The US Dollar Debt Clock has become an essential tool for tracking the financial health of the United States. As the national debt continues to rise, understanding its implications is crucial for both policymakers and citizens. This clock provides real-time updates on the nation's debt, offering valuable insights into the fiscal policies shaping the country's future.

The concept of a debt clock may seem abstract to some, but it represents a tangible reality for the nation's economy. The US Dollar Debt Clock tracks not only the federal debt but also other financial obligations, such as Social Security and Medicare. By monitoring these figures, stakeholders can better assess the long-term sustainability of government spending.

This article aims to provide a comprehensive overview of the US Dollar Debt Clock, its significance, and the implications it has on the economy. We will explore the history of the debt clock, how it works, and why it matters to everyday Americans. Additionally, we will discuss strategies to manage the national debt and the role of citizens in holding policymakers accountable.

Read also:Lake Mary Fl Movies Your Ultimate Guide To Movie Theaters And Entertainment

Table of Contents

- What is the US Dollar Debt Clock?

- History of the Debt Clock

- How Does the Debt Clock Work?

- Why is the Debt Clock Important?

- Current National Debt Statistics

- Factors Contributing to the National Debt

- Consequences of High National Debt

- Strategies to Reduce National Debt

- Role of Citizens in Managing Debt

- Future Prospects for the National Debt

What is the US Dollar Debt Clock?

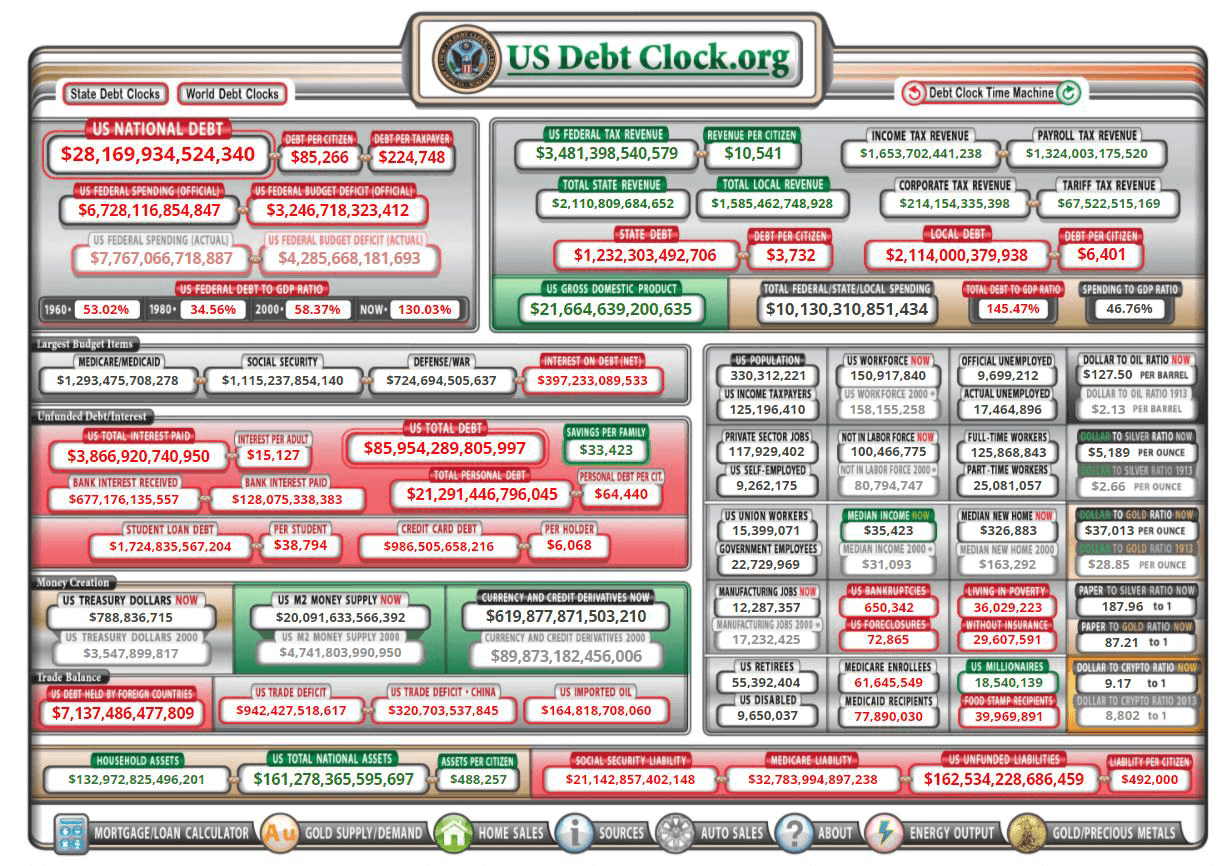

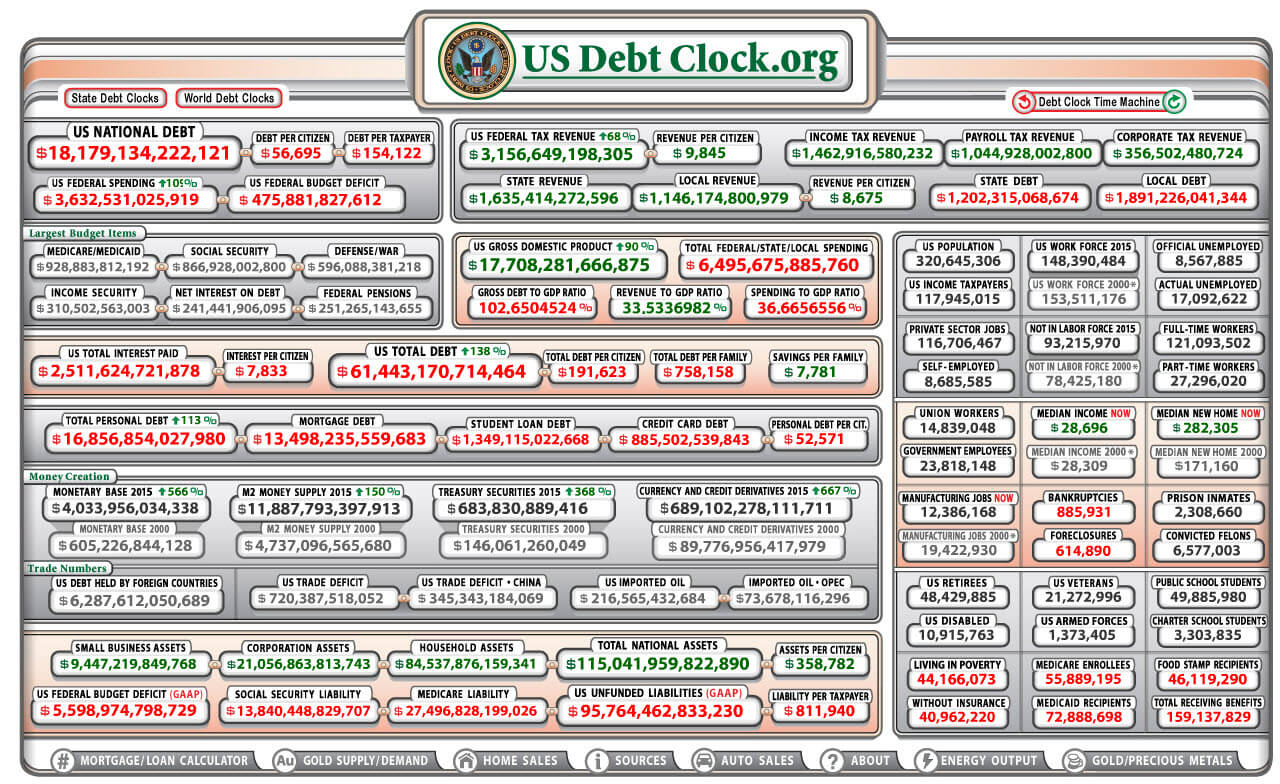

The US Dollar Debt Clock is a digital display that tracks the total outstanding debt of the United States government. This clock provides real-time updates, showing how quickly the national debt grows each second. It serves as a visual representation of the nation's financial obligations, highlighting the urgency of addressing fiscal challenges.

Real-Time Tracking of Financial Obligations

The debt clock monitors not only the federal debt but also other liabilities, such as unfunded Social Security and Medicare obligations. By presenting this information in an accessible format, the debt clock raises awareness about the nation's financial health and encourages public discourse on fiscal policy.

History of the Debt Clock

The concept of a debt clock dates back to the late 20th century. The first physical debt clock was installed in New York City in 1989 by Seymour Durst, a real estate developer concerned about the growing national debt. Since then, digital versions of the debt clock have become widely available online, providing real-time updates to a global audience.

Evolution of the Debt Clock

- 1989: Installation of the first physical debt clock in New York City.

- 1990s: Expansion of debt clock coverage to include other financial obligations.

- 2000s: Development of online debt clocks for global accessibility.

How Does the Debt Clock Work?

The US Dollar Debt Clock operates by accessing real-time data from government sources, such as the U.S. Treasury Department. It calculates the total national debt by adding up all federal obligations, including publicly held debt and intragovernmental holdings. The clock also incorporates projections for future liabilities, offering a comprehensive view of the nation's financial landscape.

Data Sources for the Debt Clock

The debt clock relies on data from:

- U.S. Treasury Department

- Congressional Budget Office (CBO)

- Government Accountability Office (GAO)

Why is the Debt Clock Important?

The US Dollar Debt Clock plays a vital role in informing the public about the nation's financial health. By providing transparent and up-to-date information, it encourages accountability and fosters informed discussions about fiscal policy. Understanding the implications of the national debt is essential for ensuring long-term economic stability.

Read also:Two And A Half Men A Comprehensive Guide To The Iconic Tv Series

Key Reasons for the Importance of the Debt Clock

- Raising awareness about fiscal challenges.

- Encouraging accountability among policymakers.

- Promoting informed discussions on economic policy.

Current National Debt Statistics

As of 2023, the total national debt of the United States exceeds $31 trillion. This figure represents a significant increase from previous years, driven by factors such as government spending, tax cuts, and economic stimulus packages. The debt clock provides real-time updates on these figures, allowing stakeholders to monitor changes in the nation's financial obligations.

Key Statistics

- Total national debt: Over $31 trillion

- Publicly held debt: Approximately $25 trillion

- Intragovernmental holdings: Approximately $6 trillion

Factors Contributing to the National Debt

Several factors contribute to the growth of the national debt, including government spending, tax policies, and economic conditions. Understanding these factors is essential for developing effective strategies to manage the debt and ensure long-term fiscal sustainability.

Primary Contributors to the National Debt

- Government spending on defense, healthcare, and infrastructure.

- Tax cuts that reduce government revenue.

- Economic recessions that increase budget deficits.

Consequences of High National Debt

A high national debt can have significant consequences for the economy, including higher interest rates, reduced economic growth, and increased fiscal pressure on future generations. It also limits the government's ability to respond to economic crises and invest in critical areas such as education and healthcare.

Potential Consequences

- Higher interest rates for consumers and businesses.

- Reduced economic growth due to lower investment.

- Increased fiscal pressure on future generations.

Strategies to Reduce National Debt

Addressing the national debt requires a comprehensive approach that balances spending cuts, revenue increases, and economic growth. Policymakers must prioritize long-term fiscal sustainability while ensuring that essential programs remain adequately funded.

Effective Strategies

- Implementing targeted spending cuts in non-essential areas.

- Increasing tax revenues through fair and equitable policies.

- Promoting economic growth to boost government revenue.

Role of Citizens in Managing Debt

Citizens play a crucial role in managing the national debt by holding policymakers accountable and advocating for responsible fiscal policies. Engaging in informed discussions and participating in the democratic process can help shape the future of the nation's financial health.

How Citizens Can Make a Difference

- Staying informed about fiscal policy and its implications.

- Engaging in discussions with elected officials and policymakers.

- Participating in elections and advocating for responsible fiscal policies.

Future Prospects for the National Debt

The future of the national debt depends on the actions taken by policymakers and citizens alike. By prioritizing fiscal responsibility and promoting economic growth, the United States can work towards reducing its debt and ensuring long-term financial stability. Continued monitoring through tools like the US Dollar Debt Clock will remain essential in this process.

Looking Ahead

As the nation faces ongoing fiscal challenges, collaboration between government, businesses, and citizens will be key to addressing the national debt. By focusing on sustainable policies and fostering economic growth, the United States can pave the way for a more stable financial future.

Conclusion

The US Dollar Debt Clock serves as a vital tool for tracking the nation's financial health and raising awareness about the implications of the national debt. By understanding its significance and contributing to informed discussions on fiscal policy, citizens can play an active role in shaping the future of the country's financial landscape. We encourage readers to share this article, engage in discussions, and explore additional resources to deepen their understanding of this critical issue.

For further reading, consider exploring related topics such as federal budget deficits, government spending priorities, and strategies for promoting economic growth. Together, we can work towards a more financially stable future for all Americans.