In today's digital banking world, understanding the ABA number is crucial for anyone dealing with financial transactions. Whether you're setting up direct deposits, paying bills online, or transferring funds, the ABA number plays a vital role in ensuring that money moves correctly between accounts. This article will delve into what an ABA number is, its importance, and how to use it effectively.

The ABA number, also known as the American Bankers Association routing number, is a nine-digit code assigned to financial institutions in the United States. This code helps identify the specific bank or credit union involved in a transaction, ensuring that funds are routed to the correct destination.

As we navigate through this guide, you will gain a deeper understanding of ABA numbers, their history, and their role in modern banking. Whether you're a business owner, a student, or simply someone interested in personal finance, this article will provide valuable insights into the mechanics of bank routing codes.

Read also:Tampa Bay Rays Baseball Schedule Your Ultimate Guide To The 2023 Season

Table of Contents

- What is ABA Number?

- History of ABA Numbers

- Structure of an ABA Number

- How to Find Your ABA Number

- The Importance of ABA Numbers

- Common Uses of ABA Numbers

- ABA Number vs. SWIFT Code

- Security Concerns with ABA Numbers

- Frequently Asked Questions About ABA Numbers

- Conclusion

What is ABA Number?

An ABA number, or routing transit number (RTN), is a nine-digit code used to identify financial institutions in the United States. It was introduced by the American Bankers Association in 1910 to streamline the check-clearing process. Today, it serves as a critical component of the U.S. banking system, ensuring that funds are routed accurately between banks and credit unions.

Why is the ABA Number Important?

The ABA number is essential because it helps financial institutions identify where money should be sent. Without it, transactions could be delayed or sent to the wrong account. This code ensures that payments, direct deposits, and other financial activities are processed efficiently and securely.

History of ABA Numbers

The concept of the ABA number dates back to 1910 when the American Bankers Association introduced it to standardize the check-clearing process. At the time, the banking industry faced challenges in processing checks efficiently. The ABA number provided a solution by creating a unique identifier for each financial institution.

Evolution of ABA Numbers

Over the years, the use of ABA numbers has expanded beyond checks. With the rise of electronic banking, ABA numbers now play a crucial role in automated clearing house (ACH) transactions, wire transfers, and other digital payment systems. This evolution has made the ABA number an indispensable part of modern banking infrastructure.

Structure of an ABA Number

An ABA number consists of nine digits, each with a specific purpose:

- First four digits: Represent the Federal Reserve routing symbol.

- Next four digits: Identify the financial institution.

- Ninth digit: Acts as a check digit to verify the accuracy of the number.

Understanding this structure helps ensure that the ABA number is correct and valid for use in transactions.

Read also:Two And A Half Men A Comprehensive Guide To The Iconic Tv Series

How to Find Your ABA Number

Locating your ABA number is straightforward. Here are some common methods:

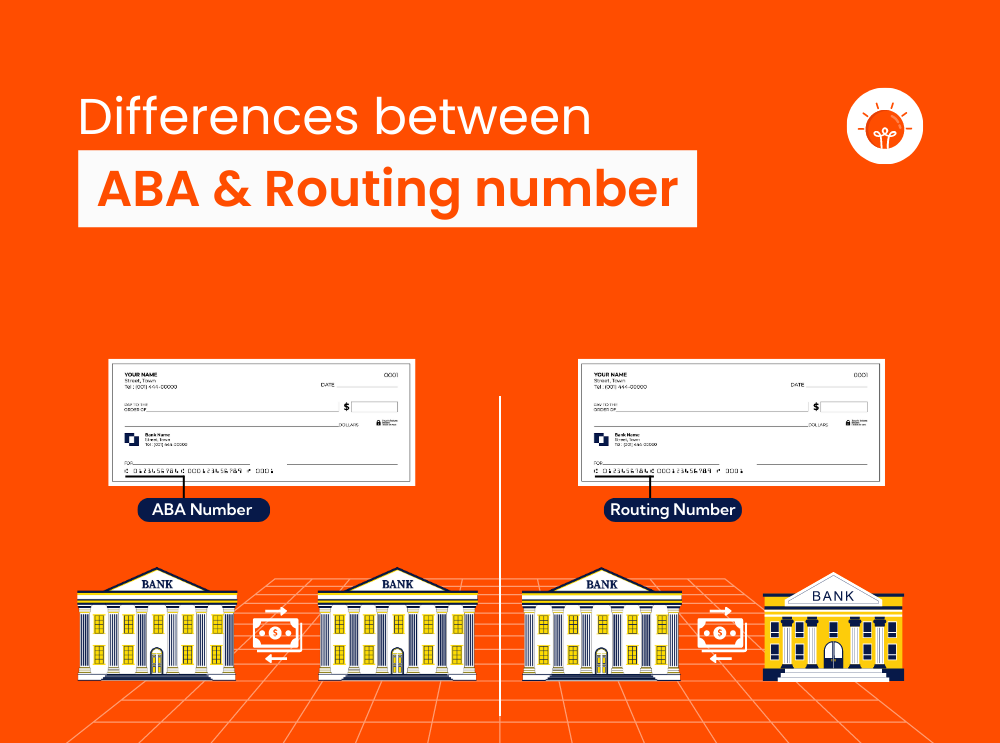

On Your Checks

For personal checks, the ABA number is usually printed at the bottom left corner. It is the nine-digit number located before your account number.

Through Online Banking

Most banks provide ABA numbers through their online banking platforms. Log in to your account and navigate to the "Account Information" section to find your routing number.

By Contacting Your Bank

If you're unsure where to find your ABA number, contact your bank's customer service department. They can provide you with the correct routing number for your account.

The Importance of ABA Numbers

ABA numbers are vital for several reasons:

- They ensure accurate routing of funds between financial institutions.

- They facilitate efficient processing of checks, direct deposits, and ACH transactions.

- They help prevent errors and fraud in financial transactions.

Without ABA numbers, the banking system would face significant challenges in processing payments and maintaining trust with customers.

Common Uses of ABA Numbers

ABA numbers are used in various financial transactions, including:

Direct Deposits

Employers use ABA numbers to deposit salaries directly into employees' bank accounts. This method is convenient, secure, and widely adopted in the modern workforce.

Bill Payments

When paying bills online, you often need to provide your ABA number to ensure that the payment is processed correctly and sent to the right financial institution.

Wire Transfers

For domestic wire transfers within the United States, the ABA number is necessary to identify the sending and receiving banks. This ensures that the funds are transferred accurately and efficiently.

ABA Number vs. SWIFT Code

While ABA numbers are used for domestic transactions within the U.S., SWIFT codes are utilized for international transfers. Here's a comparison:

- ABA Number: Nine-digit code used for U.S.-based transactions.

- SWIFT Code: Eight to eleven-character alphanumeric code used for global transactions.

Understanding the difference between these two codes is essential for anyone engaging in both domestic and international banking activities.

Security Concerns with ABA Numbers

While ABA numbers are generally safe to share, it's important to exercise caution. Avoid sharing your ABA number unnecessarily, especially online or over the phone, unless you're confident in the recipient's legitimacy. Banks and financial institutions have implemented various security measures to protect ABA numbers and prevent fraud.

Best Practices for Protecting Your ABA Number

- Only share your ABA number with trusted entities.

- Monitor your bank statements regularly for unauthorized transactions.

- Enable two-factor authentication for added security in online banking.

By following these practices, you can help safeguard your financial information and reduce the risk of fraud.

Frequently Asked Questions About ABA Numbers

1. Can I use the same ABA number for multiple accounts?

Yes, most banks assign the same ABA number to all accounts under the same financial institution. However, some banks may have different ABA numbers for different types of accounts or locations.

2. What happens if I provide the wrong ABA number?

Providing an incorrect ABA number can result in transaction delays or funds being sent to the wrong account. Always double-check your ABA number before initiating any financial transaction.

3. Are ABA numbers unique to each bank?

Yes, each financial institution in the United States has a unique ABA number. This ensures that funds are routed to the correct bank or credit union.

Conclusion

In conclusion, understanding what an ABA number is and how it functions is essential for anyone involved in financial transactions. From its historical origins to its modern applications, the ABA number remains a cornerstone of the U.S. banking system. By knowing how to find and use your ABA number correctly, you can ensure that your financial activities are processed efficiently and securely.

We encourage you to share this article with others who may benefit from learning about ABA numbers. If you have any questions or comments, feel free to leave them below. Additionally, explore other articles on our site for more insights into personal finance and banking.