Dealing with fraudulent activities can be a daunting experience, especially when it involves your financial institution. Fifth Third Bank has implemented various measures to combat fraud and protect its customers. If you suspect any fraudulent activity, it's crucial to know the Fifth Third Bank fraud phone number to report issues promptly. This article will guide you through everything you need to know about protecting yourself and resolving fraud-related concerns.

With the increasing sophistication of scams and frauds, staying informed is your best defense. Whether it's phishing calls, unauthorized transactions, or identity theft, understanding the steps to take can save you from significant financial losses. Fifth Third Bank offers resources and support to help you secure your accounts and recover from fraud.

Our goal is to provide you with comprehensive information on how to identify and report fraud, along with tips to safeguard your personal and financial information. Let's dive into the details to ensure you're well-prepared to handle any fraudulent activity.

Read also:Tmobile On The Las Vegas Strip Your Ultimate Connectivity Guide

Table of Contents

- Fifth Third Bank Fraud Phone Number

- About Fifth Third Bank

- Common Types of Fraud

- Reporting Fraudulent Activity

- Security Tips to Prevent Fraud

- Customer Support Services

- Legal Actions Against Fraud

- Identity Theft Protection

- Resources for Fraud Prevention

- Conclusion and Next Steps

Fifth Third Bank Fraud Phone Number

Knowing the Fifth Third Bank fraud phone number is essential for addressing any suspicious activity promptly. The dedicated fraud department at Fifth Third Bank is available to assist customers in resolving issues related to unauthorized transactions, identity theft, and other fraudulent activities.

To report fraud, you can contact Fifth Third Bank at 1-800-547-5664. This number is specifically designated for fraud-related concerns and ensures that your issues are handled efficiently by trained professionals. It's important to keep this number handy in case you encounter any suspicious activity involving your accounts.

Additionally, Fifth Third Bank offers an online fraud reporting system through their secure customer portal. You can log in to your account and initiate a fraud report directly, which may expedite the resolution process. Combining phone support with digital tools provides a comprehensive approach to tackling fraud effectively.

Why Prompt Reporting Matters

- Minimizes potential financial losses

- Prevents further unauthorized transactions

- Allows quicker recovery of stolen funds

- Enhances account security measures

About Fifth Third Bank

Fifth Third Bank, established in 1858, is one of the largest financial institutions in the United States, serving millions of customers across the country. Headquartered in Cincinnati, Ohio, the bank offers a wide range of banking services, including personal and commercial banking, wealth management, and investment solutions.

With a strong commitment to customer satisfaction and security, Fifth Third Bank has implemented advanced fraud detection and prevention systems to protect its clients. Their dedicated fraud team works around the clock to monitor and address any suspicious activities that may affect customer accounts.

Key Facts About Fifth Third Bank

| Foundation Year | 1858 |

|---|---|

| Headquarters | Cincinnati, Ohio |

| Number of Branches | 1,100+ |

| Assets Under Management | $200 billion+ |

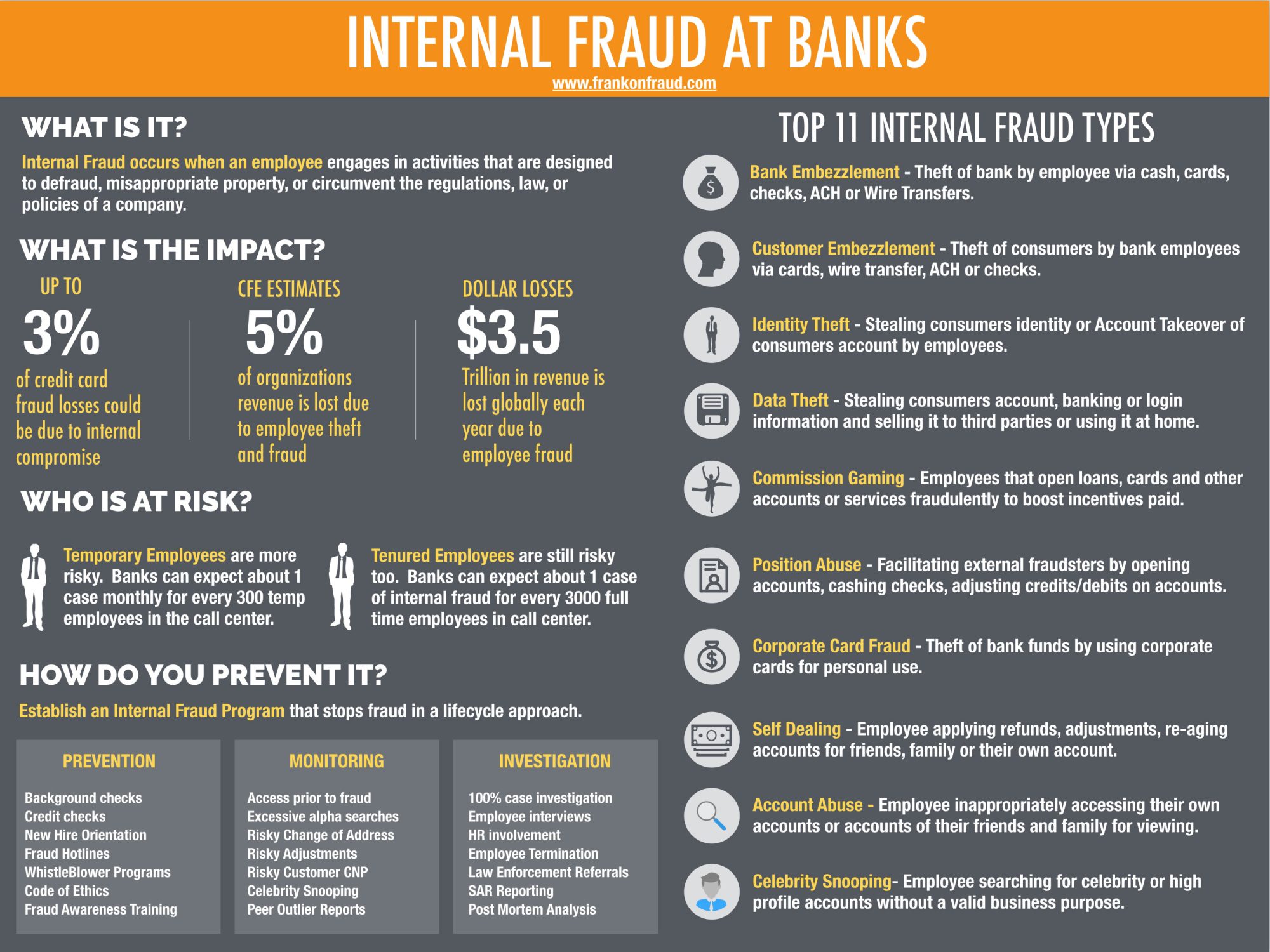

Common Types of Fraud

Understanding the types of fraud you may encounter is the first step in protecting yourself. Below are some of the most common forms of fraud that customers face:

Read also:Comprehensive Guide To Ohio Bmv Registration Fee Everything You Need To Know

1. Phishing Scams

Phishing involves fraudulent emails or calls pretending to be from legitimate sources, such as banks, to obtain sensitive information like passwords or account details. Always verify the authenticity of the source before providing any personal information.

2. Identity Theft

Identity theft occurs when someone uses your personal information without permission to commit fraud or other crimes. Regularly monitoring your credit reports and bank statements can help detect identity theft early.

3. Credit Card Fraud

Unauthorized charges on your credit card can indicate fraudulent activity. Fifth Third Bank offers zero-liability protection for unauthorized transactions, ensuring you're not held responsible for fraudulent charges.

Reporting Fraudulent Activity

When you suspect fraud, it's vital to act quickly. Follow these steps to report fraudulent activity to Fifth Third Bank:

- Contact the Fifth Third Bank fraud phone number at 1-800-547-5664.

- Provide detailed information about the suspected fraud, including dates, amounts, and any communication you've received.

- Follow up with a written report through the bank's secure online portal if necessary.

Fifth Third Bank will investigate the matter and take appropriate actions to resolve the issue. This may include freezing your account, issuing new cards, or working with law enforcement if needed.

Security Tips to Prevent Fraud

Prevention is key to avoiding fraud. Here are some tips to help you protect your personal and financial information:

- Use strong, unique passwords for all your accounts.

- Enable two-factor authentication for added security.

- Regularly monitor your bank statements and credit reports for any discrepancies.

- Avoid clicking on suspicious links or downloading attachments from unknown sources.

- Shred sensitive documents before disposal to prevent identity theft.

Customer Support Services

Fifth Third Bank provides comprehensive customer support services to assist with fraud-related issues. In addition to the fraud phone number, customers can access:

Online Support

Through the Fifth Third Bank website, customers can find resources on fraud prevention, account security, and other important topics. The online portal also allows you to manage your accounts securely and report fraud directly.

Mobile App

The Fifth Third Bank mobile app offers convenient access to your accounts and provides tools to monitor transactions and set up alerts for suspicious activity. This app is a valuable resource for staying informed and proactive about your financial security.

Legal Actions Against Fraud

In cases of severe fraud, legal action may be necessary. Fifth Third Bank works closely with law enforcement agencies to investigate and prosecute individuals involved in fraudulent activities. If you've been a victim of fraud, consider consulting with a legal professional to explore your options for recovery and compensation.

Identity Theft Protection

Protecting your identity is crucial in today's digital age. Fifth Third Bank offers identity theft protection services to help customers safeguard their personal information. These services include:

- Credit monitoring

- Identity restoration assistance

- Alerts for suspicious activity

By enrolling in these services, you can gain peace of mind knowing that your identity is being actively protected.

Resources for Fraud Prevention

Several resources are available to help you stay informed about fraud prevention:

- Fifth Third Bank Official Website

- Fifth Third Bank Security Center

- Federal Deposit Insurance Corporation (FDIC)

These resources provide valuable information on how to protect yourself from fraud and what steps to take if you become a victim.

Conclusion and Next Steps

In conclusion, knowing the Fifth Third Bank fraud phone number and understanding how to protect yourself from fraud are critical steps in ensuring your financial security. By staying vigilant and utilizing the resources provided by Fifth Third Bank, you can minimize the risk of becoming a victim of fraud.

We encourage you to take action by:

- Reviewing your bank statements regularly

- Enrolling in identity theft protection services

- Staying informed about the latest fraud trends

Share this article with friends and family to help them stay safe. If you have any questions or feedback, please leave a comment below. Together, we can combat fraud and protect our financial well-being.