Nancy Pelosi, the prominent figure in American politics, has been a subject of interest for many. Beyond her political career, her financial investments have sparked curiosity among the public. Understanding what Nancy Pelosi is investing in can provide valuable insights into her economic strategies and how they align with broader market trends.

Nancy Pelosi, the former Speaker of the U.S. House of Representatives, is not only a political heavyweight but also a savvy investor. Her investment portfolio has garnered significant attention, as it reflects her understanding of economic opportunities and her ability to capitalize on them. This article delves deep into her investment choices, offering readers a glimpse into the financial world of one of America's most influential politicians.

As we explore the details of Nancy Pelosi's investments, we will also examine the implications of her financial decisions on both personal and public levels. This exploration will help us understand the broader context of her financial strategies and how they may influence public perception and policy discussions.

Read also:Comprehensive Guide To Ohio Bmv Registration Fee Everything You Need To Know

Biography of Nancy Pelosi

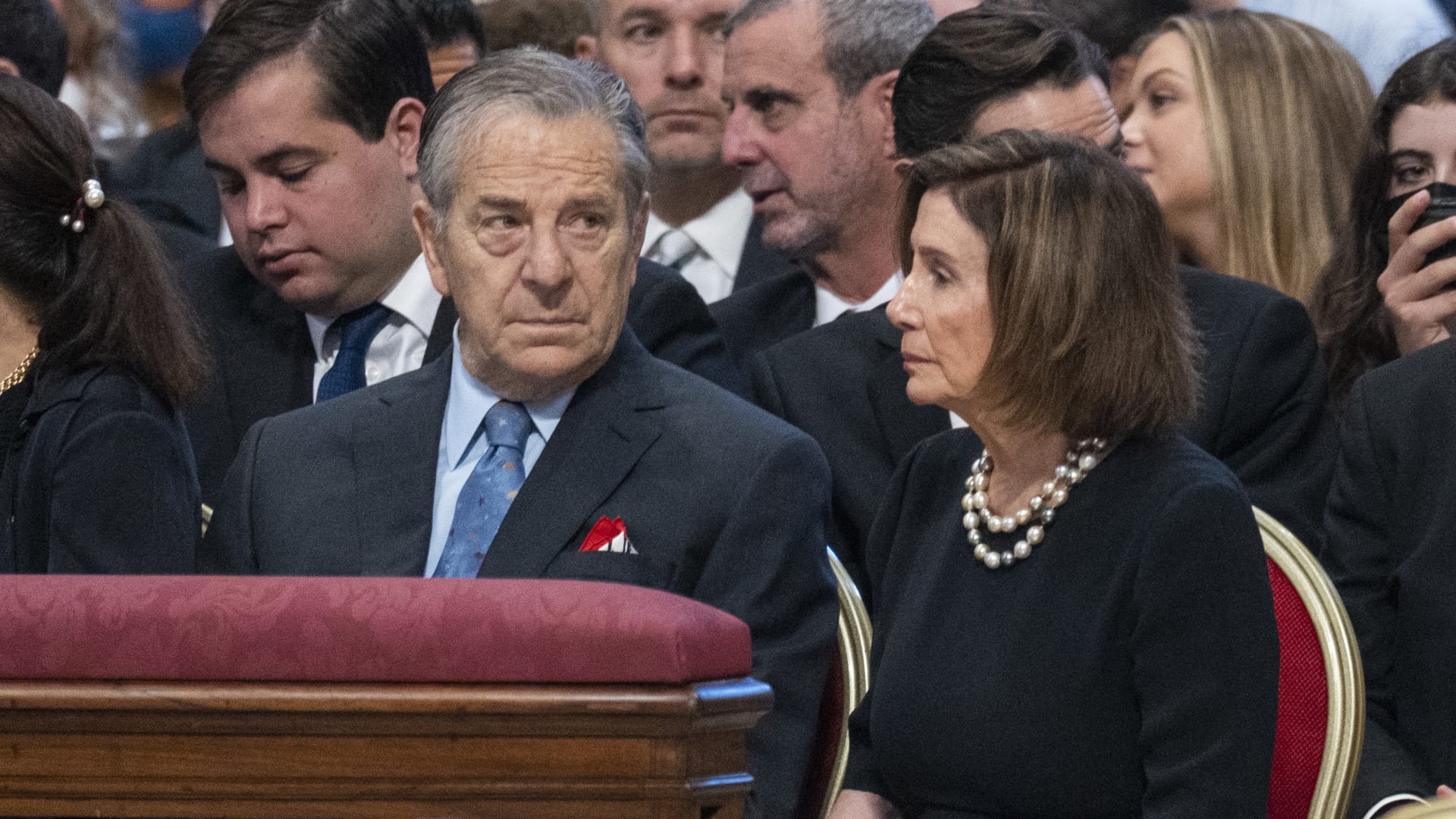

Before diving into her investment portfolio, it's essential to understand who Nancy Pelosi is. Born on March 26, 1940, in Baltimore, Maryland, Pelosi has spent decades shaping American politics. Her career in Congress began in 1987, and she became the first woman to serve as Speaker of the House in 2007.

Data and Personal Information

| Full Name | Nancy Patricia D'Alesandro Pelosi |

|---|---|

| Birth Date | March 26, 1940 |

| Birth Place | Baltimore, Maryland, U.S. |

| Political Party | Democratic |

| Spouse | Paul Pelosi |

| Children | 5 |

Understanding Nancy Pelosi's Investment Portfolio

Nancy Pelosi's investment portfolio is a reflection of her financial acumen and strategic thinking. By analyzing her investments, we gain insights into her long-term financial goals and how they align with her political ideologies.

Key Sectors in Pelosi's Investments

- Technology

- Healthcare

- Financial Services

These sectors represent some of the most dynamic and growing industries in the global economy. Pelosi's focus on these areas highlights her awareness of market trends and her ability to make informed investment decisions.

Technology Investments

In the realm of technology, Nancy Pelosi has made significant investments in companies that are driving innovation. Her portfolio includes stakes in companies like Tesla and Apple, which are at the forefront of technological advancements.

Why Technology?

The technology sector offers high growth potential and is often seen as a catalyst for economic development. Pelosi's investments in this sector reflect her belief in the transformative power of technology and its ability to shape the future.

Healthcare Investments

Beyond technology, Pelosi has also invested in healthcare, a sector that is crucial for societal well-being. Her investments in pharmaceutical companies and healthcare providers demonstrate her commitment to improving healthcare accessibility and quality.

Read also:Who Is Cch Pounder A Comprehensive Look Into The Life And Career Of A Renowned Actress

Impact on Public Health

By investing in healthcare, Pelosi contributes to advancements in medical research and treatment. These investments not only yield financial returns but also have the potential to enhance public health outcomes.

Financial Services

The financial services sector is another area where Pelosi has made notable investments. Her portfolio includes stakes in banks and financial institutions that play a pivotal role in the global economy.

Stability and Growth

Investing in financial services provides stability and growth opportunities. Pelosi's choices in this sector highlight her understanding of the importance of a robust financial system in driving economic progress.

Market Trends and Pelosi's Investment Strategies

Nancy Pelosi's investment strategies are closely aligned with current market trends. By focusing on sectors with high growth potential, she ensures that her portfolio remains competitive and profitable.

Adapting to Change

As markets evolve, Pelosi adapts her investment strategies to capitalize on new opportunities. This adaptability is a key factor in her success as an investor and demonstrates her forward-thinking approach to financial management.

Public Perception and Transparency

Transparency in investments is crucial, especially for public figures like Nancy Pelosi. Her openness about her financial holdings helps build trust with the public and ensures accountability.

Building Trust

By disclosing her investments, Pelosi fosters transparency and accountability. This practice strengthens public trust and aligns with the principles of good governance.

Challenges and Opportunities

Like any investor, Nancy Pelosi faces challenges in the financial markets. However, her ability to identify opportunities and navigate challenges sets her apart.

Navigating Risks

Understanding and managing risks is a critical aspect of investing. Pelosi's experience and knowledge enable her to make informed decisions that mitigate risks while maximizing returns.

Conclusion

In conclusion, Nancy Pelosi's investment portfolio showcases her financial expertise and strategic thinking. By focusing on sectors like technology, healthcare, and financial services, she aligns her investments with market trends and growth opportunities. Her transparency and adaptability further enhance her credibility as an investor.

We invite you to share your thoughts and insights in the comments section below. Additionally, explore other articles on our site to deepen your understanding of financial strategies and market trends. Together, let's continue the conversation on the intersection of politics and finance.

Table of Contents

- Biography of Nancy Pelosi

- Understanding Nancy Pelosi's Investment Portfolio

- Technology Investments

- Healthcare Investments

- Financial Services

- Market Trends and Pelosi's Investment Strategies

- Public Perception and Transparency

- Challenges and Opportunities

- Conclusion