In today's digital age, understanding the ABA number on check remains crucial for financial transactions. Whether you're depositing a check or setting up direct deposits, knowing what an ABA number is and how to locate it can streamline your banking processes. This guide aims to provide a detailed explanation of ABA numbers, their significance, and how they function within the banking system.

The American Banking Association (ABA) routing number, commonly referred to as the ABA number, plays a pivotal role in the smooth operation of banking transactions. It ensures that funds are routed correctly between financial institutions, preventing errors and delays. As we delve deeper into this topic, you'll discover why this seemingly small detail carries immense importance in financial dealings.

By the end of this article, you'll have a clear understanding of how to identify and utilize ABA numbers effectively. Whether you're a business owner or an individual managing personal finances, mastering the use of ABA numbers can enhance your banking experience. Let's explore this essential aspect of banking together.

Read also:Why Did Lois Marry Peter A Comprehensive Analysis

Table of Contents

- What is an ABA Number?

- History of ABA Number

- How to Find Your ABA Number

- Structure of an ABA Number

- Importance of ABA Numbers

- ABA Number vs Routing Number

- Common Uses of ABA Numbers

- ABA Number FAQs

- Security Concerns with ABA Numbers

- Future of ABA Numbers

What is an ABA Number?

An ABA number, or American Banking Association routing number, is a nine-digit code assigned to financial institutions in the United States. This number helps identify the specific bank or credit union involved in a transaction. The ABA number ensures that funds are directed to the correct institution, making it an integral part of the banking system.

Purpose of ABA Number

The primary purpose of an ABA number is to facilitate the accurate routing of financial transactions. It serves as a unique identifier for banks and credit unions, ensuring that payments and transfers are processed correctly. Whether you're depositing a check or setting up direct deposits, the ABA number plays a crucial role in the process.

History of ABA Number

The concept of the ABA number was introduced in 1910 by the American Banking Association. Initially designed to standardize check processing, the ABA number has evolved to accommodate various financial transactions. Over the years, its importance in the banking industry has grown, adapting to the digital age while maintaining its core function.

Evolution of ABA Number

From its humble beginnings as a check-processing tool, the ABA number has expanded its reach to include electronic funds transfers, direct deposits, and other financial transactions. This evolution reflects the banking industry's commitment to efficiency and accuracy in handling transactions.

How to Find Your ABA Number

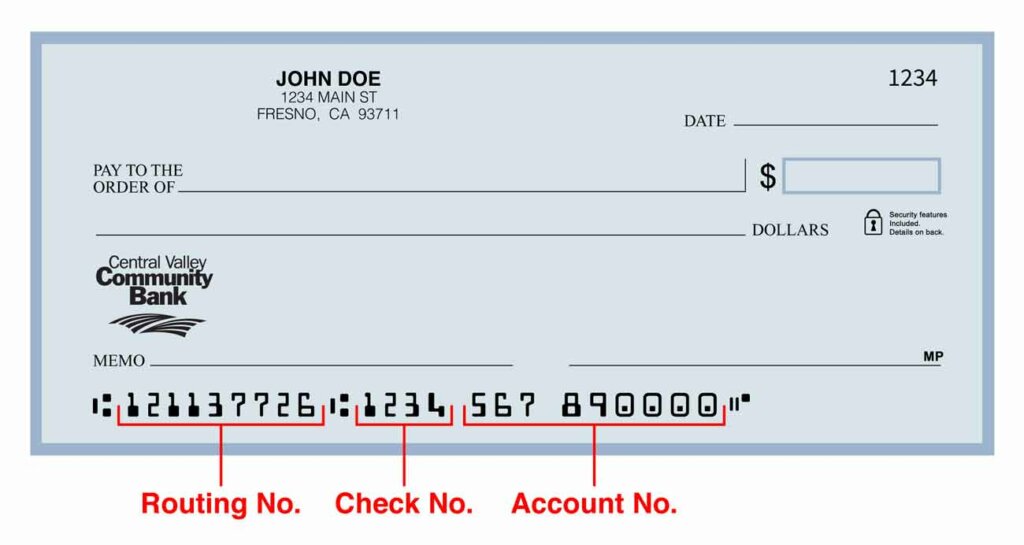

Finding your ABA number is relatively straightforward. It is typically located at the bottom of your checks, appearing as the first set of numbers in a nine-digit format. Additionally, most banks provide this information on their websites or through customer service.

Finding ABA Number Online

- Visit your bank's official website.

- Log in to your account for secure access.

- Look for account details or settings where ABA numbers are listed.

Structure of an ABA Number

The ABA number consists of nine digits, each carrying specific information about the financial institution. The first four digits represent the Federal Reserve Routing Symbol, the next four digits identify the bank or credit union, and the final digit serves as a checksum to validate the number's accuracy.

Read also:Lake Mary Fl Movies Your Ultimate Guide To Movie Theaters And Entertainment

Understanding the Checksum Digit

The checksum digit is a mathematical calculation used to verify the integrity of the ABA number. It ensures that the number entered is correct and corresponds to a valid financial institution. This feature adds an extra layer of security to financial transactions.

Importance of ABA Numbers

ABA numbers are vital for maintaining the integrity of financial transactions. They prevent errors in routing funds, ensuring that payments and transfers are directed to the correct institutions. Without ABA numbers, the banking system would face significant challenges in processing transactions efficiently.

Accuracy in Transactions

By providing a unique identifier for each financial institution, ABA numbers minimize the risk of errors in financial transactions. This accuracy is crucial for both individuals and businesses, ensuring that funds are handled correctly and securely.

ABA Number vs Routing Number

While the terms ABA number and routing number are often used interchangeably, they essentially refer to the same nine-digit code. The distinction lies in their usage; ABA numbers are typically associated with checks, while routing numbers are used for electronic transactions. Both serve the same purpose of identifying financial institutions.

Differences in Usage

For check-based transactions, the term ABA number is more commonly used. In contrast, electronic transactions such as wire transfers and direct deposits often refer to the same code as a routing number. Understanding these nuances can help clarify communication in financial dealings.

Common Uses of ABA Numbers

ABA numbers are utilized in various financial transactions, including check processing, direct deposits, and wire transfers. Their versatility makes them an indispensable tool in the banking industry, ensuring that funds are handled accurately and efficiently.

Examples of ABA Number Uses

- Processing checks for payment.

- Setting up direct deposits for payroll.

- Initiating wire transfers between accounts.

ABA Number FAQs

Many individuals have questions about ABA numbers and their functions. Below are some frequently asked questions to help clarify common concerns.

FAQ Examples

- Can I use the same ABA number for multiple accounts?

- Is the ABA number the same as the account number?

- How do I find my ABA number if I don't have checks?

Security Concerns with ABA Numbers

While ABA numbers are essential for financial transactions, they must be handled with care to prevent misuse. Sharing ABA numbers indiscriminately can lead to unauthorized access to your accounts. It's crucial to protect this information and only share it with trusted entities.

Protecting Your ABA Number

- Limit sharing your ABA number to necessary transactions.

- Ensure secure communication channels when transmitting ABA numbers.

- Monitor your accounts regularly for any suspicious activity.

Future of ABA Numbers

As technology continues to advance, the role of ABA numbers may evolve to accommodate new financial systems. However, their fundamental purpose of ensuring accurate routing of funds is likely to remain unchanged. The banking industry will continue to rely on ABA numbers as a cornerstone of transaction processing.

Technological Advancements

With the rise of digital banking and blockchain technology, the future of ABA numbers may involve integration with these emerging systems. This adaptation will further enhance the security and efficiency of financial transactions, ensuring that ABA numbers remain relevant in the ever-evolving banking landscape.

Kesimpulan

Understanding the ABA number on check is essential for anyone involved in financial transactions. From its history and structure to its importance in ensuring accurate routing of funds, ABA numbers play a critical role in the banking system. By following best practices in handling ABA numbers and staying informed about their usage, you can safeguard your financial transactions and enhance your banking experience.

We encourage you to share your thoughts and experiences with ABA numbers in the comments below. For more insights into financial topics, explore our other articles on our website. Together, let's navigate the complexities of modern banking with confidence and knowledge.

Data Source: Federal Reserve Board, American Banking Association