When it comes to tax-related issues, the IRS Help Line is one of the most reliable resources available to taxpayers in the United States. Whether you're dealing with a tax return, payment plan, or other IRS matters, understanding how to use this service can save you time and frustration. The IRS provides a toll-free hotline designed to assist taxpayers with their questions and concerns, ensuring they receive accurate and timely information.

Taxes are an inevitable part of life, and navigating the complexities of the IRS system can be overwhelming. From filing taxes to resolving disputes, the IRS Help Line serves as a lifeline for individuals and businesses alike. With the right guidance, you can address your tax issues effectively and efficiently.

This article will delve into the details of the IRS Help Line, including how to contact it, what services it offers, and tips for making the most of this valuable resource. Whether you're a first-time taxpayer or a seasoned business owner, this guide will provide you with the information you need to navigate the IRS system successfully.

Read also:Lake Mary Fl Movies Your Ultimate Guide To Movie Theaters And Entertainment

Table of Contents

- Introduction to IRS Help Line

- Why Use the IRS Help Line?

- How to Contact IRS Help Line

- Common Questions Answered

- Services Offered by IRS Help Line

- Tips for Using the IRS Help Line

- IRS Help Line Hours

- Limitations of the IRS Help Line

- Alternatives to IRS Help Line

- Conclusion and Next Steps

Introduction to IRS Help Line

The IRS Help Line is a dedicated service provided by the Internal Revenue Service to assist taxpayers with various tax-related inquiries. Whether you're seeking information about your tax return status, payment options, or other IRS matters, this hotline offers a direct line of communication to IRS representatives.

History of the IRS Help Line

The IRS Help Line was established to streamline the process of addressing taxpayer concerns. Over the years, it has evolved to include advanced features such as automated responses, live agents, and extended hours of operation. This evolution ensures that taxpayers receive prompt assistance regardless of the complexity of their issues.

Who Can Use the IRS Help Line?

Anyone with a tax-related question or issue can utilize the IRS Help Line. This includes individual taxpayers, small business owners, and even tax professionals seeking clarification on IRS policies and procedures. By providing a centralized point of contact, the IRS aims to make the tax process more accessible and user-friendly.

Why Use the IRS Help Line?

There are several reasons why the IRS Help Line is an invaluable resource for taxpayers:

- Direct Access to IRS Representatives: Speak directly to trained professionals who can provide accurate information and guidance.

- Convenient and Efficient: Save time by resolving your tax issues over the phone without the need for in-person visits.

- Wide Range of Services: From tax return status updates to payment plan arrangements, the IRS Help Line covers a broad spectrum of taxpayer needs.

Benefits of Using the IRS Help Line

Using the IRS Help Line offers numerous advantages, including:

- Reduced stress and anxiety when dealing with tax matters.

- Access to up-to-date information and resources.

- Personalized assistance tailored to your specific situation.

How to Contact IRS Help Line

Contacting the IRS Help Line is straightforward and can be done through various methods:

Read also:San Diego Airport Amenities A Comprehensive Guide To Traveler Comfort

Phone Numbers

The primary IRS Help Line number is 1-800-829-1040. This toll-free number is available to taxpayers seeking assistance with personal tax matters. For business-related inquiries, you can call 1-800-829-4933.

Online Options

In addition to phone support, the IRS offers online resources such as the IRS website and virtual assistants. These tools provide supplementary information and can help you resolve simpler tax issues without the need for a phone call.

Common Questions Answered

Here are some frequently asked questions about the IRS Help Line:

What Can I Ask the IRS Help Line?

You can ask a wide range of questions, including:

- Status of your tax return.

- Details about owed taxes or refunds.

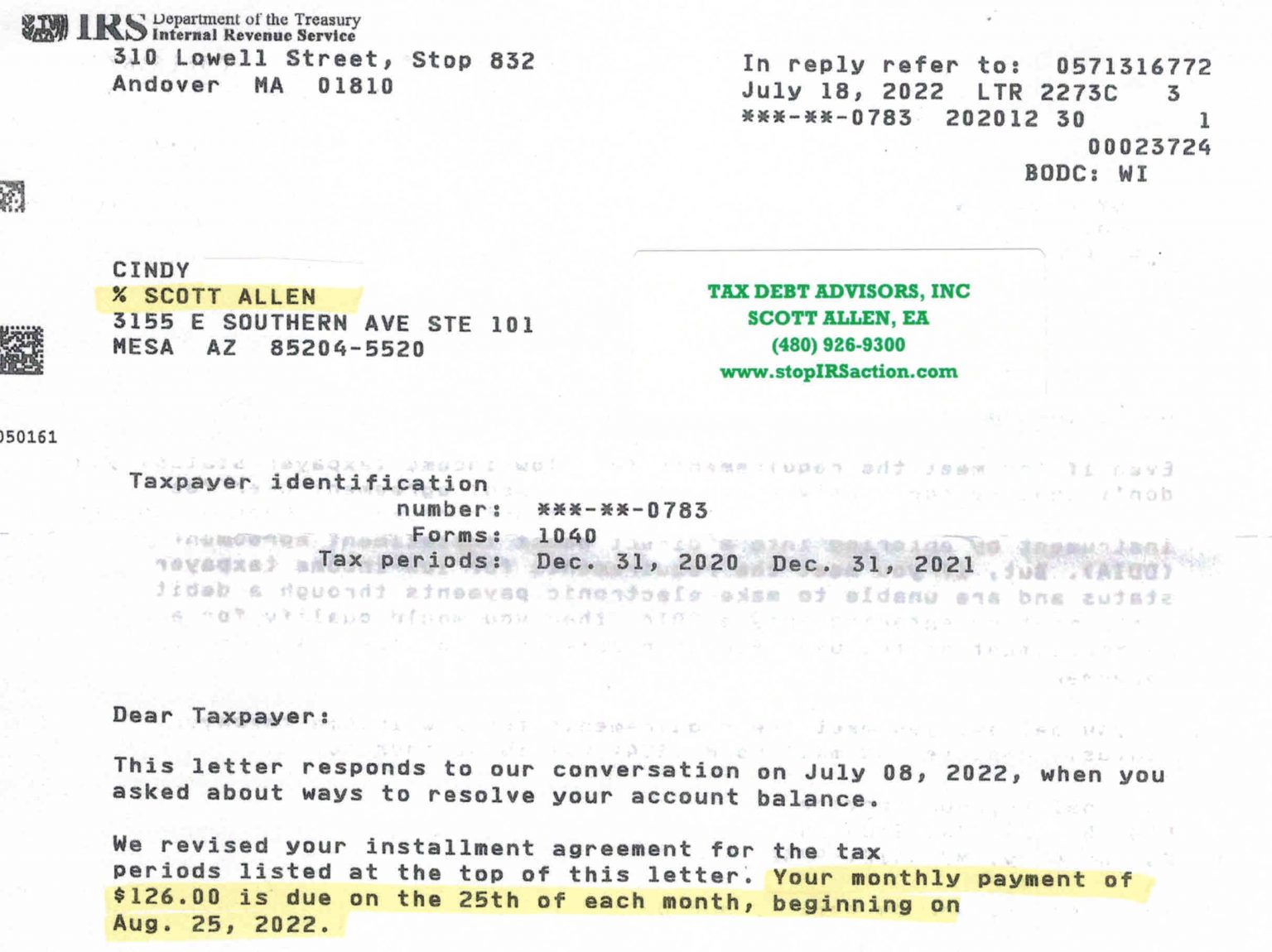

- Information on payment plans and installment agreements.

How Long Does It Take to Get an Answer?

The wait time for answers varies depending on the volume of calls. During peak tax seasons, you may experience longer wait times. To minimize delays, consider calling during off-peak hours or utilizing online resources.

Services Offered by IRS Help Line

The IRS Help Line provides a variety of services to assist taxpayers:

Tax Return Status

Check the status of your tax return by calling the IRS Help Line or using the "Where's My Refund?" tool on the IRS website.

Payment Plans

If you owe taxes and cannot pay in full, the IRS Help Line can help you set up a payment plan or installment agreement.

Taxpayer Rights

Learn about your rights as a taxpayer and how to protect yourself from scams and fraud.

Tips for Using the IRS Help Line

To make the most of your experience with the IRS Help Line, follow these tips:

Prepare Your Information

Before calling, gather all relevant documents, such as your Social Security number, tax return details, and any correspondence from the IRS.

Call During Off-Peak Hours

Try to call early in the morning or late in the afternoon to avoid long wait times.

Be Polite and Patient

Remember that IRS representatives are there to help. Maintain a polite demeanor and be patient while waiting for assistance.

IRS Help Line Hours

The IRS Help Line operates from Monday to Friday, with hours varying slightly depending on the time of year. During tax season, the hotline is typically open from 7:00 AM to 7:00 PM local time. Outside of tax season, hours may be reduced.

Extended Hours During Tax Season

During the busy tax filing period, the IRS extends its hours to accommodate the increased demand for assistance. Be sure to check the IRS website for the latest updates on operating hours.

Limitations of the IRS Help Line

While the IRS Help Line is a valuable resource, it does have some limitations:

Complex Issues

For highly complex tax issues, you may need to seek assistance from a tax professional or attorney.

Technical Difficulties

Occasionally, technical issues may arise, causing delays or disruptions in service.

Alternatives to IRS Help Line

If you prefer not to use the IRS Help Line, there are alternative resources available:

IRS Website

The IRS website offers a wealth of information, including FAQs, forms, and publications.

Tax Professionals

Consulting a certified public accountant (CPA) or enrolled agent (EA) can provide personalized guidance for complex tax situations.

Conclusion and Next Steps

The IRS Help Line is an essential tool for taxpayers seeking assistance with their tax-related issues. By understanding how to use this service effectively, you can save time and ensure compliance with IRS regulations. Remember to prepare your information, call during off-peak hours, and remain patient while waiting for assistance.

Call to Action: If you found this article helpful, please share it with others who may benefit from the information. Additionally, feel free to leave a comment below with any questions or feedback. For more resources on tax-related topics, explore our other articles on our website.

Data and statistics for this article were sourced from the IRS website and other reputable publications. Always verify information with official IRS resources to ensure accuracy and relevance.