ABA numbers, also known as routing transit numbers (RTNs), are essential components of the banking system in the United States. These numbers play a crucial role in ensuring that financial transactions are processed accurately and efficiently. Whether you're transferring money, setting up direct deposits, or paying bills online, understanding ABA numbers can help streamline your banking activities.

In today's digital age, where financial transactions are conducted with a few clicks, the importance of ABA numbers cannot be overstated. They serve as the backbone of the U.S. banking infrastructure, ensuring that funds are routed to the correct bank or financial institution. As we delve deeper into this article, we will explore the significance, functionality, and applications of ABA numbers in detail.

This guide aims to provide a comprehensive overview of ABA numbers, covering everything from their history and structure to their practical uses in everyday banking. By the end of this article, you will have a clear understanding of what an ABA number is and how it impacts your financial transactions.

Read also:Why Did Lois Marry Peter A Comprehensive Analysis

Table of Contents

- The History of ABA Numbers

- Structure of an ABA Number

- Common Uses of ABA Numbers

- How to Find Your ABA Number

- ABA vs. SWIFT: Understanding the Differences

- Security Concerns and Best Practices

- Frequently Asked Questions About ABA Numbers

- Benefits of Using ABA Numbers

- Limitations and Challenges

- The Future of ABA Numbers in Banking

The History of ABA Numbers

ABA numbers were first introduced in 1910 by the American Bankers Association (ABA) to standardize the routing of checks and other financial instruments. At the time, the U.S. banking system was growing rapidly, and there was a need for a consistent method to identify banks and financial institutions. The introduction of ABA numbers revolutionized the banking industry, enabling efficient processing of transactions across the country.

Over the years, the use of ABA numbers has expanded beyond check processing. Today, they are used for a wide range of financial transactions, including wire transfers, direct deposits, and automated clearing house (ACH) transactions. The evolution of ABA numbers reflects the changing landscape of the banking industry and the increasing demand for secure and efficient financial services.

Early Development of ABA Numbers

- 1910: ABA numbers were first introduced to standardize check routing.

- 1940s: The numbers began to be used for other financial instruments, such as money orders.

- 1970s: ABA numbers became integral to electronic funds transfers.

Structure of an ABA Number

An ABA number consists of nine digits and follows a specific format. The first four digits represent the Federal Reserve routing symbol, which identifies the Federal Reserve Bank responsible for processing transactions. The next four digits are the bank's identifying number, and the final digit is a checksum used to verify the accuracy of the ABA number.

The structure of an ABA number ensures that financial transactions are routed correctly and securely. By adhering to this standardized format, banks and financial institutions can process transactions efficiently and minimize errors.

Components of an ABA Number

- Federal Reserve Routing Symbol (First 4 Digits): Identifies the Federal Reserve Bank.

- Bank Identifier (Next 4 Digits): Identifies the specific bank or financial institution.

- Checksum (Last Digit): Verifies the accuracy of the ABA number.

Common Uses of ABA Numbers

ABA numbers are used in various financial transactions, including:

- Direct Deposits: Employers use ABA numbers to deposit employees' salaries directly into their bank accounts.

- Bill Payments: Consumers can use ABA numbers to set up automatic bill payments for utilities, loans, and other recurring expenses.

- Wire Transfers: ABA numbers are required for domestic wire transfers within the United States.

- ACH Transactions: ABA numbers facilitate electronic funds transfers between banks and financial institutions.

Understanding the common uses of ABA numbers can help individuals and businesses manage their finances more effectively and efficiently.

Read also:Two Is A Family Cast A Comprehensive Look At The Stars Behind The Screen

How to Find Your ABA Number

Locating your ABA number is a straightforward process. Here are some methods to find your ABA number:

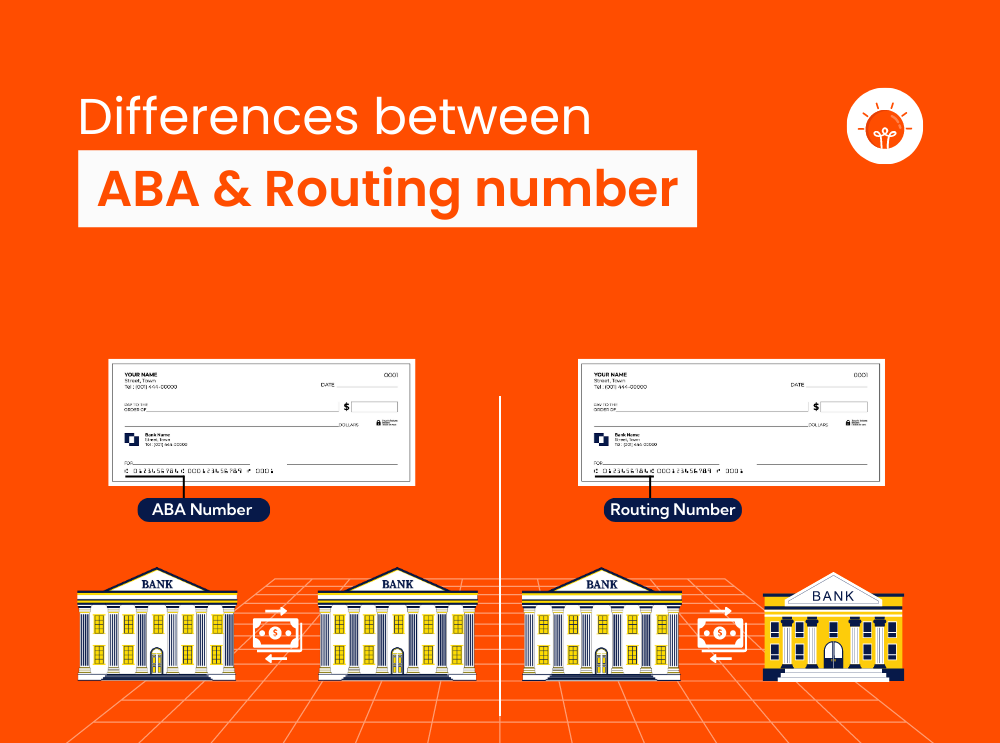

- Check the Bottom of Your Checks: The ABA number is typically printed on the bottom-left corner of your checks.

- Online Banking: Many banks provide ABA numbers through their online banking platforms.

- Bank Statement: Your ABA number may also appear on your monthly bank statement.

- Contact Your Bank: If you're unable to locate your ABA number, you can contact your bank's customer service for assistance.

Knowing how to find your ABA number is essential for conducting various financial transactions.

ABA vs. SWIFT: Understanding the Differences

While ABA numbers are used for domestic transactions within the United States, SWIFT codes are used for international transactions. Here's a comparison of the two:

- ABA Numbers: Used for domestic transactions in the U.S., consisting of nine digits.

- SWIFT Codes: Used for international transactions, consisting of 8-11 alphanumeric characters.

Understanding the differences between ABA numbers and SWIFT codes is crucial for individuals and businesses engaging in cross-border financial activities.

Key Differences Between ABA and SWIFT

- Scope: ABA numbers are domestic, while SWIFT codes are international.

- Format: ABA numbers are numeric, while SWIFT codes are alphanumeric.

- Purpose: ABA numbers are used for U.S. transactions, while SWIFT codes are used for global transactions.

Security Concerns and Best Practices

While ABA numbers are essential for financial transactions, they can also pose security risks if mishandled. Here are some best practices to ensure the security of your ABA number:

- Keep Your ABA Number Confidential: Avoid sharing your ABA number unnecessarily.

- Verify Recipients: Ensure that you are sharing your ABA number with legitimate parties.

- Monitor Transactions: Regularly review your bank statements for unauthorized transactions.

- Use Secure Channels: When sharing your ABA number online, ensure that the platform is secure and encrypted.

By following these best practices, you can protect your financial information and minimize the risk of fraud.

Frequently Asked Questions About ABA Numbers

What Happens if I Enter the Wrong ABA Number?

Entering the wrong ABA number can result in transaction errors or delays. It's essential to double-check the ABA number before initiating any financial transaction.

Can I Use My ABA Number for International Transactions?

No, ABA numbers are only used for domestic transactions within the United States. For international transactions, you will need a SWIFT code.

Are ABA Numbers Unique to Each Bank?

Yes, ABA numbers are unique identifiers assigned to each bank or financial institution in the United States.

Benefits of Using ABA Numbers

ABA numbers offer several benefits, including:

- Efficient Transactions: ABA numbers ensure that financial transactions are processed quickly and accurately.

- Reduced Errors: The standardized format of ABA numbers minimizes the risk of errors in transaction processing.

- Cost-Effective: ABA numbers facilitate electronic funds transfers, which are often less expensive than traditional methods.

By leveraging the benefits of ABA numbers, individuals and businesses can streamline their financial operations.

Limitations and Challenges

While ABA numbers are invaluable for domestic transactions, they do have certain limitations:

- Domestic Use Only: ABA numbers cannot be used for international transactions.

- Security Risks: Sharing ABA numbers improperly can lead to fraud or unauthorized transactions.

- Formatting Errors: Entering the wrong ABA number can result in transaction errors or delays.

Addressing these limitations requires vigilance and adherence to best practices in financial management.

The Future of ABA Numbers in Banking

As the banking industry continues to evolve, the role of ABA numbers is likely to expand. Advances in technology, such as blockchain and artificial intelligence, may enhance the security and efficiency of ABA number-based transactions. Additionally, the increasing adoption of digital banking services will likely lead to greater reliance on ABA numbers for various financial activities.

Looking ahead, ABA numbers will remain a critical component of the U.S. banking system, ensuring the smooth flow of financial transactions in the digital age.

Conclusion

In conclusion, ABA numbers are indispensable for domestic financial transactions in the United States. They play a vital role in ensuring the accuracy, efficiency, and security of banking activities. By understanding the structure, uses, and best practices associated with ABA numbers, individuals and businesses can better manage their finances and protect their financial information.

We invite you to share your thoughts and experiences with ABA numbers in the comments section below. Additionally, feel free to explore other articles on our site for more insights into personal finance and banking. Together, let's build a more informed and secure financial future.