MetLife is one of the largest insurance companies globally, offering a wide range of financial products and services. Founded in 1863, the company has grown into a trusted brand for millions of individuals and businesses worldwide. Its mission is to provide financial peace of mind to its customers through innovative solutions and reliable support. If you're wondering what MetLife does and how it can benefit you, this article will provide an in-depth look into its offerings, history, and impact on the insurance industry.

MetLife operates in more than 40 countries, serving diverse clients with tailored solutions. From life insurance to retirement plans, the company's comprehensive portfolio addresses the financial needs of individuals, families, and corporations. Understanding what MetLife does is crucial for anyone seeking a reliable partner in managing their financial future.

In this article, we'll explore the history of MetLife, its core services, and how it continues to innovate in the financial services sector. Whether you're considering purchasing a policy or simply curious about the company's role in the industry, you'll find valuable insights here.

Read also:San Diego Airport Amenities A Comprehensive Guide To Traveler Comfort

Table of Contents

- History of MetLife

- Core Services Offered by MetLife

- Life Insurance

- Retirement Planning

- Health Insurance

- Employee Benefits

- International Operations

- Technology and Innovation

- Customer Support and Experience

- Financial Stability and Trustworthiness

- Future Direction and Growth

- Conclusion

History of MetLife

Founded in 1863 as the Metropolitan Life Insurance Company, MetLife has a rich history spanning over 150 years. Initially, the company focused on providing insurance to working-class families in New York City. Over the decades, MetLife expanded its operations and product offerings, becoming a global leader in the insurance industry.

In the early 20th century, MetLife became one of the first companies to introduce group insurance policies, revolutionizing how businesses provided employee benefits. This innovation solidified MetLife's position as a pioneer in the industry. Today, the company continues to evolve, adapting to changing market conditions and customer needs.

Core Services Offered by MetLife

MetLife provides a wide array of financial products and services designed to meet the diverse needs of its clients. These services can be categorized into several key areas, each addressing specific financial goals and challenges.

Life Insurance

Life insurance remains one of MetLife's flagship offerings. The company provides various types of life insurance policies, including:

- Term Life Insurance: Offers coverage for a specific period, typically more affordable than permanent policies.

- Whole Life Insurance: Provides lifelong coverage with a cash value component that grows over time.

- Universal Life Insurance: Offers flexibility in premiums and coverage amounts, allowing policyholders to adjust their plans as needed.

MetLife's life insurance policies are designed to provide financial protection for loved ones in the event of the policyholder's death.

Retirement Planning

MetLife offers comprehensive retirement planning solutions, helping individuals and businesses prepare for their financial futures. These solutions include:

Read also:Exploring The Allure Of 6502 S New Braunfels A Comprehensive Guide

- 401(k) Plans: Employer-sponsored retirement savings plans that allow employees to contribute pre-tax dollars.

- IRA Accounts: Individual Retirement Accounts that provide tax advantages for retirement savings.

- Annuities: Financial products that provide a steady stream of income during retirement.

With these tools, MetLife empowers its clients to build secure and comfortable retirements.

Health Insurance

MetLife's health insurance offerings cater to both individuals and groups. The company provides:

- Short-Term Health Insurance: Temporary coverage for those experiencing a gap in insurance.

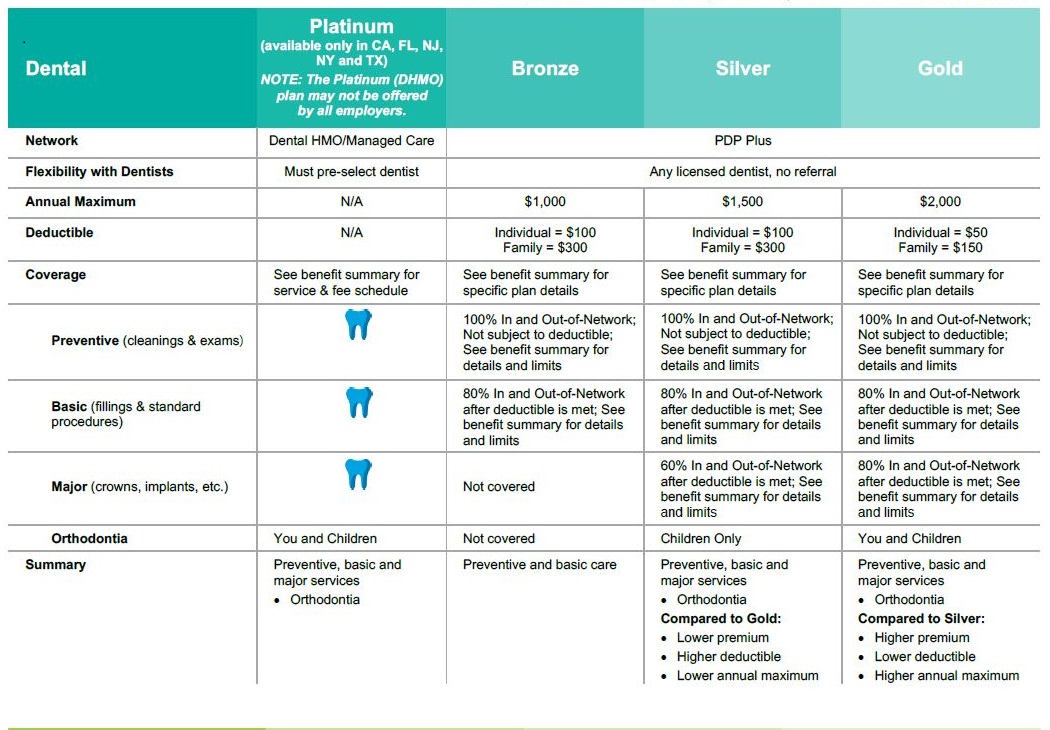

- Dental and Vision Insurance: Supplemental plans that cover dental and vision care expenses.

- Voluntary Benefits: Additional coverage options that employees can purchase through their employers.

These plans ensure that clients have access to quality healthcare services without breaking the bank.

Employee Benefits

MetLife is a leader in providing employee benefits, offering a range of solutions to help employers attract and retain top talent. These benefits include:

- Group Life Insurance: Provides financial protection for employees and their families.

- Disability Insurance: Offers income replacement in case of illness or injury.

- Wellness Programs: Encourages healthy lifestyles and reduces healthcare costs.

By offering these benefits, MetLife helps employers create a positive and supportive work environment.

International Operations

MetLife's global presence is a testament to its success and influence in the insurance industry. The company operates in over 40 countries, serving millions of clients across the Americas, Asia, and Europe. In each market, MetLife adapts its products and services to meet local regulations and customer preferences.

For example, in Asia, MetLife focuses on digital innovation to enhance customer experience and accessibility. Meanwhile, in Europe, the company emphasizes sustainability and corporate responsibility in its operations.

Technology and Innovation

MetLife invests heavily in technology and innovation to stay ahead in the competitive insurance landscape. The company leverages data analytics, artificial intelligence, and digital platforms to improve its products and services. Some notable innovations include:

- Mobile Apps: Allowing customers to manage their policies and access support anytime, anywhere.

- Blockchain Technology: Enhancing security and transparency in transactions.

- AI-Powered Chatbots: Providing instant assistance and resolving customer inquiries efficiently.

These advancements ensure that MetLife remains a leader in delivering cutting-edge solutions to its clients.

Customer Support and Experience

MetLife prioritizes customer satisfaction, offering multiple channels for support and communication. Clients can reach out through phone, email, or online chat to address their concerns and inquiries. The company also provides educational resources, such as webinars and articles, to help customers make informed decisions about their financial futures.

Additionally, MetLife's commitment to customer experience is reflected in its high ratings and positive reviews from clients worldwide. This dedication to service reinforces the trust and loyalty of its customer base.

Financial Stability and Trustworthiness

MetLife's financial stability is a cornerstone of its success. The company maintains strong ratings from leading credit agencies, including Standard & Poor's and Moody's. These ratings reflect MetLife's robust financial health and ability to meet its obligations to policyholders.

Furthermore, MetLife's commitment to transparency and ethical practices enhances its reputation as a trustworthy partner in the financial services sector. The company regularly discloses its financial performance and governance practices to stakeholders, ensuring accountability and integrity.

Future Direction and Growth

Looking ahead, MetLife is poised for continued growth and innovation. The company plans to expand its digital capabilities, enhance its product offerings, and deepen its presence in emerging markets. By focusing on sustainability and corporate responsibility, MetLife aims to create long-term value for its customers, employees, and shareholders.

Additionally, MetLife is committed to addressing global challenges, such as climate change and financial inclusion, through strategic partnerships and initiatives. This forward-thinking approach positions MetLife as a leader in shaping the future of the insurance industry.

Conclusion

MetLife plays a vital role in the financial services sector, offering a wide range of products and services to meet the needs of its clients. From life insurance to retirement planning, the company's comprehensive portfolio ensures that individuals and businesses have the tools they need to achieve financial security.

As MetLife continues to innovate and expand, its commitment to customer satisfaction and financial stability remains unwavering. We encourage you to explore MetLife's offerings further and consider how they can benefit your financial future. Don't forget to leave a comment or share this article with others who might find it useful. For more insights into the world of finance and insurance, check out our other articles on the site.