Bank transactions have become an integral part of our daily lives, and understanding the systems that facilitate these transactions is crucial. One such essential component is the ABA number, also known as the routing transit number (RTN). If you're wondering, "What is a bank's ABA number?" you're in the right place. This article will delve into the details of ABA numbers, their importance, and how they function in the banking system.

ABA numbers are vital for domestic transfers within the United States, ensuring that funds are routed to the correct financial institution. Without them, the banking system would face significant challenges in processing transactions efficiently. As we explore further, you'll gain a deeper understanding of how ABA numbers work and their role in modern banking.

In today's digital age, where banking operations are increasingly automated, knowing your bank's ABA number can save you time and prevent errors during transactions. Whether you're setting up direct deposits, paying bills online, or transferring money between accounts, understanding ABA numbers is key to a seamless banking experience.

Read also:Comprehensive Guide To Ohio Bmv Registration Fee Everything You Need To Know

Table of Contents

- What is a Bank's ABA Number?

- The History of ABA Numbers

- Structure of an ABA Number

- Functions of ABA Numbers

- How to Find Your Bank's ABA Number

- ABA vs. SWIFT: Key Differences

- ABA Number Security

- Common Uses of ABA Numbers

- Frequently Asked Questions About ABA Numbers

- Conclusion: Why Understanding ABA Numbers Matters

What is a Bank's ABA Number?

A bank's ABA number, or routing transit number, is a nine-digit code assigned to financial institutions in the United States. It serves as a unique identifier, ensuring that transactions are routed to the correct bank or credit union. This number is crucial for domestic transfers, such as direct deposits, bill payments, and wire transfers.

The ABA number was introduced by the American Bankers Association (ABA) in 1910 to standardize banking operations and improve efficiency. Today, it remains an essential part of the U.S. banking system, facilitating millions of transactions daily.

Why is an ABA Number Important?

- Ensures accurate routing of funds

- Prevents errors in domestic transactions

- Simplifies the process of setting up automatic payments

The History of ABA Numbers

The history of ABA numbers dates back to 1910 when the American Bankers Association developed the routing transit number system. Initially, the system was designed to streamline check processing, which was a labor-intensive task at the time. Over the years, the use of ABA numbers has expanded to include various electronic transactions, making them an indispensable part of modern banking.

Evolution of ABA Numbers

- 1910: Introduction of the ABA routing transit number system

- 1950s: Adoption of magnetic ink character recognition (MICR) for faster processing

- 1970s: Expansion to electronic transactions

Structure of an ABA Number

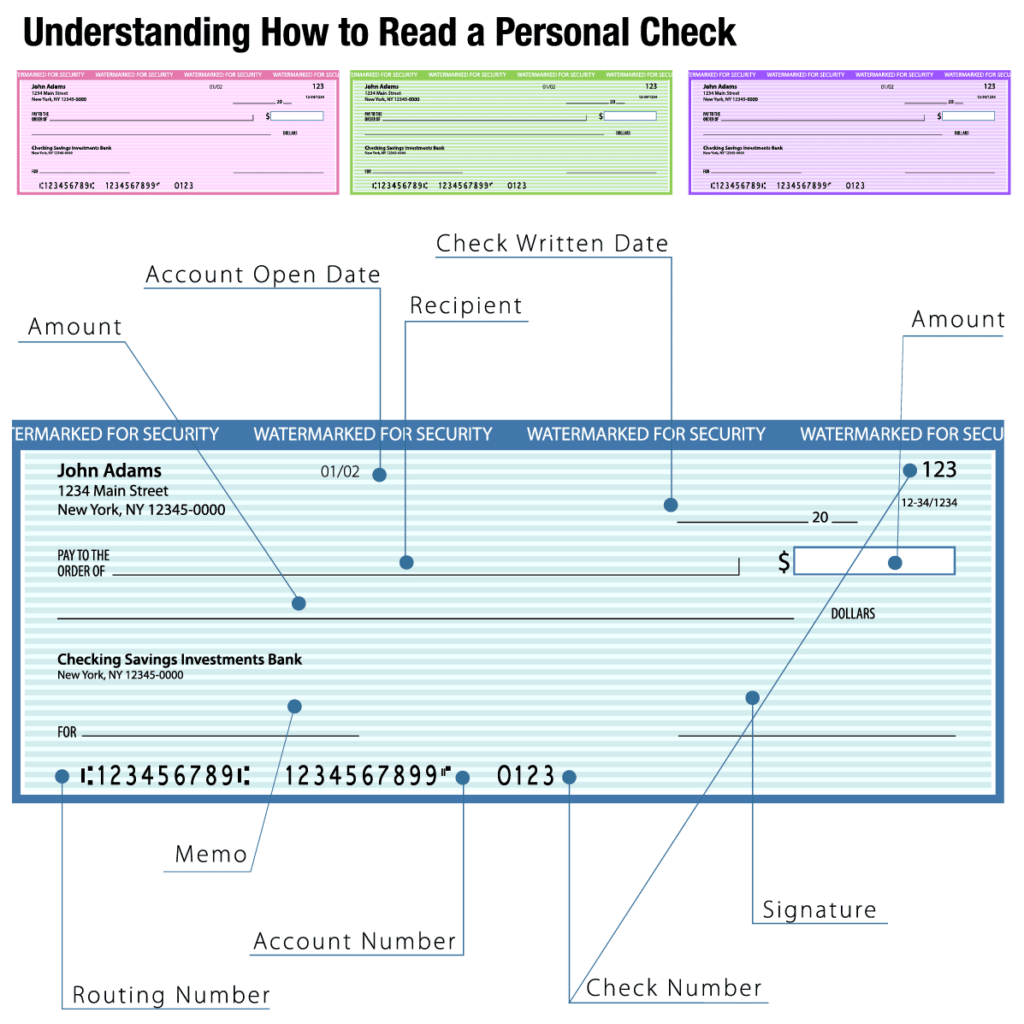

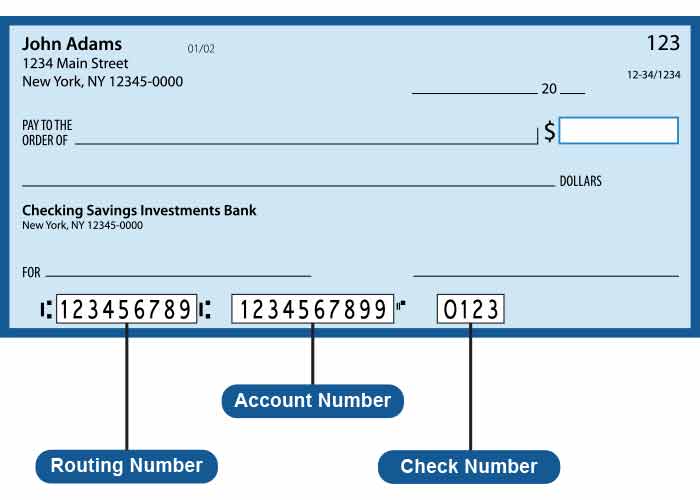

An ABA number consists of nine digits, each with a specific purpose. The first four digits represent the Federal Reserve Routing Symbol, while the next four digits identify the specific financial institution. The final digit is a check digit, used to verify the accuracy of the ABA number.

Breaking Down the ABA Number

- First four digits: Federal Reserve Routing Symbol

- Next four digits: Financial institution identifier

- Ninth digit: Check digit for validation

Functions of ABA Numbers

ABA numbers play a critical role in various banking operations, including:

- Direct deposits: Ensuring salaries and other payments are routed to the correct account

- Bill payments: Facilitating automatic bill payments from your bank account

- Wire transfers: Enabling funds to be transferred between accounts at different banks

How to Find Your Bank's ABA Number

Finding your bank's ABA number is relatively straightforward. You can locate it on your checks, your bank's website, or by contacting customer service. Below are some methods to help you find your ABA number:

Read also:Michael Keatons Movie Career A Comprehensive Look At What Movies Did Michael Keaton Play In

Methods to Locate Your ABA Number

- Check the bottom-left corner of your checks

- Visit your bank's official website

- Contact your bank's customer service

ABA vs. SWIFT: Key Differences

While ABA numbers are used for domestic transactions within the United States, SWIFT codes are employed for international transfers. Understanding the difference between the two is essential for global banking operations.

Comparison of ABA and SWIFT

- ABA: Domestic transactions in the U.S.

- SWIFT: International transactions

- ABA: Nine-digit code

- SWIFT: Eight to eleven-character alphanumeric code

ABA Number Security

Security is a top priority when it comes to ABA numbers. Financial institutions employ various measures to protect these numbers from unauthorized access and misuse. It's crucial to keep your ABA number confidential and only share it with trusted entities.

Tips for Securing Your ABA Number

- Do not share your ABA number publicly

- Verify the authenticity of requests for your ABA number

- Monitor your bank account for suspicious activity

Common Uses of ABA Numbers

ABA numbers are utilized in numerous banking operations, making them an essential component of the financial system. Some common uses include:

- Setting up direct deposits for payroll

- Automating bill payments

- Transferring funds between accounts at different banks

Frequently Asked Questions About ABA Numbers

Q1: Can ABA numbers be used for international transactions?

No, ABA numbers are specifically designed for domestic transactions within the United States. For international transfers, SWIFT codes are used instead.

Q2: Is my ABA number the same as my account number?

No, your ABA number and account number are distinct. The ABA number identifies your bank, while your account number identifies your specific account within that bank.

Q3: Can I find my ABA number online?

Yes, many banks provide ABA numbers on their official websites. Be sure to verify the authenticity of the website before accessing sensitive information.

Conclusion: Why Understanding ABA Numbers Matters

In conclusion, understanding what a bank's ABA number is and how it functions is crucial for anyone involved in banking operations. From facilitating domestic transactions to ensuring the security of your financial information, ABA numbers play a vital role in the U.S. banking system. By familiarizing yourself with ABA numbers, you can streamline your banking processes and protect your financial data.

We encourage you to share this article with others who may benefit from understanding ABA numbers. Feel free to leave a comment below if you have any questions or need further clarification. Additionally, explore our other articles for more insights into the world of finance and banking.

Data sources and references: