Property taxes in Dallas County are a crucial financial responsibility for homeowners. Understanding how these taxes work, what affects them, and how to manage them is essential for anyone owning property in the area. Whether you're a first-time homeowner or a seasoned real estate investor, this guide will provide you with all the necessary information to navigate the complexities of Dallas County property taxes.

Dallas County, one of the fastest-growing regions in Texas, is renowned for its booming real estate market. However, along with the benefits of owning property in this vibrant area comes the responsibility of paying property taxes. These taxes are not only a significant source of revenue for local governments but also fund essential public services like schools, infrastructure, and emergency services.

This article aims to demystify the Dallas County property tax system, offering practical advice, expert insights, and actionable tips to help you manage your tax obligations effectively. By the end of this guide, you'll have a clear understanding of how property taxes are calculated, assessed, and paid, as well as how to potentially lower your tax burden.

Read also:Tampa Bay Rays Baseball Schedule Your Ultimate Guide To The 2023 Season

Table of Contents

- Introduction to Dallas County Property Taxes

- How Dallas County Property Taxes Are Calculated

- Property Tax Assessment Process

- Available Property Tax Exemptions

- Appealing Your Property Tax Assessment

- Paying Your Dallas County Property Taxes

- Consequences of Delinquent Property Taxes

- Ways to Reduce Your Property Taxes

- Useful Resources for Dallas County Taxpayers

- Conclusion and Call to Action

Introduction to Dallas County Property Taxes

Property taxes in Dallas County are a fundamental part of homeownership. These taxes are levied on real estate properties and are used to fund various public services. Understanding the intricacies of the tax system is vital for homeowners to ensure they are not overpaying and are aware of their rights and responsibilities.

The Dallas County Appraisal District (DCAD) is responsible for assessing property values and calculating property taxes. Each year, property owners receive a tax bill based on their property's assessed value and the tax rates set by local taxing entities. These entities include school districts, municipalities, and counties, each contributing to the overall tax burden.

Key Factors Affecting Property Taxes:

- Property value assessments

- Tax rates set by local governments

- Exemptions and deductions available to homeowners

How Dallas County Property Taxes Are Calculated

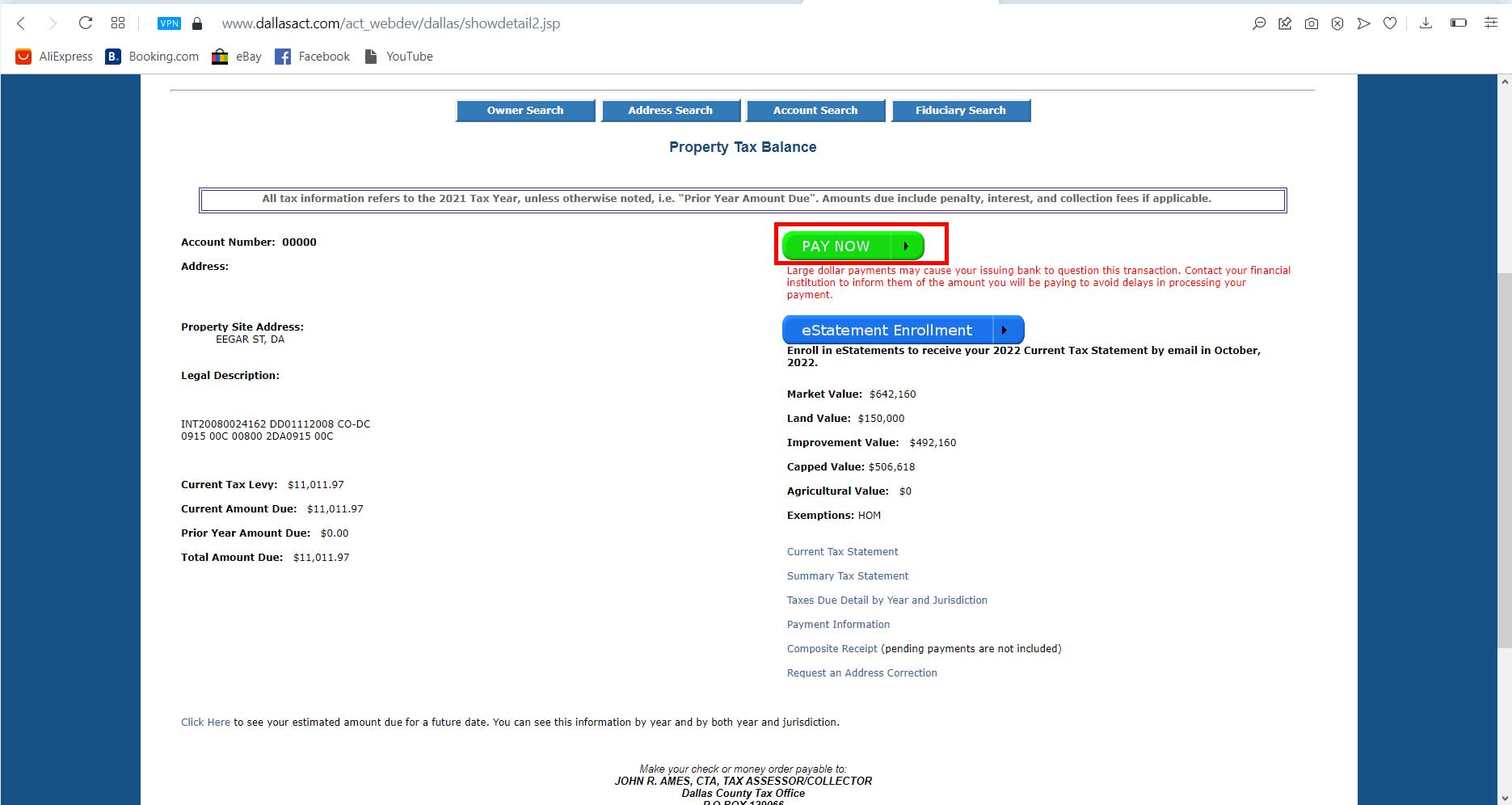

Calculating Dallas County property taxes involves several steps. First, the DCAD determines the market value of your property. This value is then adjusted by any applicable exemptions, resulting in the taxable value. Finally, the taxable value is multiplied by the tax rate to determine the total tax owed.

Market Value vs. Taxable Value

The market value represents what your property would likely sell for in the current market. The taxable value, however, is the market value minus any exemptions. For example, if your home's market value is $300,000 and you qualify for a $25,000 exemption, your taxable value would be $275,000.

Tax Rate Components

Tax rates in Dallas County are composed of several components, including:

Read also:Tmobile On The Las Vegas Strip Your Ultimate Connectivity Guide

- School district tax rates

- City or municipal tax rates

- County tax rates

- Special district tax rates (e.g., water districts)

Property Tax Assessment Process

The property tax assessment process in Dallas County begins with the DCAD conducting annual property value assessments. These assessments consider various factors, such as location, property size, and recent sales of similar properties in the area.

Timeline of the Assessment Process

January 1: The appraisal district establishes the taxable value of all properties as of this date.

April 1: Property owners receive their proposed appraised value notices.

May-June: Property owners can file protests if they disagree with their appraised value.

October: Final tax bills are sent to property owners.

Available Property Tax Exemptions

Homeowners in Dallas County may qualify for various property tax exemptions, which can significantly reduce their tax burden. Some of the most common exemptions include:

- Homestead Exemption: Provides a reduction in taxable value for primary residences.

- Over 65/School Tax Freeze: Allows homeowners aged 65 and older to freeze their school district taxes.

- Disabled Veterans Exemption: Offers tax relief to veterans with service-connected disabilities.

- Energy Efficiency Exemption: Provides tax incentives for properties with energy-efficient improvements.

Appealing Your Property Tax Assessment

If you believe your property has been overvalued, you have the right to appeal the assessment. The appeals process involves submitting a protest to the DCAD and presenting evidence to support your case.

Steps to Appeal Your Property Tax Assessment

- Review your property's appraised value and compare it to similar properties in the area.

- File a protest with the DCAD by the deadline, typically in May.

- Attend a hearing with the Appraisal Review Board (ARB) to present your case.

- Receive a decision from the ARB and, if necessary, pursue further legal action.

Paying Your Dallas County Property Taxes

Property taxes in Dallas County are typically due by January 31 of the following year. Failure to pay on time can result in penalties and interest charges. Homeowners have several options for paying their taxes, including:

- Online payment through the Dallas County Tax Office website

- Mail-in payments

- In-person payments at the tax office

- Automatic payments through a mortgage escrow account

Penalties for Late Payment

Delinquent property taxes accrue penalties and interest, which can increase your overall tax burden. For example, a 6% penalty is applied on February 1, followed by an additional 1% per month in interest until the taxes are paid in full.

Consequences of Delinquent Property Taxes

Failure to pay property taxes can have severe consequences, including:

- Lien placement on the property

- Foreclosure proceedings

- Damage to your credit score

It's crucial to address any delinquent taxes promptly to avoid these outcomes. Homeowners experiencing financial difficulties may qualify for payment plans or other assistance programs.

Ways to Reduce Your Property Taxes

There are several strategies homeowners can employ to reduce their Dallas County property taxes:

- Ensure you're taking advantage of all available exemptions.

- Appeal your property tax assessment if you believe your property has been overvalued.

- Stay informed about changes in tax rates and local government policies.

- Invest in energy-efficient upgrades to qualify for tax incentives.

Useful Resources for Dallas County Taxpayers

Several resources are available to assist Dallas County homeowners with their property tax obligations:

- Dallas County Appraisal District: Provides information on property values, exemptions, and the appeals process.

- Dallas County Tax Office: Offers details on tax rates, payment options, and delinquent tax procedures.

- Texas Comptroller of Public Accounts: A comprehensive resource for property tax laws and regulations in Texas.

Conclusion and Call to Action

Dallas County property taxes are a significant financial responsibility for homeowners, but with the right knowledge and strategies, you can manage them effectively. By understanding how taxes are calculated, taking advantage of available exemptions, and staying informed about local policies, you can minimize your tax burden and protect your investment.

We encourage you to share this article with fellow homeowners and explore additional resources to enhance your understanding of property taxes. If you have any questions or need further assistance, please leave a comment below or visit our other articles for more insights into Dallas County real estate and finance.