ABA Transit Routing Numbers play a vital role in the banking system, ensuring smooth transactions and accurate processing of checks and electronic payments. If you're unfamiliar with this concept, you're not alone. Many people find themselves puzzled when they encounter terms like "ABA" or "routing number" for the first time. In this article, we will delve into the world of ABA Transit Routing Numbers, explaining their purpose, structure, and significance in modern banking.

As digital banking continues to evolve, understanding the basics of banking systems becomes increasingly important. Whether you're setting up direct deposits, initiating wire transfers, or simply writing a check, knowing what an ABA Transit Routing Number is can save you time and prevent errors. This guide will cover everything you need to know about ABA Transit Routing Numbers, from their history to practical applications.

In today's fast-paced financial world, staying informed about banking procedures is crucial. By the end of this article, you'll have a clear understanding of what ABA Transit Routing Numbers are and how they impact your financial transactions. Let's dive in!

Read also:Rita Ora Movies And Tv Shows A Comprehensive Guide To Her Acting Career

Table of Contents

- What is ABA Transit Routing Number?

- The History of ABA Transit Routing Numbers

- Understanding the Structure of ABA Routing Numbers

- Why ABA Transit Routing Numbers Are Important

- Types of ABA Transit Routing Numbers

- How to Find Your ABA Transit Routing Number

- Common Uses of ABA Transit Routing Numbers

- ABA vs. SWIFT vs. IBAN: What's the Difference?

- Security Concerns with ABA Transit Routing Numbers

- The Future of ABA Transit Routing Numbers

What is ABA Transit Routing Number?

An ABA Transit Routing Number, also known as a routing transit number (RTN), is a nine-digit code assigned to financial institutions in the United States. This number identifies the specific bank or credit union involved in a transaction. It ensures that funds are routed to the correct institution, whether the transaction involves checks, electronic payments, or wire transfers.

The American Bankers Association (ABA) introduced these numbers in 1910 to standardize the processing of checks. Since then, ABA Transit Routing Numbers have become an essential component of the U.S. banking system. They are used by both banks and their customers to facilitate accurate and efficient financial transactions.

While the term "ABA Transit Routing Number" may sound technical, its purpose is straightforward: to direct money to the right place. Without these numbers, the banking system would face significant challenges in processing millions of transactions daily.

Key Features of ABA Transit Routing Numbers

- Nine-digit format

- Unique to each financial institution

- Used for both paper and electronic transactions

- Essential for domestic transactions within the U.S.

The History of ABA Transit Routing Numbers

The history of ABA Transit Routing Numbers dates back to the early 20th century. In 1910, the American Bankers Association introduced the system to address the growing need for standardized check processing. At the time, banks faced challenges in identifying the origin and destination of checks, leading to delays and errors in transactions.

The introduction of ABA Transit Routing Numbers revolutionized the banking industry. By assigning a unique nine-digit code to each financial institution, the system streamlined the check-clearing process. Over the years, the use of these numbers expanded to include electronic transactions, further enhancing their importance in the financial world.

Milestones in the Development of ABA Transit Routing Numbers

- 1910: ABA introduces the routing number system

- 1950s: Adoption of magnetic ink character recognition (MICR) for automated processing

- 1980s: Integration with electronic funds transfer systems

- 2000s: Expansion to include online banking and mobile transactions

Understanding the Structure of ABA Routing Numbers

The structure of an ABA Transit Routing Number is carefully designed to provide essential information about the financial institution. Each of the nine digits serves a specific purpose:

Read also:Comprehensive Guide To Ohio Bmv Registration Fee Everything You Need To Know

First four digits: Represent the Federal Reserve Bank district and branch where the financial institution holds its account.

Fifth and sixth digits: Indicate the bank's location within the Federal Reserve district.

Seventh digit: Identifies the type of institution (e.g., commercial bank, savings bank).

Last two digits: Serve as a check digit to ensure the number's validity.

Example of an ABA Transit Routing Number

Consider the routing number 123456789:

- 1234: Federal Reserve district and branch

- 56: Bank's location within the district

- 7: Type of institution

- 89: Check digit

Why ABA Transit Routing Numbers Are Important

ABA Transit Routing Numbers are crucial for several reasons. First and foremost, they ensure that funds are directed to the correct financial institution. This minimizes the risk of errors and delays in transactions, whether you're depositing a check or setting up a direct deposit.

Additionally, these numbers play a key role in maintaining the integrity of the banking system. By standardizing the identification of financial institutions, ABA Transit Routing Numbers help prevent fraud and unauthorized access to accounts. This is particularly important in today's digital age, where cyber threats are prevalent.

Benefits of ABA Transit Routing Numbers

- Facilitates accurate and efficient transactions

- Reduces the risk of errors and delays

- Enhances security and fraud prevention

- Supports both paper and electronic banking systems

Types of ABA Transit Routing Numbers

There are two main types of ABA Transit Routing Numbers: ACH routing numbers and wire routing numbers. While both serve the purpose of identifying financial institutions, they differ in their specific applications:

ACH Routing Numbers

ACH (Automated Clearing House) routing numbers are used for electronic transactions, such as direct deposits and automatic bill payments. These numbers are typically associated with domestic transactions within the United States.

Wire Routing Numbers

Wire routing numbers are used for wire transfers, which involve the transfer of funds between banks. Unlike ACH transactions, wire transfers are typically processed faster and may incur additional fees. Some banks use the same routing number for both ACH and wire transactions, while others assign separate numbers for each.

How to Find Your ABA Transit Routing Number

Finding your ABA Transit Routing Number is a straightforward process. Here are several methods you can use:

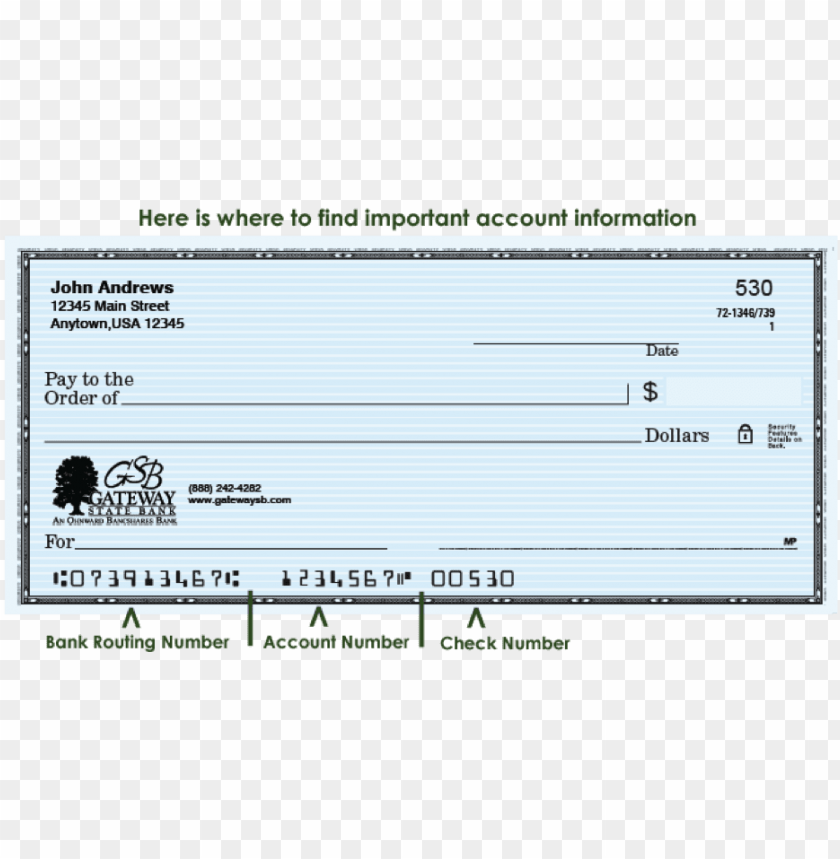

1. Check Your Checks

The routing number is usually printed at the bottom left corner of your checks, along with your account number and check number. Look for the nine-digit code that starts with a number between 00 and 12.

2. Online Banking

Most banks provide your routing number through their online banking portals. Simply log in to your account and navigate to the account information section.

3. Contact Your Bank

If you're unable to locate your routing number, contact your bank's customer service department. They can provide you with the correct number and answer any questions you may have.

Common Uses of ABA Transit Routing Numbers

ABA Transit Routing Numbers are used in various financial transactions, including:

Direct Deposits

Many employers use ABA Transit Routing Numbers to deposit employees' salaries directly into their bank accounts. This eliminates the need for paper checks and ensures timely payment.

Bill Payments

Automated bill payment systems rely on routing numbers to transfer funds from your account to the payee's account. This method is convenient and reduces the risk of late payments.

Wire Transfers

For international or domestic wire transfers, the routing number ensures that the funds are directed to the correct financial institution. This is especially important for large transactions that require immediate processing.

ABA vs. SWIFT vs. IBAN: What's the Difference?

While ABA Transit Routing Numbers are used for domestic transactions within the United States, other systems like SWIFT and IBAN are used for international transactions. Here's a brief overview of each:

ABA Transit Routing Numbers

Used exclusively for U.S. domestic transactions, ABA Transit Routing Numbers identify financial institutions and facilitate accurate processing of checks and electronic payments.

SWIFT Codes

SWIFT codes, or Business Identifier Codes (BIC), are used for international wire transfers. These codes identify banks and financial institutions worldwide, ensuring secure and efficient cross-border transactions.

IBAN Numbers

International Bank Account Numbers (IBAN) are used in conjunction with SWIFT codes for international transactions. IBANs provide detailed account information, making it easier to identify the recipient's account.

Security Concerns with ABA Transit Routing Numbers

While ABA Transit Routing Numbers are essential for banking operations, they also pose potential security risks. Cybercriminals may attempt to misuse these numbers to gain unauthorized access to accounts or perpetrate fraud. To protect yourself:

1. Keep Your Routing Number Secure

Avoid sharing your routing number unnecessarily. Only provide it to trusted entities when required for legitimate transactions.

2. Monitor Your Accounts

Regularly review your bank statements for any suspicious activity. Report any unauthorized transactions to your bank immediately.

3. Use Secure Payment Methods

Whenever possible, use secure payment methods like encrypted online banking platforms or mobile apps. This reduces the risk of your routing number being intercepted by cybercriminals.

The Future of ABA Transit Routing Numbers

As technology continues to evolve, the role of ABA Transit Routing Numbers in the banking system may change. With the rise of blockchain and decentralized finance, traditional banking systems may face new challenges and opportunities. However, for the foreseeable future, ABA Transit Routing Numbers remain a critical component of the U.S. financial infrastructure.

Financial institutions are continually exploring ways to enhance security and efficiency in transaction processing. This includes adopting advanced encryption methods and implementing stricter authentication protocols to protect sensitive information like routing numbers.

Emerging Trends in Banking Technology

- Increased use of biometric authentication

- Integration of artificial intelligence for fraud detection

- Development of real-time payment systems

Conclusion

In conclusion, ABA Transit Routing Numbers are indispensable in the U.S. banking system. They ensure accurate and efficient processing of financial transactions, whether you're writing a check or setting up a direct deposit. By understanding their purpose, structure, and applications, you can make informed decisions about your banking activities.

We encourage you to share this article with others who may benefit from learning about ABA Transit Routing Numbers. Additionally, feel free to leave a comment or question below. For more informative content on banking and finance, explore our other articles on the site.