Protecting your business from unexpected liabilities is crucial, and obtaining a Hartford General Liability quote can provide the financial security you need. Whether you're a small business owner or run a large corporation, understanding general liability insurance is essential to safeguarding your assets. This article will delve into everything you need to know about The Hartford General Liability quote, including its benefits, coverage options, and how to get the best rates for your business.

Running a business comes with inherent risks, and one of the most significant concerns is liability. General liability insurance acts as a safety net, protecting your company from potential lawsuits and claims. With The Hartford General Liability quote, you can tailor a policy that fits your unique business needs.

This guide will cover all aspects of The Hartford General Liability quote, helping you make informed decisions about your business's insurance needs. From understanding the basics of general liability insurance to exploring advanced coverage options, we'll ensure you have the knowledge to protect your company effectively.

Read also:Comprehensive Guide To Chase Com Banking Help Your Ultimate Resource

Table of Contents

- Introduction to The Hartford General Liability Insurance

- Why General Liability Insurance Is Crucial for Businesses

- Coverage Details in The Hartford General Liability Quote

- Steps to Get a Hartford General Liability Quote

- Factors Affecting the Cost of Your Quote

- Additional Coverage Options with The Hartford

- The Claims Process with The Hartford

- Benefits of Choosing The Hartford for Your Business

- Common Questions About The Hartford General Liability Insurance

- Conclusion: Secure Your Business with The Hartford

Introduction to The Hartford General Liability Insurance

The Hartford is one of the leading insurance providers in the United States, offering a wide range of policies designed to meet the needs of businesses of all sizes. Their general liability insurance is specifically crafted to protect businesses from potential lawsuits and claims that could arise from accidents, injuries, or property damage.

Understanding The Hartford General Liability quote is the first step in securing your business's future. This insurance provides coverage for claims related to bodily injury, property damage, advertising injury, and personal injury. By obtaining a quote, you can assess the cost and tailor the coverage to fit your specific business requirements.

The Hartford's reputation for reliability and customer service makes them a trusted choice for many business owners. With a history spanning over 200 years, they have the expertise and resources to provide comprehensive protection for your business.

Why General Liability Insurance Is Crucial for Businesses

General liability insurance is an essential component of any business's risk management strategy. Without it, your company could face significant financial losses due to unexpected claims or lawsuits. Here are some reasons why obtaining a Hartford General Liability quote is crucial:

- Protection against lawsuits and claims

- Coverage for property damage and bodily injury

- Financial security for your business

- Peace of mind knowing your assets are safeguarded

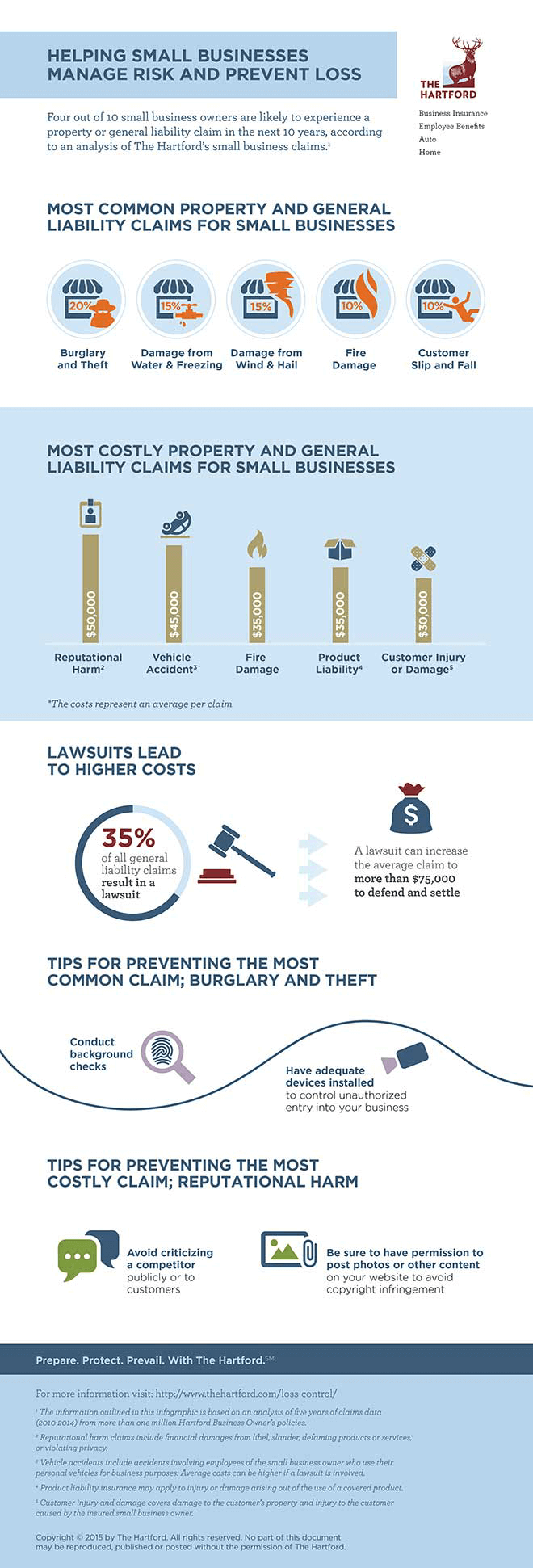

According to a study by the Insurance Information Institute, small businesses face an average of $50,000 in legal costs per claim. Having general liability insurance can significantly reduce this financial burden, allowing you to focus on growing your business.

Coverage Details in The Hartford General Liability Quote

What Does General Liability Insurance Cover?

A Hartford General Liability quote typically includes coverage for the following:

Read also:Tampa Bay Rays Baseball Schedule Your Ultimate Guide To The 2023 Season

- Bodily injury: Covers medical expenses and legal costs if someone is injured on your premises or due to your products or services.

- Property damage: Provides coverage for damages to someone else's property caused by your business operations.

- Advertising injury: Protects against claims related to libel, slander, copyright infringement, or misuse of advertising materials.

- Personal injury: Covers claims involving false arrest, detention, or invasion of privacy.

It's important to review these coverage options carefully to ensure they align with your business's specific needs. The Hartford offers customizable policies, allowing you to add endorsements or riders for additional protection.

Steps to Get a Hartford General Liability Quote

How to Obtain a Quote

Getting a Hartford General Liability quote is a straightforward process. Follow these steps to secure the best rates for your business:

- Visit The Hartford's official website or contact a local agent.

- Provide detailed information about your business, including industry type, annual revenue, and number of employees.

- Answer questions about your business operations and risk factors.

- Review the quote and customize the coverage options to fit your needs.

- Compare multiple quotes to find the best value for your business.

By taking the time to gather accurate information, you can ensure that your quote reflects your business's true risk profile.

Factors Affecting the Cost of Your Quote

Understanding Premium Pricing

Several factors influence the cost of a Hartford General Liability quote. These include:

- Business size and revenue

- Industry type and associated risks

- Location and state regulations

- Claims history and loss experience

- Policy limits and deductibles

For example, a construction company may face higher premiums due to the inherent risks involved in their operations compared to a retail business. Understanding these factors can help you identify ways to reduce your insurance costs.

Additional Coverage Options with The Hartford

Enhancing Your Policy

While a standard Hartford General Liability quote provides essential coverage, you may want to consider adding endorsements or riders for additional protection. These options include:

- Product liability coverage

- Professional liability insurance

- Employment practices liability insurance

- Cyber liability insurance

By tailoring your policy with these additional coverages, you can address specific risks unique to your business. The Hartford's experienced agents can help you identify the right endorsements to enhance your protection.

The Claims Process with The Hartford

How to File a Claim

In the event of a claim, it's important to know the steps to take to ensure a smooth process. Here's how to file a claim with The Hartford:

- Contact The Hartford immediately upon becoming aware of a potential claim.

- Provide detailed information about the incident, including dates, locations, and involved parties.

- Cooperate fully with The Hartford's investigation and legal defense team.

- Keep records of all communications and documentation related to the claim.

The Hartford is known for its efficient claims handling, ensuring that your business is protected throughout the process.

Benefits of Choosing The Hartford for Your Business

Why Trust The Hartford?

There are numerous benefits to choosing The Hartford for your general liability insurance needs:

- Over 200 years of experience in the insurance industry

- Customizable policies tailored to your business's specific needs

- Excellent customer service and claims handling

- Access to a network of trusted agents and brokers

- Competitive pricing and flexible payment options

With The Hartford, you can trust that your business is in capable hands, providing the peace of mind you need to focus on growth and success.

Common Questions About The Hartford General Liability Insurance

Frequently Asked Questions

Here are some frequently asked questions about The Hartford General Liability quote:

- How long does it take to get a quote? Typically, you can receive a quote within a few hours, depending on the complexity of your business operations.

- Can I customize my policy? Yes, The Hartford offers customizable policies with various coverage options to suit your business's needs.

- What if I have multiple locations? The Hartford can provide coverage for businesses with multiple locations, ensuring comprehensive protection across all your operations.

For more detailed information, consult with a qualified insurance agent or visit The Hartford's official website.

Conclusion: Secure Your Business with The Hartford

In conclusion, obtaining a Hartford General Liability quote is a vital step in protecting your business from potential liabilities. By understanding the coverage details, factors affecting costs, and additional options available, you can make informed decisions about your insurance needs.

We encourage you to take action today by requesting a quote and exploring the various coverage options offered by The Hartford. Don't hesitate to share this article with fellow business owners or leave a comment below with any questions or feedback. Together, let's ensure that your business is safeguarded for the future.