Paying for your car payment with a credit card might seem like an attractive option, but it’s essential to understand the nuances involved. Many car owners and potential buyers are curious about whether this method is viable and how it impacts their finances. This article aims to explore the topic in detail, offering insights into the benefits, drawbacks, and best practices.

As the world becomes increasingly digital, financial transactions are evolving. Credit cards offer convenience, rewards, and flexibility, making them a popular choice for managing expenses. However, when it comes to car payments, there are specific considerations to keep in mind.

This guide will delve into the mechanics of using a credit card for car payments, highlight potential pitfalls, and provide actionable advice. Whether you're a first-time car buyer or a seasoned vehicle owner, this information will help you make informed decisions.

Read also:Official Tampa Bay Rays Website Your Ultimate Guide To All Things Rays

Table of Contents

- Introduction to Car Payments and Credit Cards

- Can You Pay a Car Payment with a Credit Card?

- Benefits of Using a Credit Card for Car Payments

- Drawbacks of Using a Credit Card for Car Payments

- Understanding Convenience Fees

- Maximizing Credit Card Rewards

- Credit Card Limits and Car Payments

- Alternative Payment Methods

- Tips for Using Credit Cards Responsibly

- Conclusion and Final Thoughts

Introduction to Car Payments and Credit Cards

Car payments are a significant financial commitment for many individuals. Traditionally, these payments are made through bank transfers, checks, or automatic deductions from a savings account. However, with the rise of digital payment solutions, more people are exploring the possibility of using credit cards for car payments.

Why Credit Cards Are Popular

Credit cards offer numerous advantages, including cashback, travel rewards, and purchase protection. These benefits make them an appealing option for managing monthly expenses, including car payments. However, not all lenders or dealerships accept credit card payments, and there are specific rules and fees to consider.

Can You Pay a Car Payment with a Credit Card?

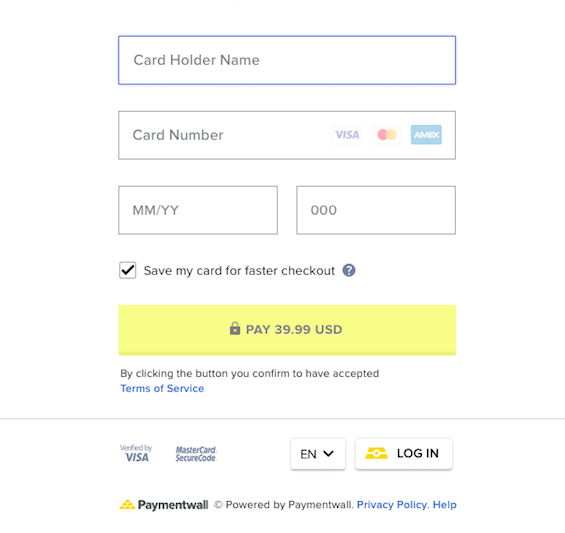

Yes, in many cases, you can pay your car payment with a credit card, but it depends on your lender's policies and the terms of your credit card agreement. Some lenders directly accept credit card payments, while others may require the use of third-party services that charge additional fees.

Factors to Consider

Before proceeding, it's crucial to evaluate the following factors:

- Lender policies: Check if your lender allows credit card payments.

- Credit card network: Ensure your credit card is compatible with the payment system used by your lender.

- Convenience fees: Be aware of any fees associated with using a credit card for car payments.

Benefits of Using a Credit Card for Car Payments

Using a credit card for car payments can offer several advantages, provided you use it responsibly. Below are some of the key benefits:

Rewards and Cashback

Many credit cards offer rewards programs that allow you to earn points, miles, or cashback on your purchases. By using your credit card for car payments, you can accumulate these rewards, which can be redeemed for travel, merchandise, or statement credits.

Read also:Michael Keatons Movie Career A Comprehensive Look At What Movies Did Michael Keaton Play In

Purchase Protection

Credit cards often come with purchase protection benefits, such as extended warranties and price protection. These features can provide additional security for your car-related expenses.

Drawbacks of Using a Credit Card for Car Payments

While there are benefits to using a credit card for car payments, there are also potential drawbacks that you should be aware of:

Convenience Fees

Many lenders charge a convenience fee for accepting credit card payments. These fees can range from 2% to 4% of the payment amount, which can significantly increase your overall costs.

Interest Rates

If you don't pay off your credit card balance in full each month, you may incur interest charges. High interest rates can make using a credit card for car payments less financially viable in the long run.

Understanding Convenience Fees

Convenience fees are charges imposed by lenders or third-party payment processors for accepting credit card payments. These fees are designed to offset the processing costs associated with credit card transactions. While some lenders waive these fees, others pass them on to the borrower.

How to Minimize Fees

To minimize the impact of convenience fees, consider the following strategies:

- Look for lenders that do not charge convenience fees.

- Use a credit card with a high rewards rate to offset the cost of fees.

- Pay off your credit card balance in full each month to avoid interest charges.

Maximizing Credit Card Rewards

If you decide to use a credit card for car payments, it's important to maximize the rewards you earn. Here are some tips to help you get the most out of your credit card:

Choose the Right Card

Select a credit card that offers generous rewards for purchases in categories that align with your spending habits. For example, if you frequently travel, consider a card that offers travel rewards.

Track Your Rewards

Regularly monitor your rewards balance to ensure you're earning the maximum benefits. Many credit card issuers provide online tools and mobile apps to help you track your rewards.

Credit Card Limits and Car Payments

Credit card limits can impact your ability to use a credit card for car payments. If your credit limit is lower than your monthly car payment, you may need to explore alternative payment methods or request a limit increase from your credit card issuer.

Managing Credit Utilization

Credit utilization is the ratio of your credit card balance to your credit limit. Keeping your utilization below 30% can help improve your credit score. If you use your credit card for large car payments, be mindful of how it affects your utilization ratio.

Alternative Payment Methods

If using a credit card for car payments is not feasible or desirable, there are alternative payment methods to consider:

Debit Cards

Debit cards offer the convenience of card payments without the risk of accumulating debt. However, they typically do not offer the same rewards or protections as credit cards.

Bank Transfers

Direct bank transfers are a secure and cost-effective way to make car payments. Many lenders offer automatic payment options that simplify the process.

Tips for Using Credit Cards Responsibly

Using a credit card for car payments can be a smart financial decision if done responsibly. Follow these tips to ensure you make the most of your credit card:

Pay Off Your Balance Monthly

Avoid interest charges by paying off your credit card balance in full each month. This practice also helps maintain a healthy credit score.

Set a Budget

Create a budget that accounts for your car payments and other expenses. This will help you manage your finances effectively and avoid overspending.

Conclusion and Final Thoughts

In conclusion, paying your car payment with a credit card is possible in many cases, but it requires careful consideration of the associated costs and benefits. By understanding the policies of your lender, managing convenience fees, and using your credit card responsibly, you can make informed decisions about your financial strategy.

We encourage you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our site for more insights into personal finance and credit card management. Remember, knowledge is power, and making smart financial choices can lead to long-term success.

Data Sources: