Banking transactions have become more convenient and secure with the advent of technology, and one crucial component of this system is the ABA number. If you're unfamiliar with what an ABA number is and its role in banking, you're not alone. This comprehensive guide will walk you through everything you need to know about ABA numbers, their purpose, and how they work in modern banking.

An ABA number, also known as a routing transit number (RTN), plays a vital role in ensuring that financial transactions are routed to the correct bank. This unique nine-digit code is essential for both domestic and international transfers, making it indispensable in today's interconnected financial world.

In this article, we'll delve into the details of ABA numbers, including their history, structure, and importance in banking operations. Whether you're managing personal finances or handling business transactions, understanding ABA numbers will help you streamline your banking activities and avoid common mistakes.

Read also:Comprehensive Guide To Chase Com Banking Help Your Ultimate Resource

Table of Contents

- Introduction to ABA Numbers

- The History of ABA Numbers

- Structure of an ABA Number

- Purpose of ABA Numbers

- Common Uses of ABA Numbers

- ABA vs. SWIFT vs. IBAN

- Security Features of ABA Numbers

- How to Verify an ABA Number

- Common Errors with ABA Numbers

- The Future of ABA Numbers

- Conclusion

Introduction to ABA Numbers

ABA numbers, or routing transit numbers, are fundamental to the banking industry. These nine-digit codes are used to identify specific financial institutions within the United States, ensuring that transactions are routed correctly. Every bank or credit union in the U.S. has its own unique ABA number, which acts as a digital address for financial transactions.

Why Are ABA Numbers Important?

ABA numbers are critical for several reasons:

- They ensure accurate routing of funds between banks.

- They help prevent fraud by verifying the authenticity of financial institutions.

- They streamline the process of electronic transactions, such as direct deposits and automated payments.

The History of ABA Numbers

The ABA number system was introduced in 1910 by the American Bankers Association (ABA) to standardize banking transactions. Before this system, there was no uniform method for identifying banks, leading to confusion and errors in transactions. The introduction of ABA numbers revolutionized the banking industry by creating a reliable and consistent way to identify financial institutions.

Evolution of ABA Numbers

Over the years, ABA numbers have evolved to meet the changing needs of the banking industry. Initially, they were used primarily for check processing, but with the rise of electronic banking, their role has expanded to include various types of transactions, including wire transfers and direct deposits.

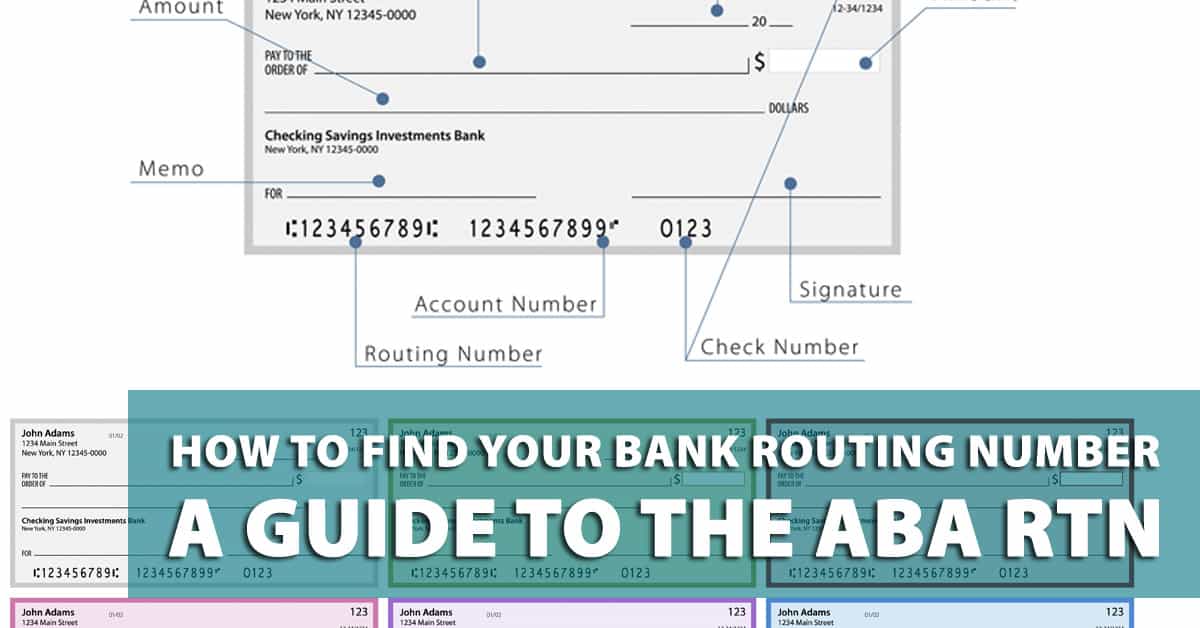

Structure of an ABA Number

An ABA number consists of nine digits, each with a specific purpose. Here's a breakdown of the structure:

- First four digits: These represent the Federal Reserve Routing Symbol and identify the Federal Reserve Bank where the financial institution holds its account.

- Next four digits: These are the ABA Institution Identifier and uniquely identify the specific financial institution.

- Ninth digit: This is a check digit used to verify the accuracy of the ABA number.

Purpose of ABA Numbers

The primary purpose of an ABA number is to facilitate accurate and efficient financial transactions. By providing a unique identifier for each financial institution, ABA numbers ensure that funds are routed to the correct bank or credit union. This is particularly important for electronic transactions, where manual intervention is minimal.

Read also:Two Is A Family Cast A Comprehensive Look At The Stars Behind The Screen

How ABA Numbers Work

When you initiate a transaction, such as a direct deposit or electronic payment, the ABA number is used to direct the funds to the appropriate bank. The receiving bank verifies the ABA number to ensure that it matches the account information provided, reducing the risk of errors or fraud.

Common Uses of ABA Numbers

ABA numbers are used in a variety of banking transactions, including:

- Direct deposits

- Bill payments

- Wire transfers

- Check processing

- Automated Clearing House (ACH) transactions

Each of these transactions relies on the ABA number to ensure that funds are transferred accurately and efficiently.

ABA vs. SWIFT vs. IBAN

While ABA numbers are used primarily for domestic transactions within the United States, other systems like SWIFT and IBAN are used for international transactions. Here's a comparison of these systems:

ABA Numbers

ABA numbers are nine-digit codes used to identify U.S. financial institutions for domestic transactions.

SWIFT Codes

SWIFT codes, also known as BIC codes, are alphanumeric codes used to identify banks globally for international transactions.

IBAN Numbers

IBAN numbers are international bank account numbers used to identify accounts in foreign countries, ensuring accurate routing of funds across borders.

Security Features of ABA Numbers

ABA numbers incorporate several security features to prevent fraud and ensure the integrity of financial transactions. One of the most important features is the check digit, which verifies the accuracy of the ABA number. Additionally, banks and financial institutions employ advanced security protocols to protect ABA numbers and prevent unauthorized access.

Protecting Your ABA Number

While ABA numbers are generally secure, it's important to protect them like any other sensitive financial information. Avoid sharing your ABA number unnecessarily, and ensure that any online transactions involving your ABA number are conducted on secure platforms.

How to Verify an ABA Number

Verifying an ABA number is essential to ensure the accuracy of financial transactions. Here are some steps you can take to verify an ABA number:

- Check the bottom of your checks, where the ABA number is usually printed.

- Contact your bank or credit union for confirmation of your ABA number.

- Use online resources, such as the American Bankers Association website, to verify ABA numbers.

Common Errors with ABA Numbers

Despite their importance, ABA numbers can sometimes lead to errors in transactions. Common mistakes include:

- Transposing digits in the ABA number.

- Using an outdated or incorrect ABA number.

- Providing incomplete account information alongside the ABA number.

Double-checking your ABA number before initiating a transaction can help prevent these errors and ensure smooth financial processing.

The Future of ABA Numbers

As technology continues to evolve, the role of ABA numbers in banking is likely to change. Advances in digital banking and blockchain technology may lead to new methods of identifying financial institutions and routing transactions. However, ABA numbers are likely to remain a crucial component of the banking system for the foreseeable future, ensuring the accuracy and security of financial transactions.

Conclusion

ABA numbers are an essential part of the banking system, providing a reliable and secure method for routing financial transactions. By understanding the structure and purpose of ABA numbers, you can ensure that your banking activities are efficient and error-free. Remember to verify your ABA number carefully and protect it like any other sensitive financial information.

We encourage you to share this article with others who may benefit from learning about ABA numbers. If you have any questions or comments, feel free to leave them below. For more information on banking and finance, explore our other articles on the website.

Sources:

- American Bankers Association

- Federal Reserve Bank

- U.S. Treasury Department

:max_bytes(150000):strip_icc()/what-is-an-aba-number-and-where-can-i-find-it-315435_final-5b632380c9e77c002c9ef750.png)