can find it:

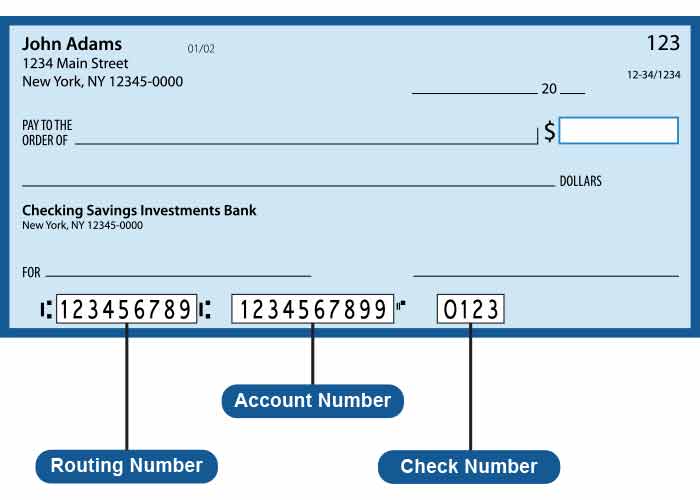

- On the bottom left corner of your checks

- In your online banking account

- By contacting your bank's customer service

Checking Your Checks

If you have physical checks, the routing number is the first group of numbers at the bottom. Always double-check to ensure accuracy.

Importance of Routing ABA Numbers

Routing ABA numbers are vital for several reasons:

- They ensure accurate and efficient fund transfers.

- They help prevent fraud by verifying the authenticity of transactions.

- They facilitate seamless integration with digital banking platforms.

Without routing numbers, the banking system would be far less reliable and secure.

Impact on Financial Transactions

Routing numbers streamline the process of moving money between accounts, making it faster and more convenient for consumers and businesses alike.

Security Considerations

While routing ABA numbers are essential, they must be handled with care. Sharing your routing number with unauthorized parties can lead to fraud or unauthorized transactions.

Best Practices for Security

To protect your routing number:

- Only share it with trusted entities.

- Monitor your account activity regularly.

- Enable two-factor authentication for added security.

Common Questions About Routing ABA Numbers

Here are answers to some frequently asked questions about routing ABA numbers:

Can Routing Numbers Be Shared?

Yes, but only with trusted parties, such as your employer for direct deposits or utility companies for bill payments.

Do All Banks Have Routing Numbers?

Yes, all U.S. banks and credit unions have unique routing numbers assigned by the ABA.

Routing ABA Numbers in Digital Banking

With the rise of online and mobile banking, routing ABA numbers have become even more important. They enable users to perform transactions from anywhere, at any time.

Advantages of Digital Banking

Using routing numbers in digital banking offers several benefits:

- Convenience

- Speed

- Security

Future of Routing ABA Numbers

As technology continues to evolve, so will the role of routing ABA numbers. Advances in blockchain and cryptocurrency may introduce new systems, but routing numbers will remain a cornerstone of traditional banking for the foreseeable future.

Innovations on the Horizon

Future developments may include:

- Enhanced security features

- Integration with emerging technologies

- Streamlined processes for international transactions

Conclusion

Routing ABA numbers are an essential part of the U.S. banking system, ensuring that financial transactions are accurate and secure. Understanding their function and importance is key to managing your finances effectively. By following best practices for security and staying informed about advancements in banking technology, you can make the most of this vital tool.

We invite you to share your thoughts and experiences with routing ABA numbers in the comments below. Additionally, feel free to explore other articles on our site for more insights into personal finance and banking.

Data sources: Federal Reserve, American Bankers Association